- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

EVgo, Inc. (NASDAQ:EVGO) Looks Just Right With A 52% Price Jump

EVgo, Inc. (NASDAQ:EVGO) shares have continued their recent momentum with a 52% gain in the last month alone. The annual gain comes to 107% following the latest surge, making investors sit up and take notice.

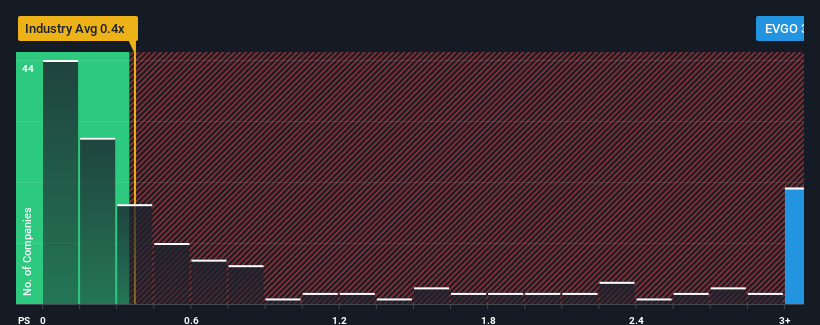

After such a large jump in price, you could be forgiven for thinking EVgo is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in the United States' Specialty Retail industry have P/S ratios below 0.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for EVgo

What Does EVgo's P/S Mean For Shareholders?

EVgo certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think EVgo's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

EVgo's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 82%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 34% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 5.7% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why EVgo's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to EVgo's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into EVgo shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for EVgo (1 makes us a bit uncomfortable!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade EVgo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles in the United States.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives