- United States

- /

- Specialty Stores

- /

- NasdaqGS:FLWS

1-800-FLOWERS.COM, Inc.'s (NASDAQ:FLWS) 25% Share Price Surge Not Quite Adding Up

1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS) shares have continued their recent momentum with a 25% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

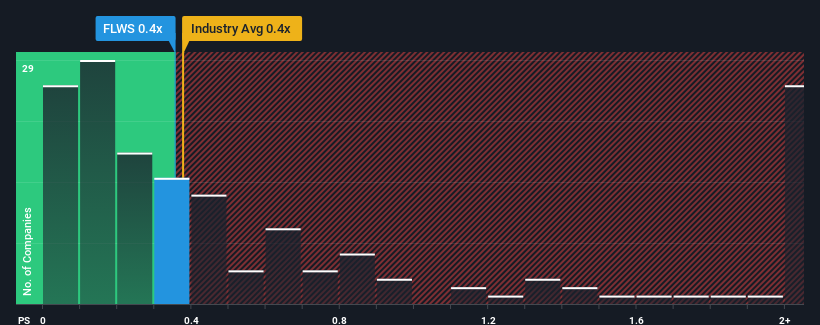

In spite of the firm bounce in price, it's still not a stretch to say that 1-800-FLOWERS.COM's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for 1-800-FLOWERS.COM

How Has 1-800-FLOWERS.COM Performed Recently?

While the industry has experienced revenue growth lately, 1-800-FLOWERS.COM's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on 1-800-FLOWERS.COM.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like 1-800-FLOWERS.COM's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 9.9% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.6% during the coming year according to the four analysts following the company. Meanwhile, the broader industry is forecast to expand by 5.4%, which paints a poor picture.

In light of this, it's somewhat alarming that 1-800-FLOWERS.COM's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From 1-800-FLOWERS.COM's P/S?

Its shares have lifted substantially and now 1-800-FLOWERS.COM's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of 1-800-FLOWERS.COM's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for 1-800-FLOWERS.COM that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FLWS

1-800-FLOWERS.COM

Provides gifts for various occasions in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives