- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

Improved Earnings Required Before GigaCloud Technology Inc. (NASDAQ:GCT) Stock's 27% Jump Looks Justified

GigaCloud Technology Inc. (NASDAQ:GCT) shares have had a really impressive month, gaining 27% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

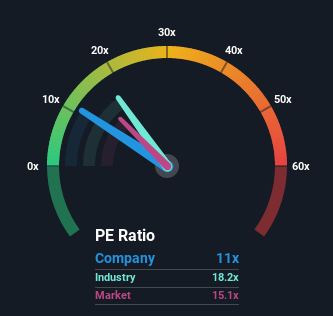

Even after such a large jump in price, GigaCloud Technology may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11x, since almost half of all companies in the United States have P/E ratios greater than 16x and even P/E's higher than 31x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent earnings growth for GigaCloud Technology has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for GigaCloud Technology

How Is GigaCloud Technology's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like GigaCloud Technology's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.7% gain to the company's bottom line. The latest three year period has also seen an excellent 433% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 29% during the coming year according to the one analyst following the company. With the market predicted to deliver 4.6% growth , that's a disappointing outcome.

With this information, we are not surprised that GigaCloud Technology is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Despite GigaCloud Technology's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that GigaCloud Technology maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for GigaCloud Technology with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than GigaCloud Technology. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Flawless balance sheet and undervalued.