- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

Does eBay’s Collectibles Push Signal a New Opportunity After a 32% Rally in 2025?

Reviewed by Bailey Pemberton

- Ever wondered whether eBay's current share price really reflects its true value? You're definitely not alone, and the answer might surprise you as we dig deeper.

- eBay's stock has had quite a ride lately, climbing 32.5% year-to-date despite experiencing a 15.8% pullback over the past month.

- Recent headlines have focused on eBay's new partnership in the collectibles space and its push towards enhanced buyer protections. Both of these developments have drawn fresh attention to the company and its future growth prospects. These changes may help explain the shifts in investor sentiment driving eBay's most recent price swings.

- According to our latest analysis, eBay scores 5 out of 6 on our valuation checks for undervaluation, making it one of the more intriguing picks in the market today. Next, we will break down the different ways to approach valuation, and at the end of the article, we will reveal a smarter method to cut through the noise.

Approach 1: eBay Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by predicting its future cash flows and discounting them back to their present value. This approach helps investors determine what the company is really worth today, based on its potential to generate cash over time.

For eBay, the current Free Cash Flow stands at approximately $1.54 billion. Analysts provide specific forecasts for the first five years, with estimates rising to about $3.22 billion by 2029. Beyond that point, further projections are extrapolated using Simply Wall St’s methodology. This outlook points to steady annual growth in eBay’s cash generation through the next decade.

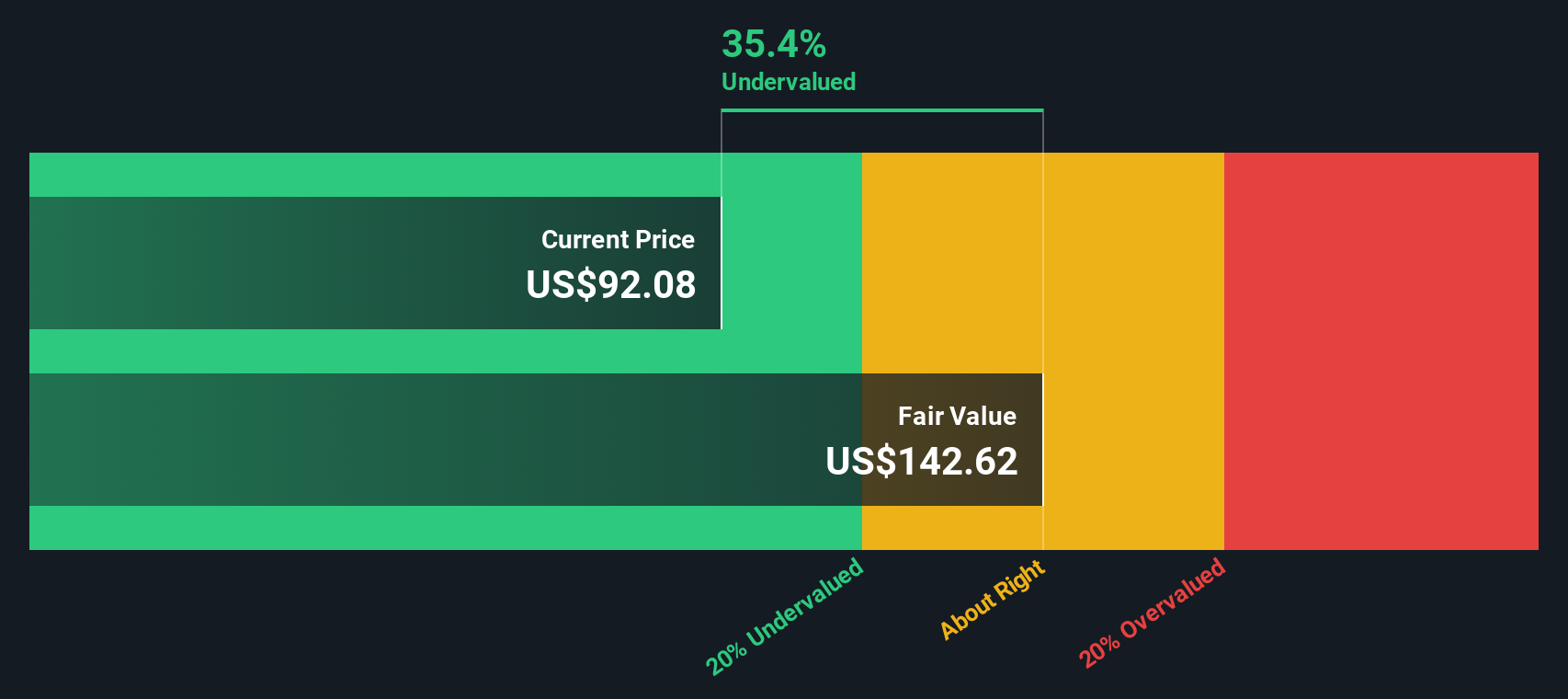

Based on these cash flow estimates and using the 2 Stage Free Cash Flow to Equity model, eBay’s intrinsic value is calculated at $115.52 per share. Compared to the company’s current share price, this implies the stock is trading at a 28.6% discount to its fair value. This suggests the market currently undervalues the company.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests eBay is undervalued by 28.6%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: eBay Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most trusted ways to value a profitable company like eBay. It tells investors how much they are paying for every dollar of current earnings, making it a practical snapshot of market expectations. For companies with steady profits, the PE ratio can quickly flag whether shares look cheap or expensive based on established norms.

However, what counts as a “normal” or “fair” PE ratio cannot be boiled down to a single number. Companies expected to grow earnings faster or ones seen as having lower risk can justify a higher PE. On the other hand, lagging growth or higher risk warrants a lower PE. In this case, context is everything.

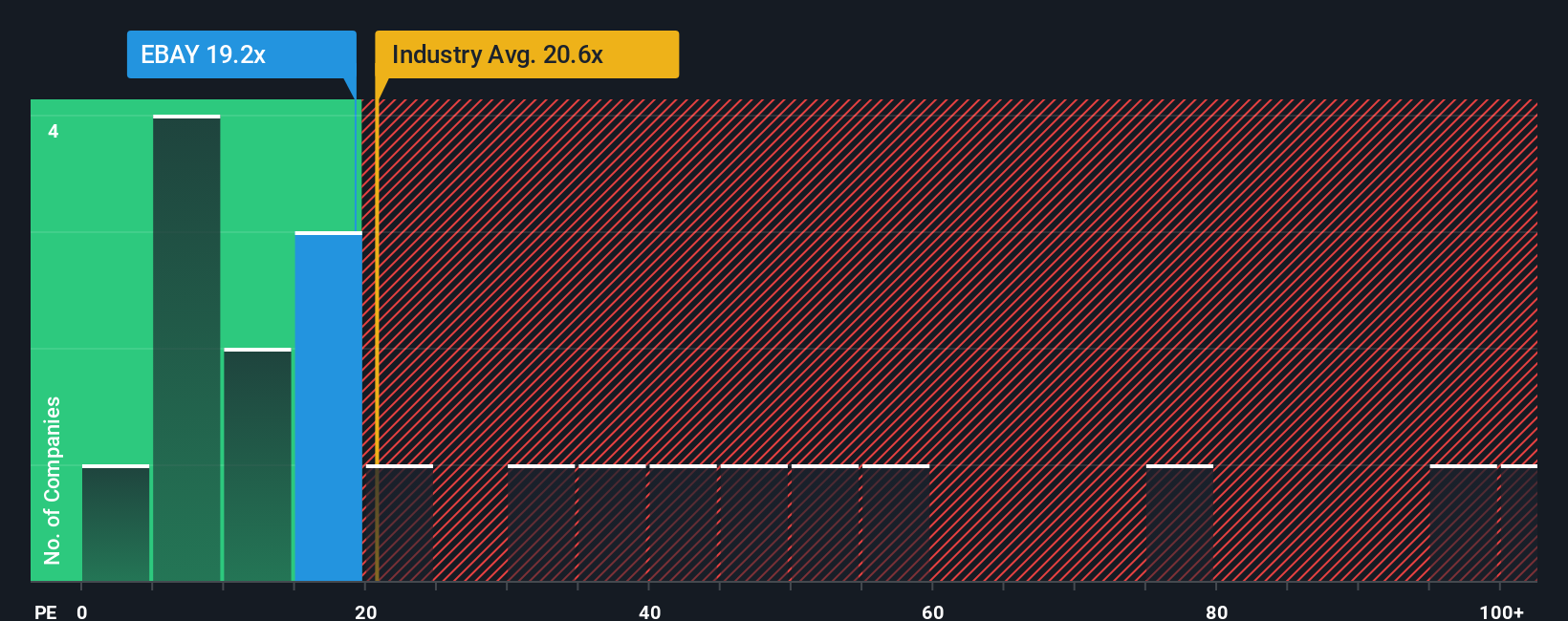

Right now, eBay trades at a PE of 17.33x. That is a little below the Multiline Retail industry average of 19.76x and well below its peer average of 51.39x. Simply Wall St also calculates a “Fair Ratio” for eBay of 18.36x. This proprietary metric blends together the company’s expected earnings growth, its profit margins, sector trends, market size, and risk factors, placing it a step ahead of broad industry averages or peer group numbers.

Comparing eBay’s current PE to its Fair Ratio, there is only a minor gap, which suggests the market has landed on a valuation that is largely in line with what the fundamentals justify.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your eBay Narrative

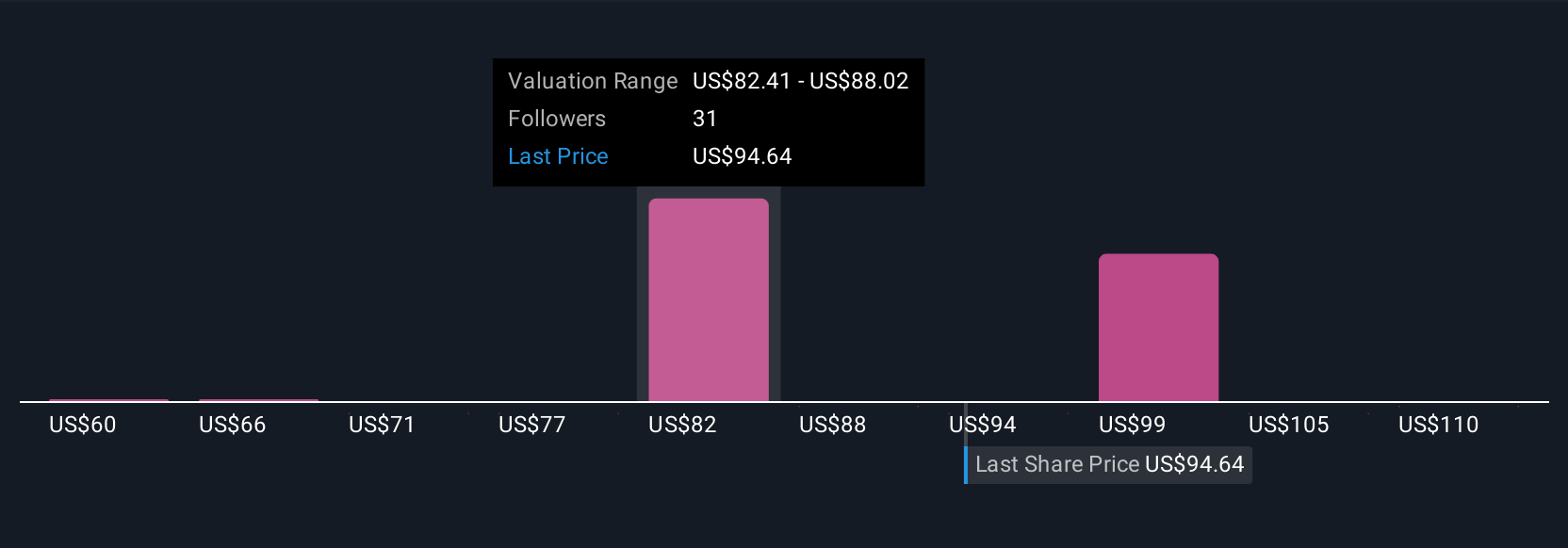

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you put your own story behind the numbers by connecting your assumptions about a company’s future revenue, earnings, and margins with a financial forecast and ultimately a fair value.

Rather than just relying on models or ratios, Narratives make investing more accessible by allowing you to clearly link eBay’s business outlook to what you think it’s really worth. This can help you decide if now is the right time to buy or sell, based on how the Fair Value compares with the current share price. Narratives are available within the Simply Wall St Community page, used by millions of investors, and update dynamically whenever new information or events are released, including earnings reports and forecast changes.

For example, some investors currently have a bullish Narrative for eBay, anticipating a fair value as high as $102 based on ongoing momentum in focus categories like collectibles and tech-driven improvements. Others are bearish, projecting as low as $60 due to macroeconomic risks and unpredictable growth. This demonstrates that your Narrative, grounded in your own perspective and up-to-date facts, is a useful way to navigate information and make more informed decisions.

Do you think there's more to the story for eBay? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success