- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GRPN

More Unpleasant Surprises Could Be In Store For Groupon, Inc.'s (NASDAQ:GRPN) Shares After Tumbling 37%

Groupon, Inc. (NASDAQ:GRPN) shares have had a horrible month, losing 37% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 143% in the last twelve months.

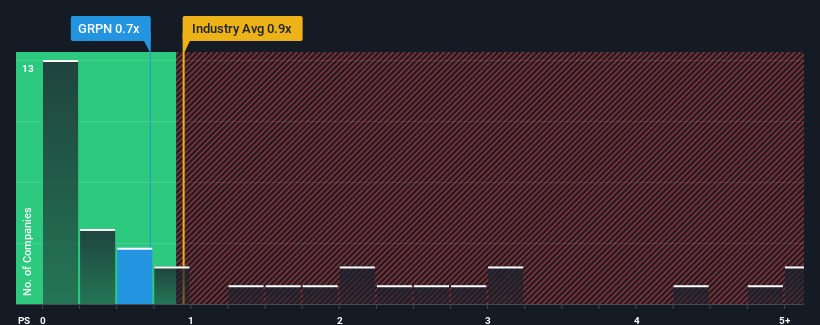

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Groupon's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Multiline Retail industry in the United States is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Groupon

How Groupon Has Been Performing

While the industry has experienced revenue growth lately, Groupon's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Groupon.Is There Some Revenue Growth Forecasted For Groupon?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Groupon's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. As a result, revenue from three years ago have also fallen 64% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 4.1% per annum over the next three years. With the industry predicted to deliver 13% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's curious that Groupon's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Following Groupon's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Groupon's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 3 warning signs for Groupon that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GRPN

Groupon

Operates a marketplace that connects consumers to merchants by offering goods and services at a discount in North America and international.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives