- United States

- /

- Specialty Stores

- /

- NasdaqGS:ARHS

Assessing Arhaus (ARHS) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Arhaus.

Arhaus’s recent share price jump, capped by an impressive 18% return over the last week, has caught the eye of investors. While the 1-year total shareholder return sits at a modest 3.8%, momentum appears to be building again after a period of slower performance. This suggests renewed optimism around the company’s outlook.

If you’re looking for more growth stories beyond home furnishings, this could be the perfect moment to discover fast growing stocks with high insider ownership.

Given Arhaus’s recent rally and solid returns, the key question now is whether shares remain undervalued and offer further upside, or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 6.7% Undervalued

Arhaus's most-followed narrative suggests the shares are trading below the calculated fair value, with the last close at $10.48 versus a fair value estimate of $11.23. This difference points to room for upside if forecasts and assumptions play out as projected.

Ongoing investment in omnichannel platforms, digital content, and supply chain efficiency, including successful in-sourcing of distribution and implementation of new inventory/ERP systems, are expected to improve operating leverage and expand net margins as scale increases.

Curious what bold moves and aggressive expansion plans underpin this ambitious fair value estimate? The secret to this valuation lies in projections of margin gains and future revenue growth that challenge conventional expectations. Discover the core assumptions that could reshape Arhaus’s trajectory. Click through to unpack the financial story behind the stock.

Result: Fair Value of $11.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer uncertainty and rising input costs could challenge Arhaus’s growth narrative. These factors may potentially impact revenue momentum and future margin expectations.

Find out about the key risks to this Arhaus narrative.

Another View: Multiples Tell a Different Story

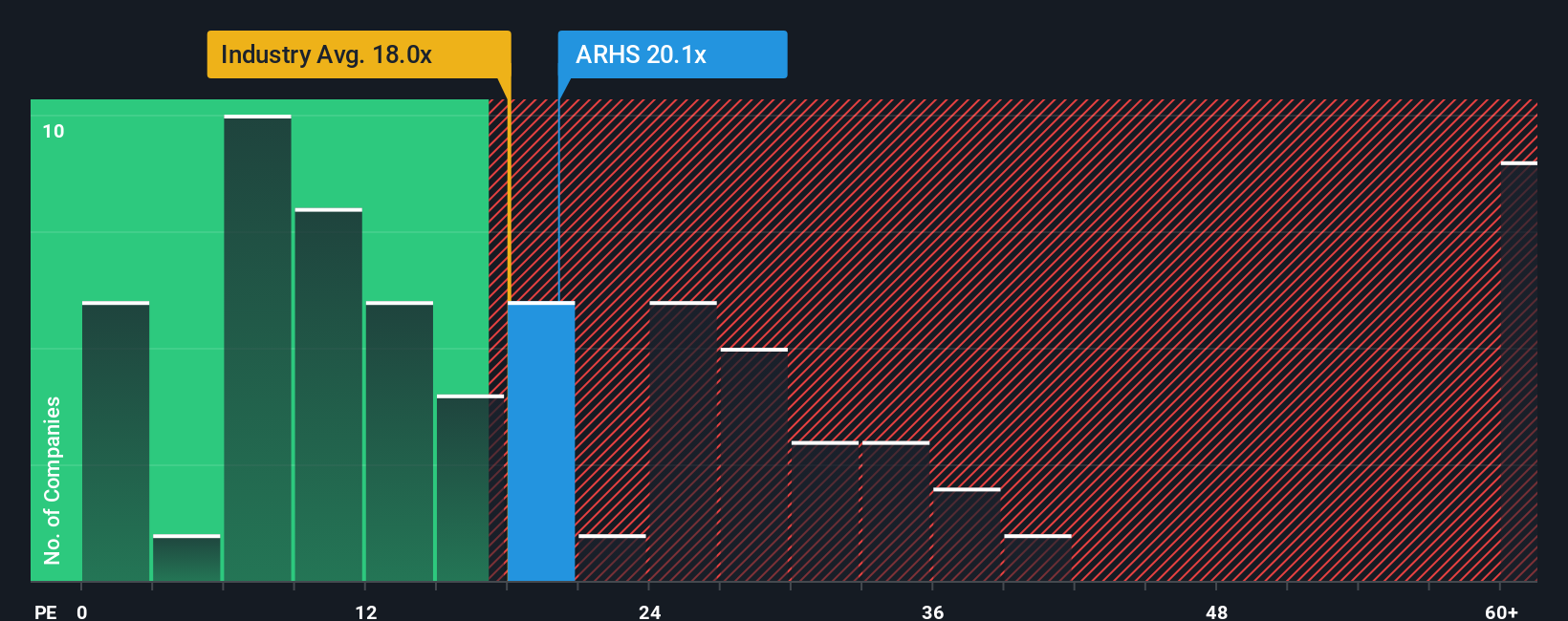

Taking a look at Arhaus's valuation through the lens of its price-to-earnings ratio, a different picture emerges. Shares are trading at 20.1 times earnings, which is higher than both the Specialty Retail industry average of 18.9 and the fair ratio of 15.2. This suggests investors are paying a premium, possibly making the stock more vulnerable to a shift in market sentiment. Could the premium be justified or is there risk in the current setup?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arhaus Narrative

If you have a different take or want to dig into the numbers personally, you can easily craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Arhaus.

Looking for More Investment Ideas?

Don’t let fresh investment opportunities pass you by. The right ideas at your fingertips today could fuel the results you want tomorrow. Here are a few standout stock themes you’ll want to consider:

- Power your portfolio growth by tapping into these 927 undervalued stocks based on cash flows with prices supported by robust cash flows and untapped potential.

- Capture income with confidence as you check out these 15 dividend stocks with yields > 3% offering yields over 3% and rewarding shareholders on a regular basis.

- Unleash the future of medicine by starting with these 30 healthcare AI stocks transforming healthcare with intelligent diagnostics and innovations in treatment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARHS

Arhaus

Operates as a lifestyle brand and premium retailer in the home furnishings market in the United States.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success