- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

GigaCloud Technology (NasdaqGM:GCT) Reports Strong Q1 Earnings With US$272 Million Revenue

Reviewed by Simply Wall St

GigaCloud Technology (NasdaqGM:GCT) recently announced first-quarter earnings, reporting a revenue increase to $272 million and maintaining stable earnings per share. The company also provided optimistic revenue guidance for the second quarter, expecting revenues to range between $275 million and $305 million. This positive outlook likely contributed to the company's 51% share price increase over the last month, significantly outpacing the broader market’s 3.9% rise over the same period. The stable earnings and forward guidance helped GigaCloud's strong price performance despite a minor dip in net income, showing resilience in investors’ confidence.

We've identified 1 risk for GigaCloud Technology that you should be aware of.

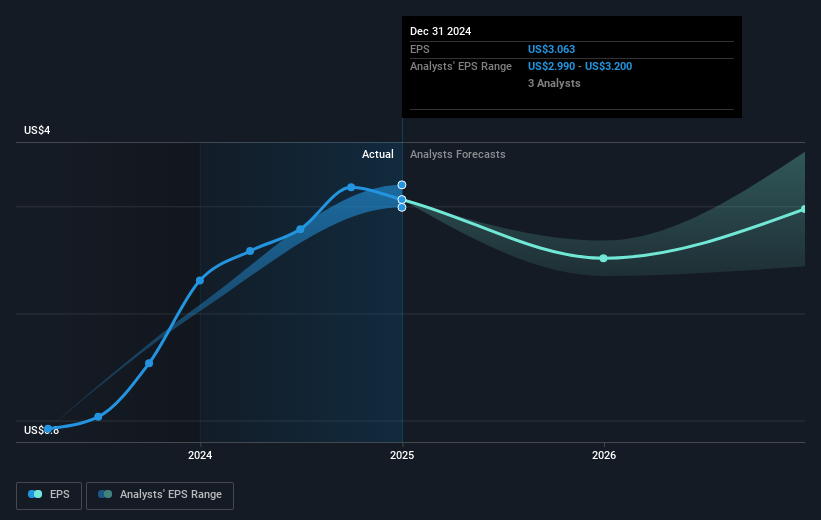

GigaCloud Technology's recent upbeat revenue guidance and stable earnings against a backdrop of macroeconomic challenges point to a resilient business model. This news aligns with the company's proactive expansion into Europe, which includes establishing a fulfillment center in Germany. Such initiatives are anticipated to boost revenue and market share, potentially insulating the company from prevailing industry pressures, including declining consumer spending and freight cost fluctuations. Analysts have projected a modest annual revenue growth of 4.2% over the next three years, despite anticipating a 2% average annual earnings decline, hinting at some skepticism about the company's future profitability. This tempered earnings outlook coincides with a recent 51% rise in GigaCloud's share price as of early May 2025, outpacing the broader market's increase over the same period. However, this increase in share value does not erase the broader context of the company's total returns over the past year, which showed a 52.11% decline, indicating a challenging period for the company's stockholders in the longer term.

While GigaCloud's current share price of US$12.94 shows significant growth in the short term, the price still trades at a substantial 54.3% discount to the consensus analyst price target of US$28.33. This suggests potential market undervaluation, highlighting a divergence between market sentiment and analyst expectations. The outlook for GigaCloud includes managing identified risks such as integration challenges from past acquisitions and maintaining profitability amid fluctuating market conditions. The share price movement, amid these circumstances, remains crucial as it reflects market perception in relation to the company's forward-looking strategy and growth potential.

Our valuation report here indicates GigaCloud Technology may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GigaCloud Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives