- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Will Five Below’s (FIVE) Response to Michigan Pricing Probe Shape Its Brand Trust Long Term?

Reviewed by Sasha Jovanovic

- In the past week, Michigan’s Attorney General issued a notice of intended action against Five Below, alleging repeated overcharging of customers and inadequate price display at nearly 20 stores across the state, following 30 documented violations since June 2025.

- This regulatory move raises significant concerns for Five Below regarding compliance, reputational risk, and the potential financial and operational impact from legal proceedings or fines.

- We'll examine how this heightened regulatory scrutiny around pricing and consumer protection compliance could influence Five Below’s investment narrative and future prospects.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Five Below Investment Narrative Recap

To own Five Below stock is to believe in the company's ability to drive consistent transaction growth by delivering trendy, value-priced products, even as it aggressively expands and navigates margin headwinds. The recent regulatory scrutiny in Michigan on pricing practices brings some near-term compliance and reputational risk but does not appear material enough to sway the most important short-term catalysts, which remain new store growth and execution on merchandising strategy.

Among recent announcements, Five Below's upcoming third-quarter earnings release, scheduled for December 3, stands out. With investors likely to focus on operational execution and any commentary around regulatory and pricing compliance, this event could provide clarity on how management is addressing both ongoing risks and growth drivers.

In contrast, Michigan's regulatory pressure raises compliance questions that investors should be aware of, particularly if further legal or financial consequences emerge...

Read the full narrative on Five Below (it's free!)

Five Below's narrative projects $5.7 billion in revenue and $352.1 million in earnings by 2028. This requires 10.6% annual revenue growth and a $79 million increase in earnings from the current $273.1 million.

Uncover how Five Below's forecasts yield a $161.95 fair value, a 4% upside to its current price.

Exploring Other Perspectives

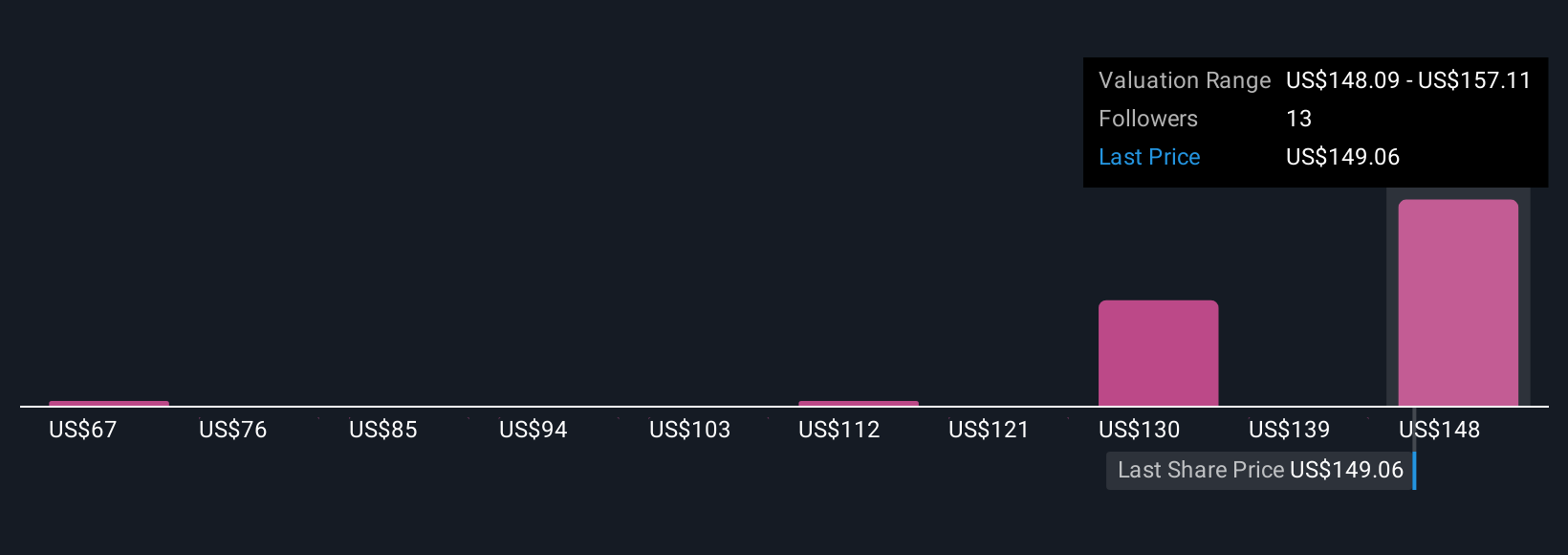

Community valuations for Five Below range from US$89 to US$162 based on three outlooks from the Simply Wall St Community. With ongoing concerns about price accuracy and compliance, your view on risk management could shape a very different forecast for future performance.

Explore 3 other fair value estimates on Five Below - why the stock might be worth 42% less than the current price!

Build Your Own Five Below Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Five Below research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Five Below research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Five Below's overall financial health at a glance.

No Opportunity In Five Below?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success