How Investors May Respond To JD (JD) Singles’ Day Boost and Declining Net Income

Reviewed by Sasha Jovanovic

- JD.com recently completed a share repurchase of 80,900,000 shares for US$1.5 billion and reported third-quarter revenue of ¥299.06 billion, up from ¥260.39 billion the previous year, despite a sharp fall in net income to ¥5.28 billion.

- While the company posted record user orders and revenue growth during its Singles’ Day event, the sharp decline in net income and ongoing pressure on margins have kept analyst outlooks mixed.

- We'll explore how JD.com's strong Singles’ Day sales and quarterly revenue growth, alongside falling net income, influence its investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

JD.com Investment Narrative Recap

If you invest in JD.com, you’re likely betting on the company’s ability to keep expanding revenues through user growth and new business lines, while management works to control costs and rebuild margins. The latest share buyback and record Singles’ Day sales reinforce its position as a retail giant, but short-term sentiment remains influenced by persistently shrinking net income and margin pressures, factors that continue to outweigh isolated sales surges as the key risk for now. For the moment, the buyback does not materially shift the main short-term catalyst or risk profile.

The company’s headline-making Singles’ Day results, where user orders surged nearly 60% and shoppers increased by 40%, stand out as the most relevant announcement. These figures support JD.com’s core growth catalyst, accelerating customer engagement and order volume, but come at a time when profit pressures reflect both fierce competition and higher operating expenses, tempering the optimism such milestones might otherwise generate.

By contrast, what remains just as important for investors to be aware of is the risk that rapid expansion into new business areas could...

Read the full narrative on JD.com (it's free!)

JD.com's outlook projects CN¥1,517.4 billion in revenue and CN¥45.1 billion earnings by 2028. This implies an annual revenue growth rate of 6.2% and a CN¥6.4 billion increase in earnings from the current CN¥38.7 billion.

Uncover how JD.com's forecasts yield a $45.26 fair value, a 47% upside to its current price.

Exploring Other Perspectives

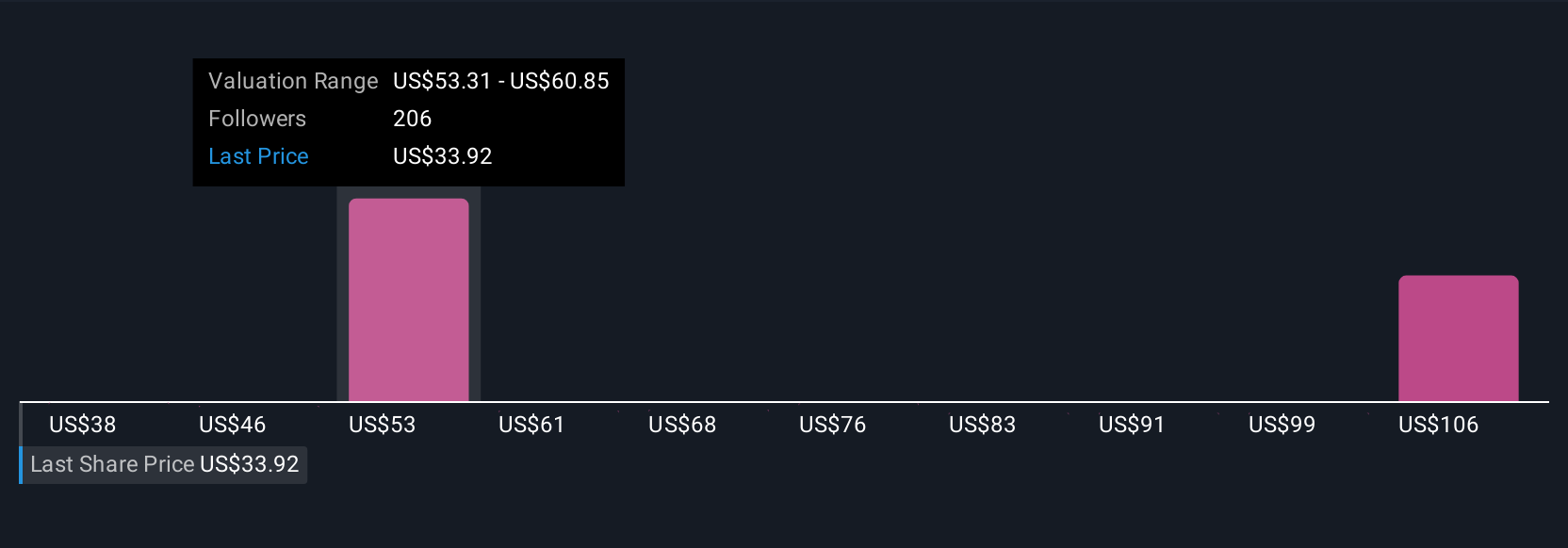

The Simply Wall St Community submitted 27 fair value estimates for JD.com, ranging from US$30 to US$119 per share. Balancing this wide range are persistent concerns about rising competition and margin pressure in the company’s most ambitious new businesses, pointing to several paths for JD’s future performance.

Explore 27 other fair value estimates on JD.com - why the stock might be worth over 3x more than the current price!

Build Your Own JD.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JD.com research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JD.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JD.com's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JD

JD.com

Operates as a supply chain-based technology and service provider in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives