- United States

- /

- Specialty Stores

- /

- NasdaqGS:FLWS

1-800-FLOWERS.COM, Inc.'s (NASDAQ:FLWS) Popularity With Investors Is Under Threat From Overpricing

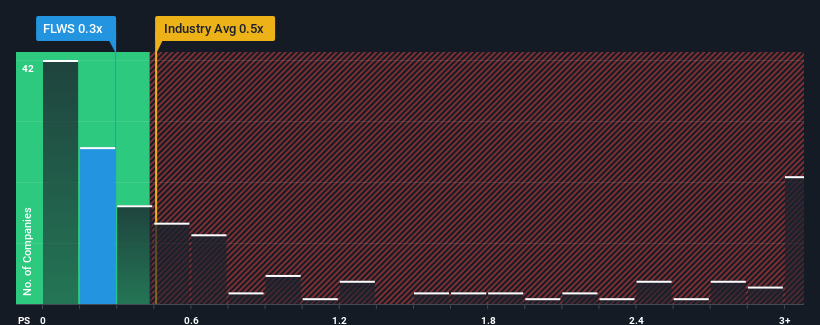

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Specialty Retail industry in the United States, you could be forgiven for feeling indifferent about 1-800-FLOWERS.COM, Inc.'s (NASDAQ:FLWS) P/S ratio of 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for 1-800-FLOWERS.COM

How Has 1-800-FLOWERS.COM Performed Recently?

1-800-FLOWERS.COM could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on 1-800-FLOWERS.COM will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like 1-800-FLOWERS.COM's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.1%. The last three years don't look nice either as the company has shrunk revenue by 16% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 0.2% over the next year. That's shaping up to be materially lower than the 4.3% growth forecast for the broader industry.

In light of this, it's curious that 1-800-FLOWERS.COM's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that 1-800-FLOWERS.COM's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 1 warning sign for 1-800-FLOWERS.COM you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FLWS

1-800-FLOWERS.COM

Provides gifts for various occasions in the United States and internationally.

Undervalued with moderate growth potential.