- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

A Closer Look at Five Below (FIVE) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Five Below.

Five Below’s share price has been steadily climbing, and its year-to-date gain of 66.4% stands out among retailers, especially as enthusiasm has picked up across the sector. Although the stock’s one-year total shareholder return mirrors the price move, long-term gains have been much more modest. This suggests that momentum is a more recent phenomenon.

If you’re wondering what other names are seeing renewed momentum, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares near all-time highs and a strong run-up this year, the key question becomes whether Five Below is fundamentally undervalued or if the recent surge has already priced in its next phase of growth. Is there still a buying opportunity, or is the market already anticipating continued momentum?

Most Popular Narrative: Fairly Valued

With Five Below closing at $164.89 and the narrative fair value set at $163.14, the current price is within 1% of what analysts consider fair. This narrow gap shows the market is largely aligned with the most popular outlook. So what is underpinning this carefully balanced stance?

Five Below's commitment to providing extreme value and trend-right products at low price points is driving broad-based transaction growth, especially as consumers across demographics become increasingly value-focused due to persistent economic pressures. This is expanding the store traffic and addressable market, supporting higher revenue and potential sustained comp sales growth.

Curious what numbers are fueling this consensus? One relentless statistic is at the heart of this narrative. Hint: it is not just earnings or revenue projections. Ready to see which powerful variable tips the scales on fair value?

Result: Fair Value of $163.14 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued tariff-related costs or setbacks from rapid store expansion could quickly undermine the positive outlook currently priced into Five Below’s shares.

Find out about the key risks to this Five Below narrative.

Another View: Looking at Valuation Multiples

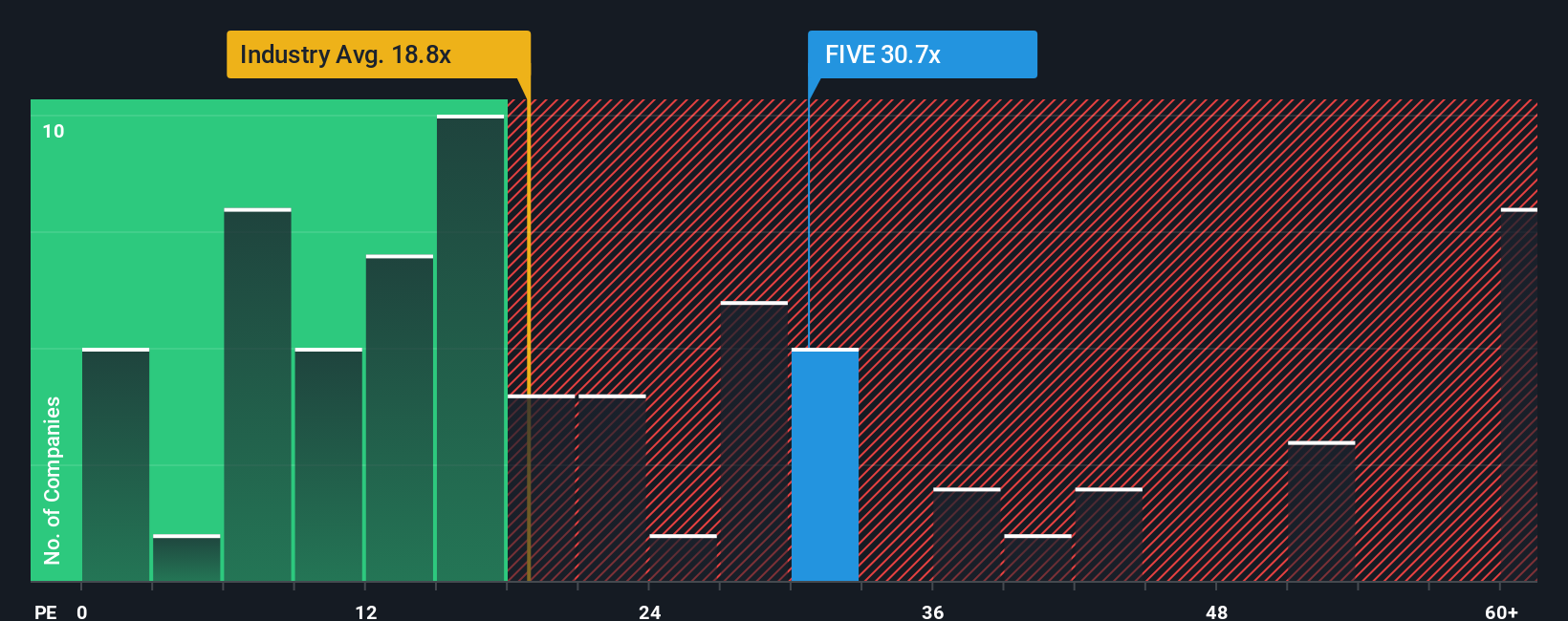

Switching gears, a look at price-to-earnings shows Five Below trading at 33.3 times earnings. Compared to industry peers averaging 18 times and a fair ratio estimate of 19 times, this suggests the stock sits at a premium. Does this premium reflect genuine growth potential, or is it exposing investors to valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five Below Narrative

If you have a different view or want to dig deeper into the details on your own, you can craft a personalized Five Below narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Five Below.

Looking for More Investment Ideas?

Take the next step in your investing journey by finding opportunities beyond just Five Below. Missing out on these ideas could mean passing on potential gains.

- Tap into high-yield potential and earn from resilient companies when you browse these 15 dividend stocks with yields > 3% with yields above 3% and a record of stability.

- Take advantage of developments in artificial intelligence by tracking innovators making progress in healthcare technology with these 30 healthcare AI stocks.

- Explore rapid growth opportunities by reviewing potential breakout performers among these 3557 penny stocks with strong financials that are showing strong fundamentals this year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026