- United States

- /

- Specialty Stores

- /

- NasdaqCM:EM

Slammed 34% Smart Share Global Limited (NASDAQ:EM) Screens Well Here But There Might Be A Catch

The Smart Share Global Limited (NASDAQ:EM) share price has fared very poorly over the last month, falling by a substantial 34%. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

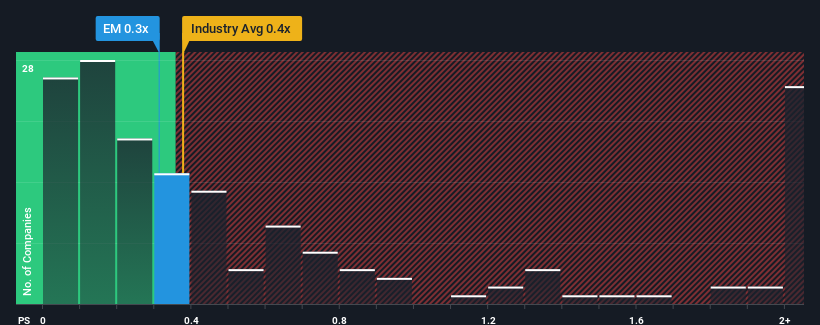

Although its price has dipped substantially, there still wouldn't be many who think Smart Share Global's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Smart Share Global

What Does Smart Share Global's Recent Performance Look Like?

Smart Share Global hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Smart Share Global's future stacks up against the industry? In that case, our free report is a great place to start.How Is Smart Share Global's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Smart Share Global's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 19% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 52% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 5.5% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Smart Share Global's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following Smart Share Global's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Smart Share Global's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about this 1 warning sign we've spotted with Smart Share Global.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EM

Smart Share Global

A consumer tech company, provides mobile device charging services in the People's Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives