- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

eBay’s (EBAY) Dividend and Guidance: A Signal of Strength or Simply Business as Usual?

Reviewed by Sasha Jovanovic

- Following its recent earnings report, eBay announced financial guidance for the fourth quarter and full year 2025, including expected revenues between US$2.83 billion and US$2.89 billion for the quarter, and declared a fourth quarter cash dividend of US$0.29 per share payable in December 2025.

- This combination of earnings guidance and dividend affirmation highlights eBay's ongoing focus on shareholder returns and its confidence in the company's financial outlook.

- We'll examine how eBay's updated revenue and earnings guidance could influence the company's investment narrative and market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

eBay Investment Narrative Recap

To be comfortable holding eBay shares, investors need to believe in the company’s ability to expand its core recommerce platform and sustain growth in high-engagement categories like collectibles, luxury, and parts. The latest earnings and dividend announcements reaffirm eBay’s focus on shareholder value, but they do not materially reduce the key risks: cooling trading card momentum or soft international consumer demand could still weigh on results in the near term.

The recently announced changes to Promoted Listings ad attribution are particularly relevant, as they could significantly increase eBay’s advertising revenue alongside seller costs. For shareholders, this shift ties directly into the short-term catalyst of margin expansion, but also intersects with the risk that higher ad fees might put pressure on the platform’s seller ecosystem and competitiveness.

However, the effect of rising seller costs and potential buyer price sensitivity is an issue investors should keep firmly in mind as...

Read the full narrative on eBay (it's free!)

eBay's narrative projects $12.3 billion revenue and $2.3 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $0.1 billion earnings increase from $2.2 billion.

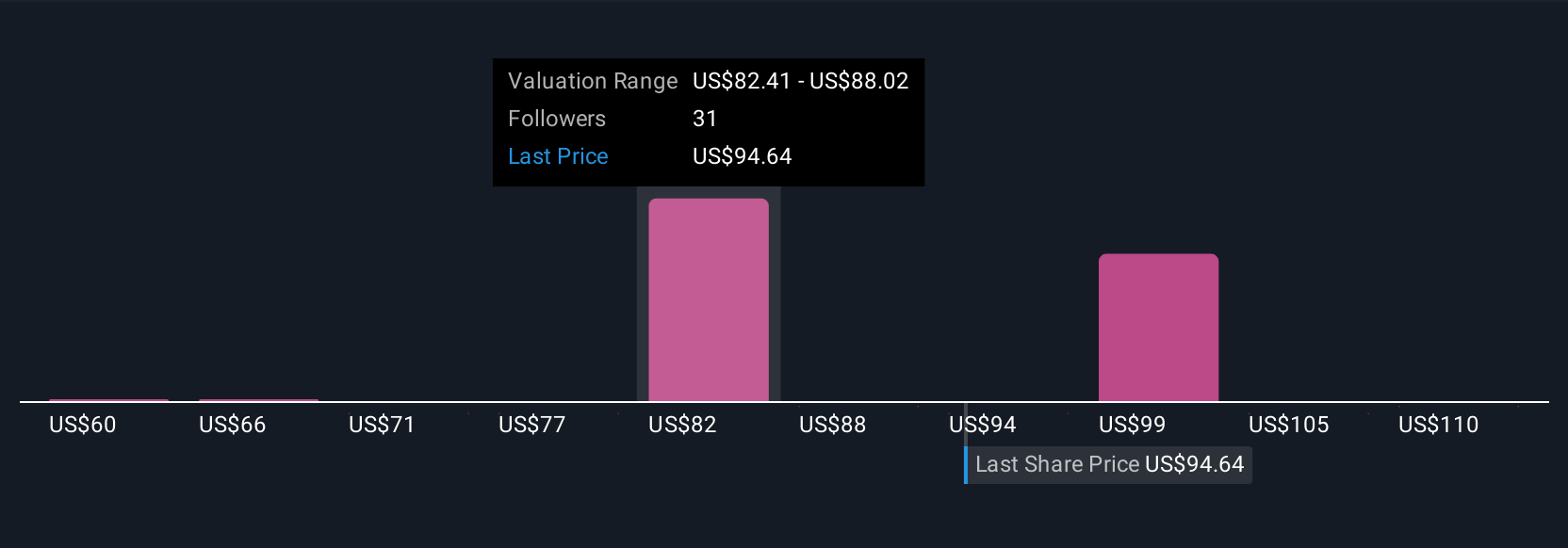

Uncover how eBay's forecasts yield a $91.55 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Fair value estimates for eBay from seven Simply Wall St Community members range from US$63.45 to US$143.54. Revenue growth in the core business outside focus categories remains slow, raising questions about longer-term performance across these contrasting viewpoints.

Explore 7 other fair value estimates on eBay - why the stock might be worth as much as 44% more than the current price!

Build Your Own eBay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your eBay research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free eBay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate eBay's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives