- United States

- /

- Specialty Stores

- /

- NasdaqGS:EVGO

EVgo (EVGO): Evaluating Growth Prospects and Fair Value After Recent Investor Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for EVgo.

Over the past year, EVgo’s share price has moved in fits and starts. While momentum has picked up in recent weeks, the one-year total shareholder return remains negative. The latest uptick reflects shifting sentiment toward future growth potential and possibly a more favorable view of risks, after a challenging stretch for both the stock and the broader EV infrastructure space.

If EVgo’s recent moves have you rethinking where to look next in this dynamic sector, be sure to check out See the full list for free.

With shares trading at a sizable discount to analyst price targets and a recent surge in momentum, is the market still overlooking EVgo’s growth potential, or is all the upside already priced in for investors?

Most Popular Narrative: 21.5% Undervalued

With EVgo’s fair value setting a price target notably above its last close, attention is shifting to what’s driving this valuation gap and whether it can be sustained.

Strategic partnerships and expansion into dedicated ultra-fast charging hubs for rideshare, autonomous vehicles, and NACS/Tesla-ready chargers are unlocking new customer segments with high charging frequency and large addressable markets. This supports higher recurring revenue, ancillary revenue growth, and stronger long-term earnings visibility.

What makes analysts so bullish on EVgo? The most eye-catching part of this narrative is built around ambitious expectations for future revenue and profit margins, as well as a daring profit multiple that is usually reserved for industry trailblazers. Wondering which numbers fuel this valuation call? Look closer to see the bold estimates driving that fair value target.

Result: Fair Value of $6.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on government incentives and concerns about operational reliability could quickly dampen optimism around EVgo’s future growth outlook.

Find out about the key risks to this EVgo narrative.

Another View: Valuation Ratios Tell a Different Story

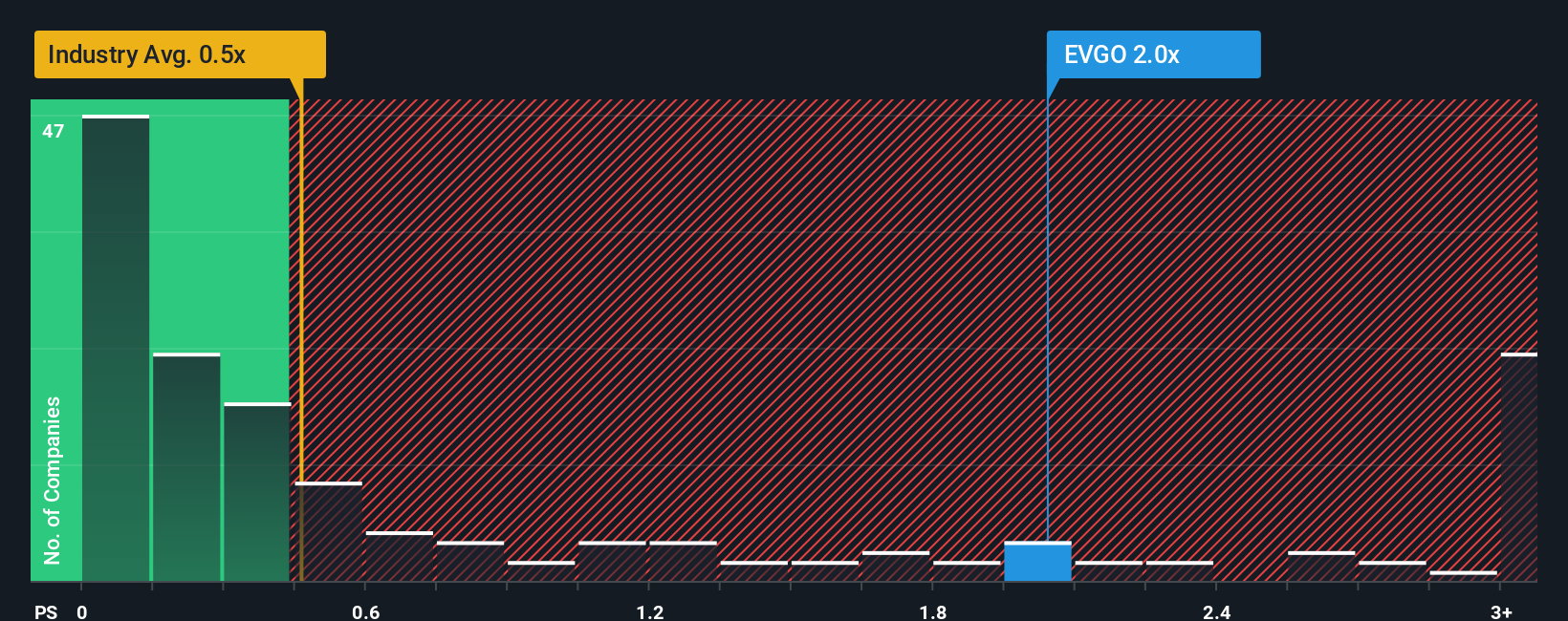

While analyst models point to significant upside, valuation based on sales paints a more muted picture. EVgo trades at 2.2 times its sales, which is well above both industry peers at 1.3x and the US specialty retail average of just 0.5x. The fair ratio sits lower at 1.6x, suggesting the stock might be priced for big expectations already. If the market reverts closer to these benchmarks, could downside risk outweigh the potential opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EVgo Narrative

If this perspective doesn’t fit your outlook or you’d rather dive deeper on your own, it’s quick and easy to craft your own story around the numbers. Do it your way

A great starting point for your EVgo research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity when outstanding stocks are waiting to be found? Let these handpicked screens inspire your next smart investment move before the crowd catches on.

- Unlock growth by checking out these 24 AI penny stocks fueling innovation in artificial intelligence across multiple industries and setting the pace for tomorrow’s market leaders.

- Secure reliable income streams by reviewing these 19 dividend stocks with yields > 3% with high yields and compelling fundamentals that could strengthen your portfolio with every payout.

- Position yourself at the cutting edge as you tap into these 26 quantum computing stocks driving the next wave of breakthroughs in computing and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVGO

EVgo

Owns and operates a direct current fast charging network for electric vehicles in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives