- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:BZUN

Baozun Inc.'s (NASDAQ:BZUN) Price Is Right But Growth Is Lacking After Shares Rocket 29%

The Baozun Inc. (NASDAQ:BZUN) share price has done very well over the last month, posting an excellent gain of 29%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.7% in the last twelve months.

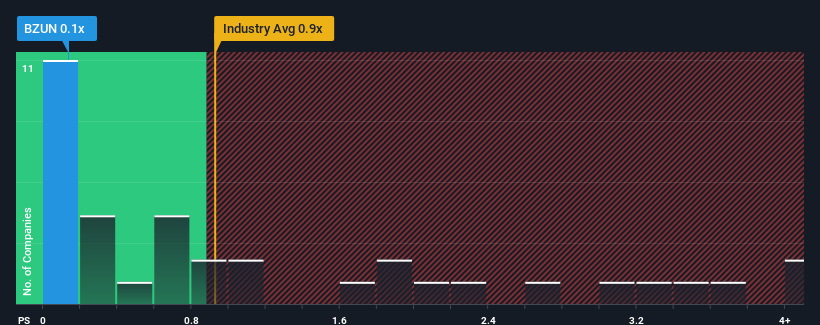

Even after such a large jump in price, Baozun may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Multiline Retail industry in the United States have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Baozun

What Does Baozun's P/S Mean For Shareholders?

Recent times haven't been great for Baozun as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Baozun will help you uncover what's on the horizon.How Is Baozun's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Baozun's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.6% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 5.5% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 5.0% per annum during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 12% per annum, which is noticeably more attractive.

With this information, we can see why Baozun is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Baozun's P/S Mean For Investors?

Baozun's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Baozun's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Baozun with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Baozun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BZUN

Baozun

Through its subsidiaries, engages in the provision of end-to-end e-commerce solutions in the People's Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives