- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

These 4 Measures Indicate That Amazon.com (NASDAQ:AMZN) Is Using Debt Extensively

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Amazon.com, Inc. (NASDAQ:AMZN) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Amazon.com

What Is Amazon.com's Net Debt?

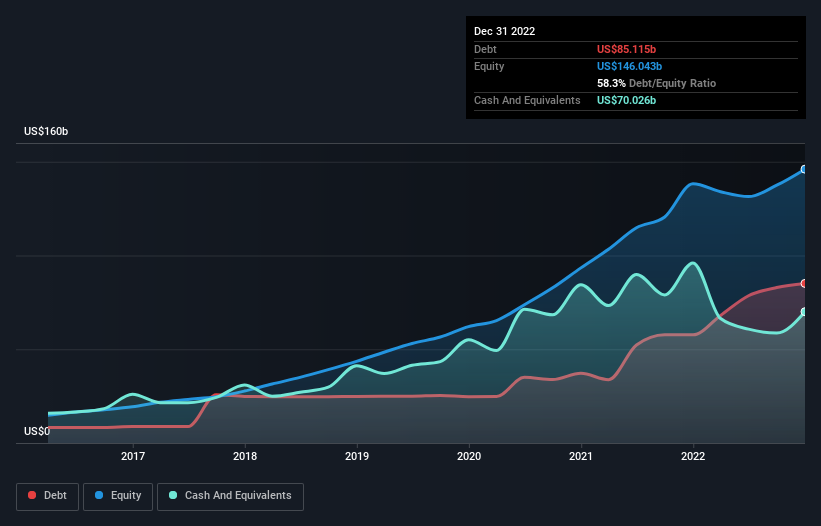

You can click the graphic below for the historical numbers, but it shows that as of December 2022 Amazon.com had US$85.1b of debt, an increase on US$57.7b, over one year. However, it does have US$70.0b in cash offsetting this, leading to net debt of about US$15.1b.

How Healthy Is Amazon.com's Balance Sheet?

According to the last reported balance sheet, Amazon.com had liabilities of US$155.4b due within 12 months, and liabilities of US$161.2b due beyond 12 months. Offsetting these obligations, it had cash of US$70.0b as well as receivables valued at US$42.0b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$204.6b.

While this might seem like a lot, it is not so bad since Amazon.com has a huge market capitalization of US$1.01t, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. Carrying virtually no net debt, Amazon.com has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With net debt sitting at just 0.28 times EBITDA, Amazon.com is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 8.9 times the interest expense over the last year. It is just as well that Amazon.com's load is not too heavy, because its EBIT was down 51% over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Amazon.com's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Considering the last three years, Amazon.com actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Both Amazon.com's EBIT growth rate and its conversion of EBIT to free cash flow were discouraging. But at least its net debt to EBITDA is a gleaming silver lining to those clouds. Taking the abovementioned factors together we do think Amazon.com's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. Even though Amazon.com lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

A fully integrated LNG business seems to be ignored by the market.

Qualcomm 2026: Navigating Short-Term Supply Constraints to Fuel a Multi-Sector AI Breakout

Hitit Bilgisayar Based on 2026 expectations, the company is priced at 20x PE and 17x Enterprise Value/EBITDA.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026