- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Will Analyst Optimism on Cloud and Ads Growth Shift Amazon.com's (AMZN) Profitability Narrative?

Reviewed by Sasha Jovanovic

- Leading up to Amazon’s quarterly earnings announcement, multiple top analysts expressed optimism about the company’s growth prospects in cloud computing and advertising, highlighting expanded Amazon Ads capabilities and AWS service momentum.

- Efficiency initiatives, such as recent corporate job cuts and large-scale automation, have further shaped expectations for an improved operational performance and profitability at Amazon, as investors await its results.

- We'll explore how the anticipated growth in Amazon's cloud and advertising businesses could influence the company's investment outlook going forward.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Amazon.com Investment Narrative Recap

To be an Amazon shareholder, you need to believe the company can maintain its leadership across e-commerce, cloud, and advertising, and that these segments will offset growing competition and cost pressures. The recent surge of optimism around Amazon’s cloud and ads business remains intact, as the news flow, including expanded ad platform capabilities, does not materially alter upcoming earnings catalysts or introduce new business risks in the near term.

Among the latest announcements, the upgraded collaboration between Clinch and Amazon Ads stands out by enhancing ad targeting and privacy for brands using Amazon DSP. With advertising being a key short-term catalyst, this supports the bullish analyst sentiment around Amazon’s potential to capture incremental revenue and strengthen its high-margin segments.

Yet, in contrast to this momentum, investors should stay alert to the squeeze on AWS margins if supply constraints or high investment needs outpace...

Read the full narrative on Amazon.com (it's free!)

Amazon.com's outlook anticipates $905.9 billion in revenue and $111.9 billion in earnings by 2028. This scenario relies on an annual revenue growth rate of 10.6% and represents a $41.3 billion increase in earnings from the current level of $70.6 billion.

Uncover how Amazon.com's forecasts yield a $266.56 fair value, a 17% upside to its current price.

Exploring Other Perspectives

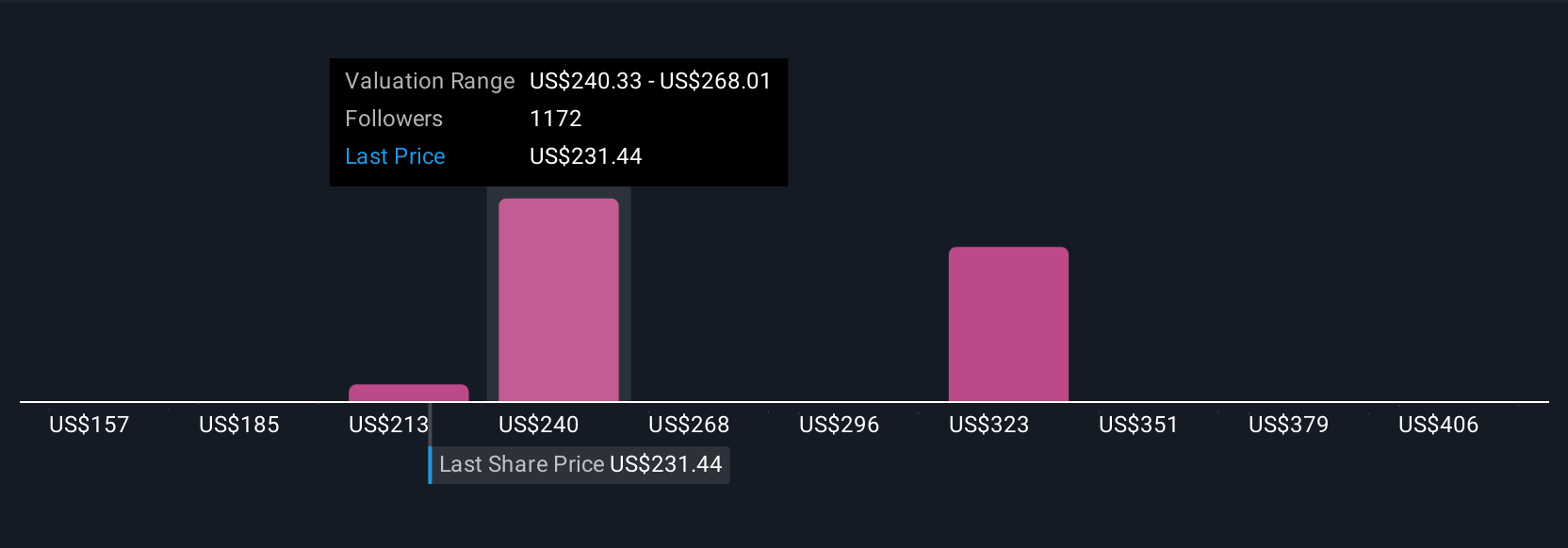

Community members on Simply Wall St estimate Amazon's fair value between US$173 and US$273 across 132 viewpoints. As you weigh AWS investment risks, consider how differently participants assess the company's long-term earnings power.

Explore 132 other fair value estimates on Amazon.com - why the stock might be worth as much as 20% more than the current price!

Build Your Own Amazon.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amazon.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amazon.com's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion