- United States

- /

- Specialty Stores

- /

- NasdaqCM:EM

Smart Share Global Second Quarter 2024 Earnings: EPS: CN¥0.036 (vs CN¥0.094 in 2Q 2023)

Smart Share Global (NASDAQ:EM) Second Quarter 2024 Results

Key Financial Results

- Revenue: CN¥462.9m (down 55% from 2Q 2023).

- Net income: CN¥9.18m (down 63% from 2Q 2023).

- Profit margin: 2.0% (down from 2.4% in 2Q 2023). The decrease in margin was driven by lower revenue.

- EPS: CN¥0.036 (down from CN¥0.094 in 2Q 2023).

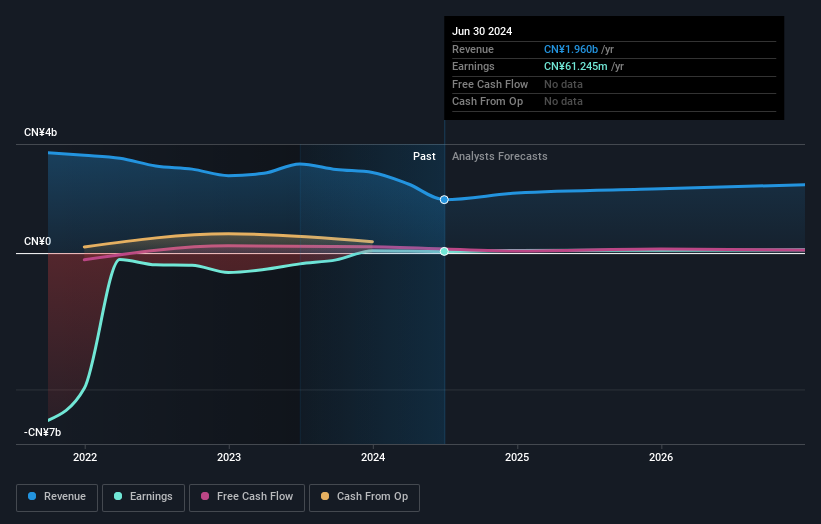

All figures shown in the chart above are for the trailing 12 month (TTM) period

Smart Share Global Earnings Insights

Looking ahead, revenue is forecast to grow 9.0% p.a. on average during the next 3 years, compared to a 4.9% growth forecast for the Specialty Retail industry in the US.

Performance of the American Specialty Retail industry.

The company's shares are up 1.0% from a week ago.

Balance Sheet Analysis

While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. See our latest analysis on Smart Share Global's balance sheet health.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EM

Smart Share Global

A consumer tech company, provides mobile device charging services through online and offline network in the People's Republic of China.

Adequate balance sheet with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026