- United States

- /

- Specialty Stores

- /

- NasdaqGS:ARHS

Optimistic Investors Push Arhaus, Inc. (NASDAQ:ARHS) Shares Up 26% But Growth Is Lacking

Arhaus, Inc. (NASDAQ:ARHS) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 86%.

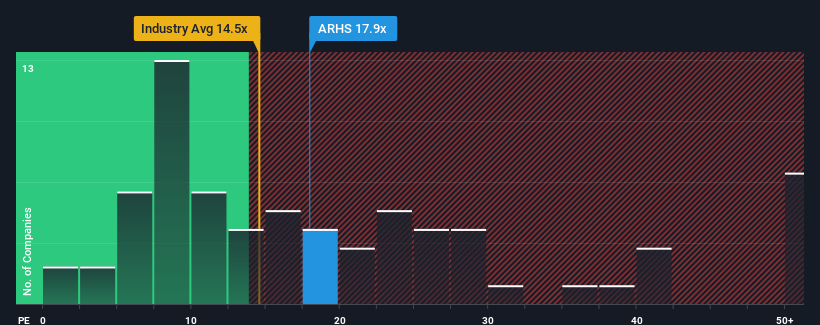

Even after such a large jump in price, there still wouldn't be many who think Arhaus' price-to-earnings (or "P/E") ratio of 17.9x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Arhaus has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Arhaus

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Arhaus' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 9.2%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 2,993% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 1.9% per year over the next three years. With the market predicted to deliver 10% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Arhaus is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Arhaus' P/E?

Its shares have lifted substantially and now Arhaus' P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Arhaus' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Arhaus you should know about.

If you're unsure about the strength of Arhaus' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARHS

Arhaus

Operates as a lifestyle brand and premium retailer in the home furnishings market in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives