- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Did Amazon Grocery’s Private Label Launch Just Shift Amazon.com’s (AMZN) Food Retail Investment Narrative?

Reviewed by Sasha Jovanovic

- Amazon recently launched its new Amazon Grocery private label, merging Amazon Fresh and Happy Belly into a unified grocery essentials collection featuring over 1,000 affordable, high-quality products with sustainability-focused packaging and clear nutrition labeling.

- This move positions Amazon to further increase its market share in the grocery sector while enhancing customer value and convenience through expanded product selection and improved transparency.

- We'll examine how Amazon's expansion of its grocery private label portfolio could shape its investment narrative and long-term position in food retail.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Amazon.com Investment Narrative Recap

To be a shareholder of Amazon today, you need to believe in its ability to continually grow both cloud and e-commerce segments, while managing cost pressures and fierce competition, particularly in AWS, which remains the most important short-term catalyst for the stock. Amazon’s new Grocery private label launch expands its retail presence, but its impact on AWS’s margin and growth outlook, the company’s central earnings driver, is currently not material and does little to alter near-term risks from higher cloud investment and regulatory scrutiny.

Among recent announcements, the rollout of cloud enhancements with AWS generative AI solutions stands out as most relevant to Amazon’s main earnings engine. While expanding grocery offerings strengthens the core marketplace flywheel and appeals to customers, it’s Amazon’s progress in AI and cloud that directly addresses the enduring catalysts and barriers shaping the company’s future performance.

In contrast, investors should pay close attention to long-term margin pressure from AWS capital intensity and...

Read the full narrative on Amazon.com (it's free!)

Amazon.com's narrative projects $905.9 billion revenue and $111.9 billion earnings by 2028. This requires 10.6% yearly revenue growth and a $41.3 billion earnings increase from $70.6 billion today.

Uncover how Amazon.com's forecasts yield a $266.56 fair value, a 21% upside to its current price.

Exploring Other Perspectives

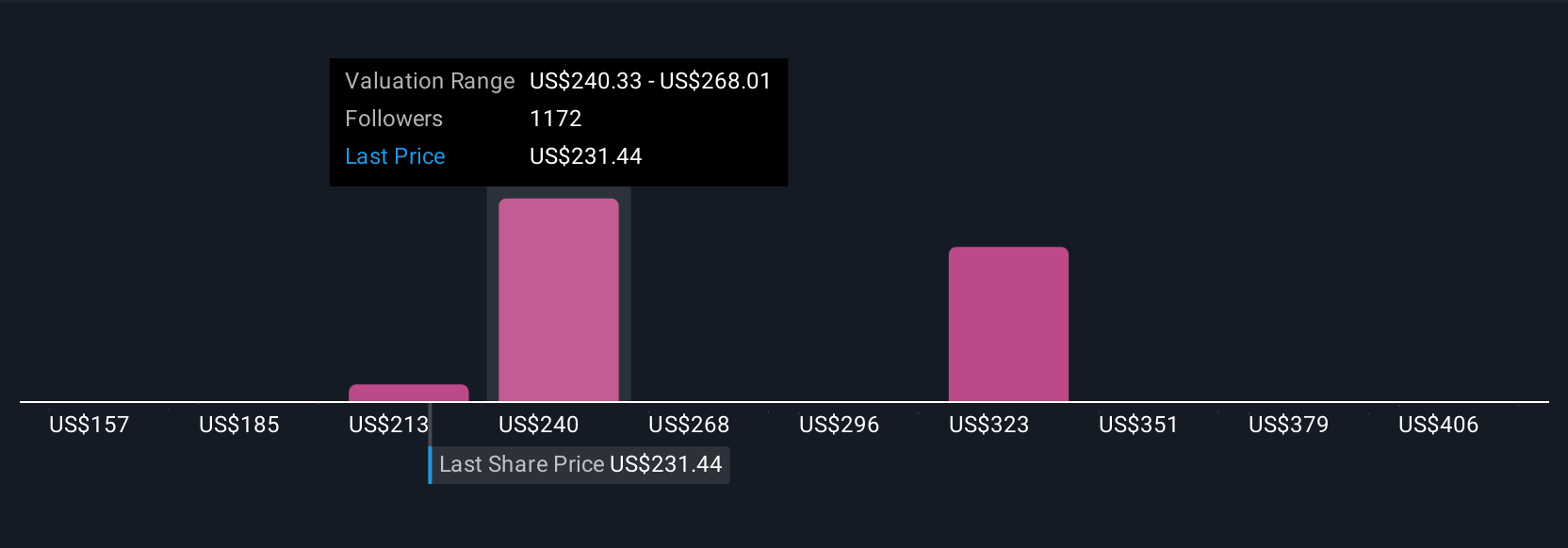

With 172 fair value estimates from the Simply Wall St Community ranging from US$166 to US$434.13, member perspectives are wide ranging. Keep in mind: the ongoing need for massive cloud investment remains a defining factor for Amazon’s future direction.

Explore 172 other fair value estimates on Amazon.com - why the stock might be worth 24% less than the current price!

Build Your Own Amazon.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amazon.com research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amazon.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amazon.com's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion