- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:ETSY

Should You Take a Fresh Look at Etsy After Its 40% Jump in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Etsy stock? You are not alone. After all, Etsy has been a bit of a rollercoaster, with sharp swings that can leave both new investors and seasoned holders wondering whether now is the moment to buy, sell, or simply watch from the sidelines. Just in the past week, shares have risen a striking 14.1%, and the momentum is even more dramatic over the past month, with a 40.3% jump. Year-to-date, the stock is up by 36.6%. Yet, it is impossible to ignore the steeper declines across the longer term, with three and five-year returns down by 37.0% and 48.0% respectively. That pattern suggests investor sentiment is evolving, possibly as the market reassesses Etsy’s role and growth potential in the e-commerce world.

Some of these recent moves may be tied to wider market optimism around digital commerce and shifts in consumer behavior, sparking a fresh look at companies with differentiated marketplaces. Still, with volatility comes a question that every prudent investor wants answered: Is Etsy undervalued, or does risk lurk beneath the surface?

Based on standard valuation metrics, Etsy appears undervalued in 2 out of 6 areas, resulting in a value score of 2. However, there is more to valuation than just a scorecard, especially in a market that tends to move on narrative as much as numbers. It is important to look into what the various valuation methods actually mean for Etsy, and later, I will share a perspective that goes beyond the usual formulas.

Etsy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Etsy Discounted Cash Flow (DCF) Analysis

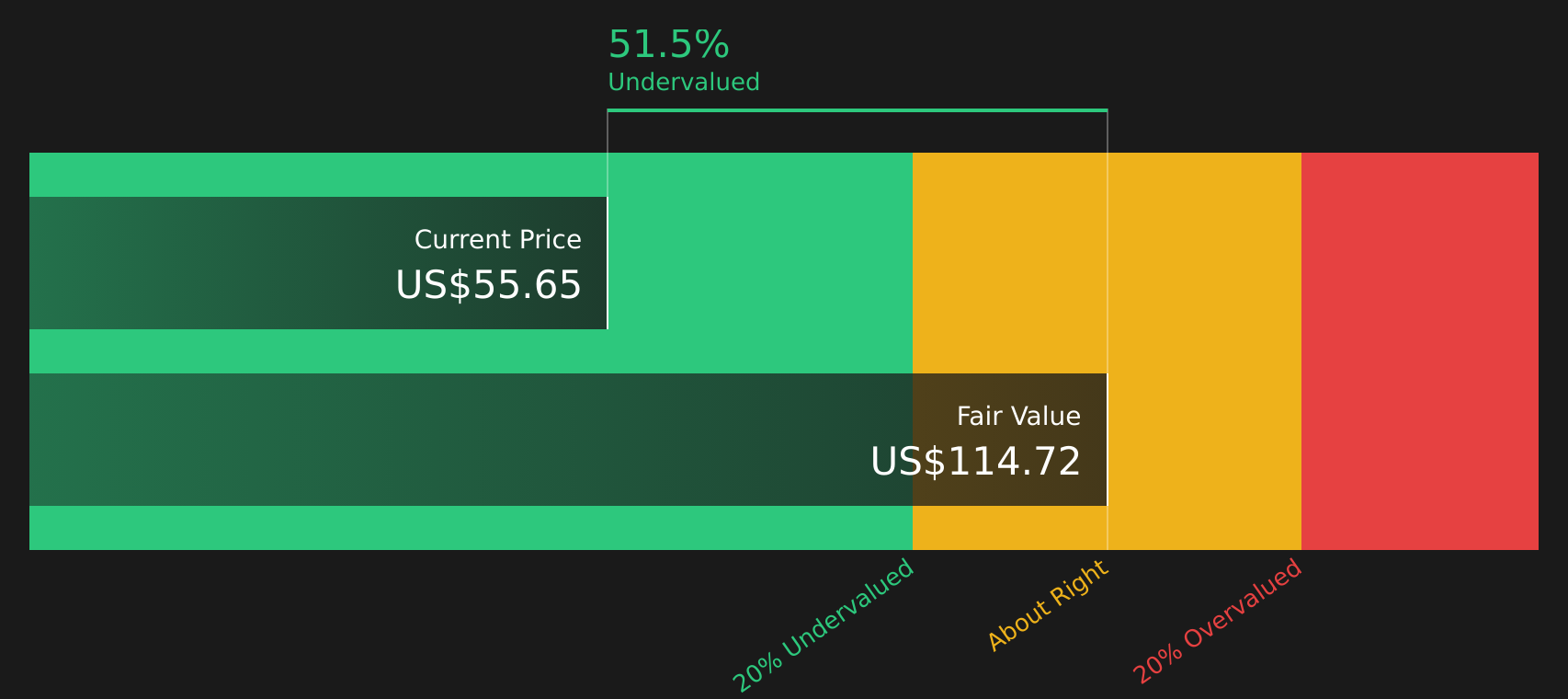

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to today’s value. This method reflects what the business could be worth if it continues performing as expected and factors in the time value of money.

For Etsy, the current Free Cash Flow stands at $643.4 Million. Over the next decade, analysts and model projections suggest that annual FCF will climb, reaching roughly $1.03 Billion by 2035. While analyst estimates cover five years, these long-term numbers are extrapolated based on growth trends and updated assumptions about market conditions.

Using the DCF model, Etsy’s estimated intrinsic value comes to $121.47 per share. This is notably higher than its current market price and implies the stock is trading at a 40.3% discount, which suggests it is significantly undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Etsy is undervalued by 40.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Etsy Price vs Earnings (PE Ratio)

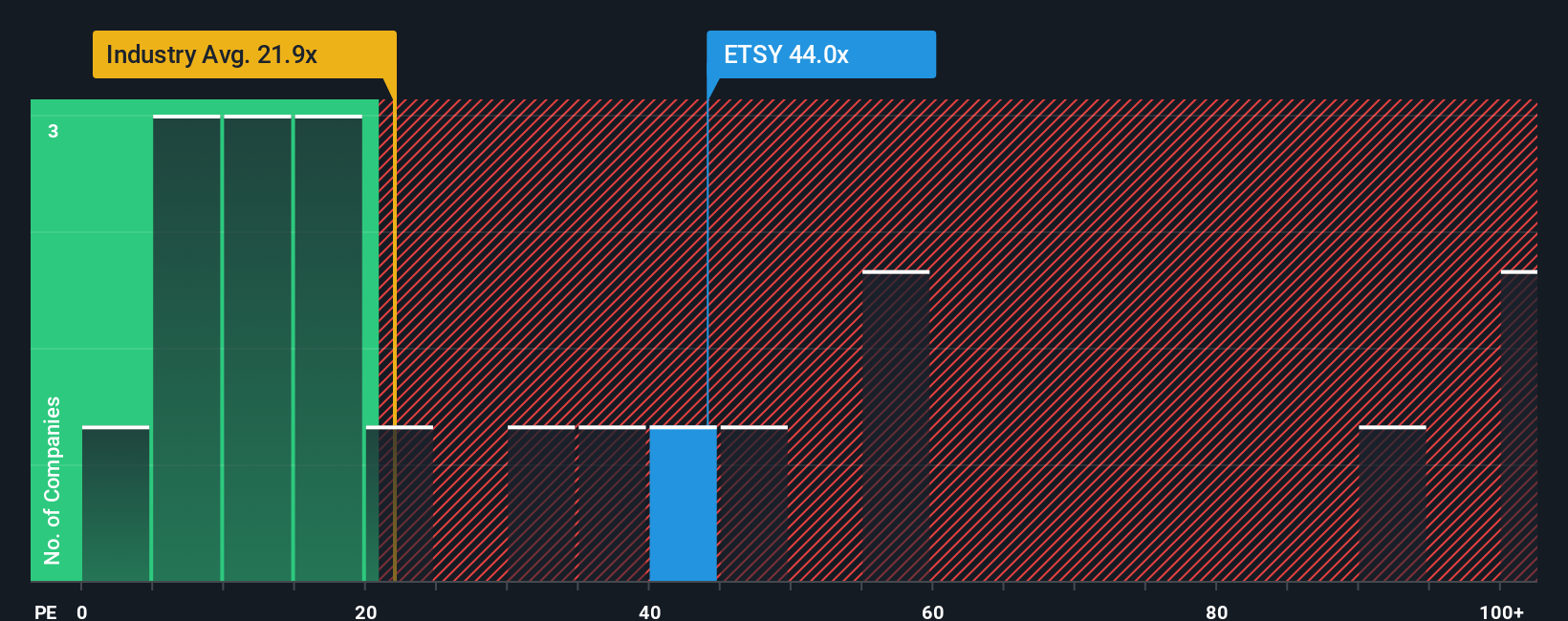

The Price-to-Earnings (PE) ratio is a widely used valuation metric for companies that are profitable because it connects the price investors are willing to pay to how much the company earns. For a growing, established business like Etsy, the PE ratio helps indicate whether the market is pricing its future prospects sensibly or getting ahead of itself.

Typically, higher growth or lower risks justify a higher PE ratio. In contrast, sluggish growth or elevated risks push the “fair” multiple lower. Etsy’s current PE ratio is 43.8x, which is well above the Multiline Retail industry average of 21.7x and the peer average of 19.4x. At first glance, this could make Etsy appear very expensive. However, simple comparisons do not always tell the full story, especially for companies with distinct business models and future outlooks.

This is where the “Fair Ratio” from Simply Wall St is useful. Their Fair Ratio for Etsy is 24.8x, calculated using a model that weighs not only growth and profitability but also factors like industry conditions, risks, profit margins, and market cap. This approach often provides a more nuanced and tailored benchmark than using simple peer or industry averages. Comparing Etsy’s actual PE of 43.8x to its Fair Ratio of 24.8x suggests that the stock is priced considerably above where its fundamentals and risks might justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Etsy Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story about a company. It connects your view of Etsy’s business, its future growth, and the risks or opportunities you see to specific financial forecasts, such as what you think are realistic future revenues, margins, and, ultimately, a fair value for the stock.

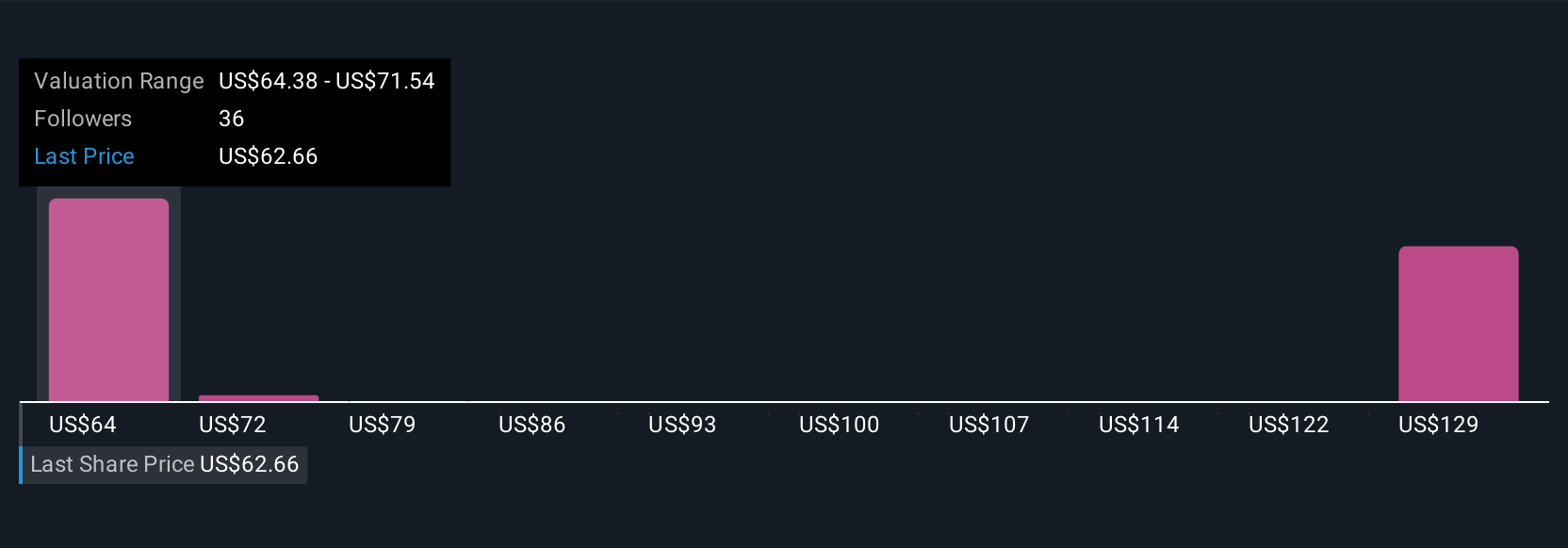

This approach bridges the gap between the numbers and the story, giving a clear logic chain from your perspective on the business through to the fair value you arrive at, all in a format that is accessible and easy to use via Simply Wall St’s Community page. Millions of investors are using Narratives to decide when to buy or sell by comparing their Narrative’s Fair Value to Etsy’s current share price.

Narratives update automatically as fresh events such as earnings reports or industry news emerge, meaning your view is always kept in sync with the latest information. For example, one investor might craft a bullish Narrative with a fair value of $86 per share, convinced that AI-powered personalization and app-led engagement will spark a revenue turnaround. Another investor, more cautious, might set their fair value far lower, say $48, due to risks from falling buyer engagement and stiffening competition. Narratives let you compare these perspectives at a glance and make investment choices that truly suit your beliefs and outlook.

Do you think there's more to the story for Etsy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives