- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

EVgo, Inc.'s (NASDAQ:EVGO) 26% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, EVgo, Inc. (NASDAQ:EVGO) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

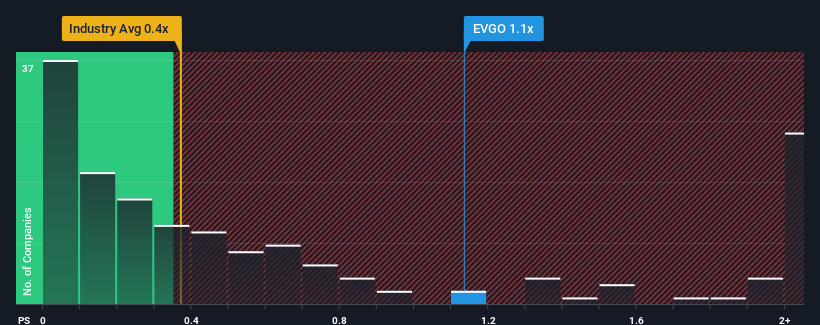

In spite of the heavy fall in price, given close to half the companies operating in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider EVgo as a stock to potentially avoid with its 1.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for EVgo

How Has EVgo Performed Recently?

With revenue growth that's superior to most other companies of late, EVgo has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on EVgo will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as EVgo's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 195%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 50% per annum during the coming three years according to the twelve analysts following the company. With the industry only predicted to deliver 5.5% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that EVgo's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does EVgo's P/S Mean For Investors?

Despite the recent share price weakness, EVgo's P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of EVgo's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - EVgo has 3 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles in the United States.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026