- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

Here's Why National Vision Holdings (NASDAQ:EYE) Has A Meaningful Debt Burden

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, National Vision Holdings, Inc. (NASDAQ:EYE) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for National Vision Holdings

How Much Debt Does National Vision Holdings Carry?

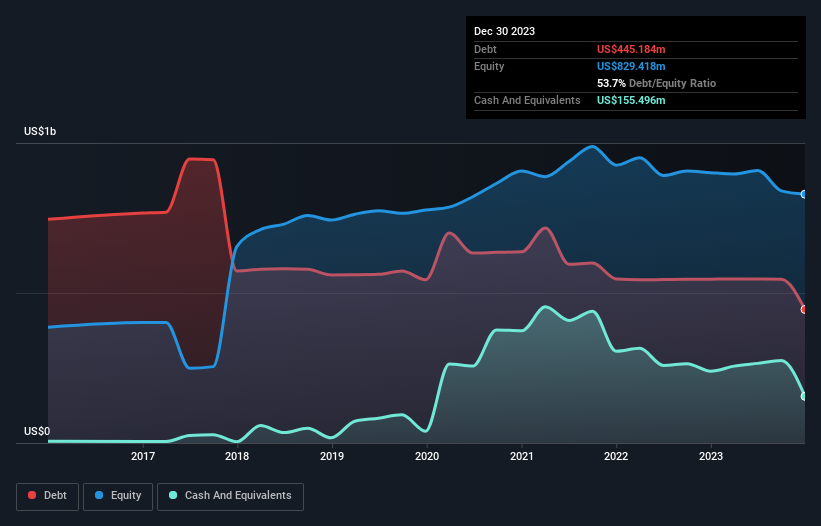

The image below, which you can click on for greater detail, shows that National Vision Holdings had debt of US$445.2m at the end of December 2023, a reduction from US$546.2m over a year. However, it does have US$155.5m in cash offsetting this, leading to net debt of about US$289.7m.

How Healthy Is National Vision Holdings' Balance Sheet?

We can see from the most recent balance sheet that National Vision Holdings had liabilities of US$397.7m falling due within a year, and liabilities of US$945.4m due beyond that. On the other hand, it had cash of US$155.5m and US$87.8m worth of receivables due within a year. So its liabilities total US$1.10b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of US$1.61b, so it does suggest shareholders should keep an eye on National Vision Holdings' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though National Vision Holdings's debt is only 2.1, its interest cover is really very low at 2.5. In large part that's it has so much depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) In any case, it's safe to say the company has meaningful debt. Importantly, National Vision Holdings's EBIT fell a jaw-dropping 45% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine National Vision Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, National Vision Holdings generated free cash flow amounting to a very robust 81% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Neither National Vision Holdings's ability to grow its EBIT nor its interest cover gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that National Vision Holdings is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. Given our hesitation about the stock, it would be good to know if National Vision Holdings insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade National Vision Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives