- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GLBE

Global-E Online (GLBE) Is Down 11.2% After Return to Profitability and Raised 2025 Revenue Outlook – Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this week, Global-E Online Ltd. reported second quarter earnings showing sales of US$214.88 million and a net income of US$10.49 million, compared with a loss in the prior year, and also raised its full-year 2025 revenue guidance to between US$921.5 million and US$971.5 million.

- The company’s shift from a net loss to profitability coupled with higher full-year revenue expectations signals operational progress and improved business outlook.

- We’ll examine how Global-E Online’s return to profitability and higher revenue guidance could reshape its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Global-E Online Investment Narrative Recap

To be a shareholder in Global-E Online, you need to believe in the sustained globalization of direct-to-consumer e-commerce and the company’s ability to provide merchants with seamless cross-border solutions despite growing regulatory complexity and competition. The recent return to profitability and higher revenue guidance supports the bull case by demonstrating successful execution, but these earnings do not materially reduce the risks from shifting trade policies and ongoing price pressure from rivals.

Among recent announcements, the raised full-year 2025 revenue guidance stands out, reflecting increased confidence in merchant onboarding and client retention. This update strengthens the near-term catalyst of expanding international ecommerce partnerships, but the company’s revenue concentration in large enterprise clients and ongoing global trade uncertainties still weigh heavily on its risk profile.

Yet, despite this progress, the potential for abrupt regulatory changes and escalating tariff barriers remains a concern investors should be aware of...

Read the full narrative on Global-E Online (it's free!)

Global-E Online's outlook anticipates $1.7 billion in revenue and $328.6 million in earnings by 2028. This reflects a 25.2% annual revenue growth rate and a $357 million increase in earnings from the current level of -$28.4 million.

Uncover how Global-E Online's forecasts yield a $47.38 fair value, a 54% upside to its current price.

Exploring Other Perspectives

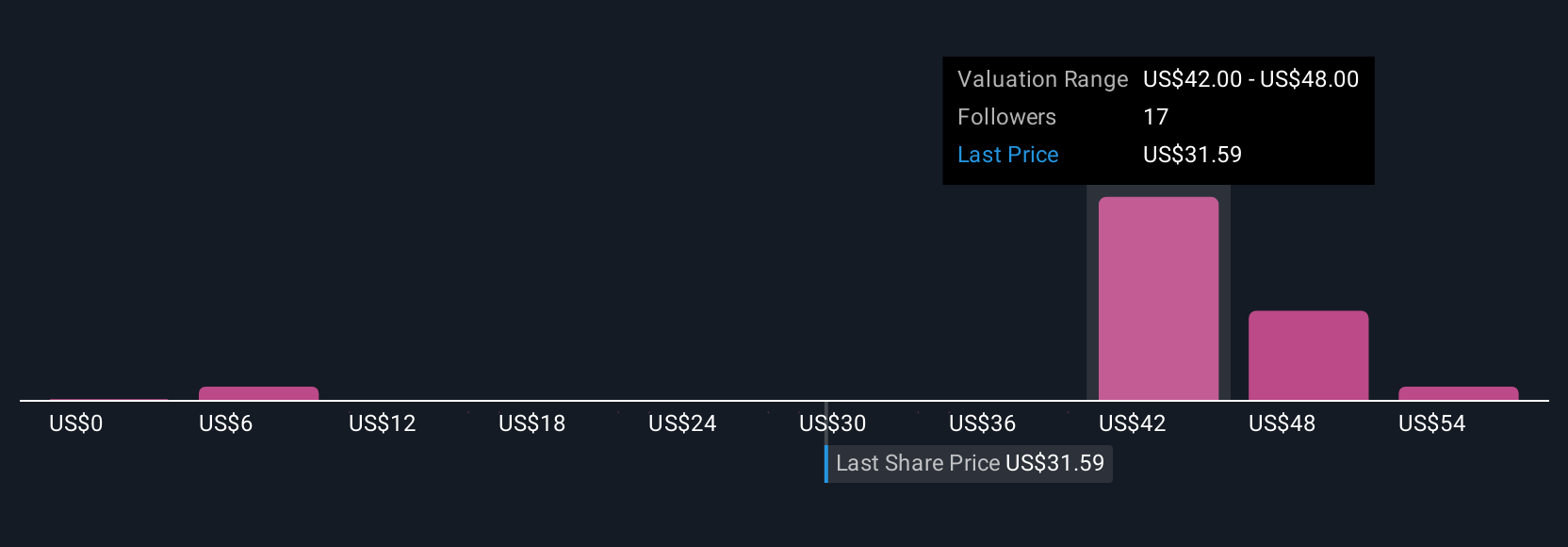

The Simply Wall St Community produced seven fair value estimates for Global-E Online, ranging from US$6 to US$60 per share. As you review these investor perspectives, consider how dependency on enterprise clients could shape the company’s long-term resilience.

Explore 7 other fair value estimates on Global-E Online - why the stock might be worth as much as 95% more than the current price!

Build Your Own Global-E Online Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global-E Online research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Global-E Online research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global-E Online's overall financial health at a glance.

No Opportunity In Global-E Online?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLBE

Global-E Online

Provides direct-to-consumer cross-border e-commerce platform in Israel, the United Kingdom, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives