- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Assessing Amazon (AMZN) Valuation After Recent Pullback And Mixed Views On Fair Value

Reviewed by Simply Wall St

Amazon.com (AMZN) continues to attract attention after recent trading, with the share price last closing at $242.60. Investors are weighing this level against the company’s scale across e-commerce, subscriptions, advertising, and Amazon Web Services.

See our latest analysis for Amazon.com.

The recent pullback, with a 1 day share price return of a 1.57% decline from US$242.60, comes after a 30 day share price return of 7.26% and a 1 year total shareholder return of 11.41%. This suggests momentum has been building over recent months even as shorter term sentiment has cooled.

If Amazon.com has your attention, it could be a good moment to scan high growth tech and AI stocks for other large tech and AI names that might fit your watchlist next.

With Amazon.com trading at US$242.60 and an indicated 35% intrinsic discount plus a 22% gap to analyst targets, the key question is whether this suggests genuine undervaluation or indicates that the market has already priced in future growth.

Most Popular Narrative: 3.3% Overvalued

According to Zwfis, the fair value estimate of Amazon.com sits slightly below the last close of US$242.60. This frames the narrative as pricing in a premium.

Overall I was very impressed from the call and feel very good about the companies long term future. The only two negatives I took from it was AWS not growing to revenue expectations and then also during the Q and A they were asked about AI innovation and so on, and they never really never answered the questions and were just very vague.

Curious what kind of earnings path, profit margins, and future P/E Zwfis uses to justify a value just under today’s price? The full narrative lays out the numbers behind that view.

Result: Fair Value of $234.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this view could shift if AWS growth slows further, or if ongoing power, chip, and tariff pressures weigh more heavily on margins and cash flow.

Find out about the key risks to this Amazon.com narrative.

Another View: Market Ratios Tell a Different Story

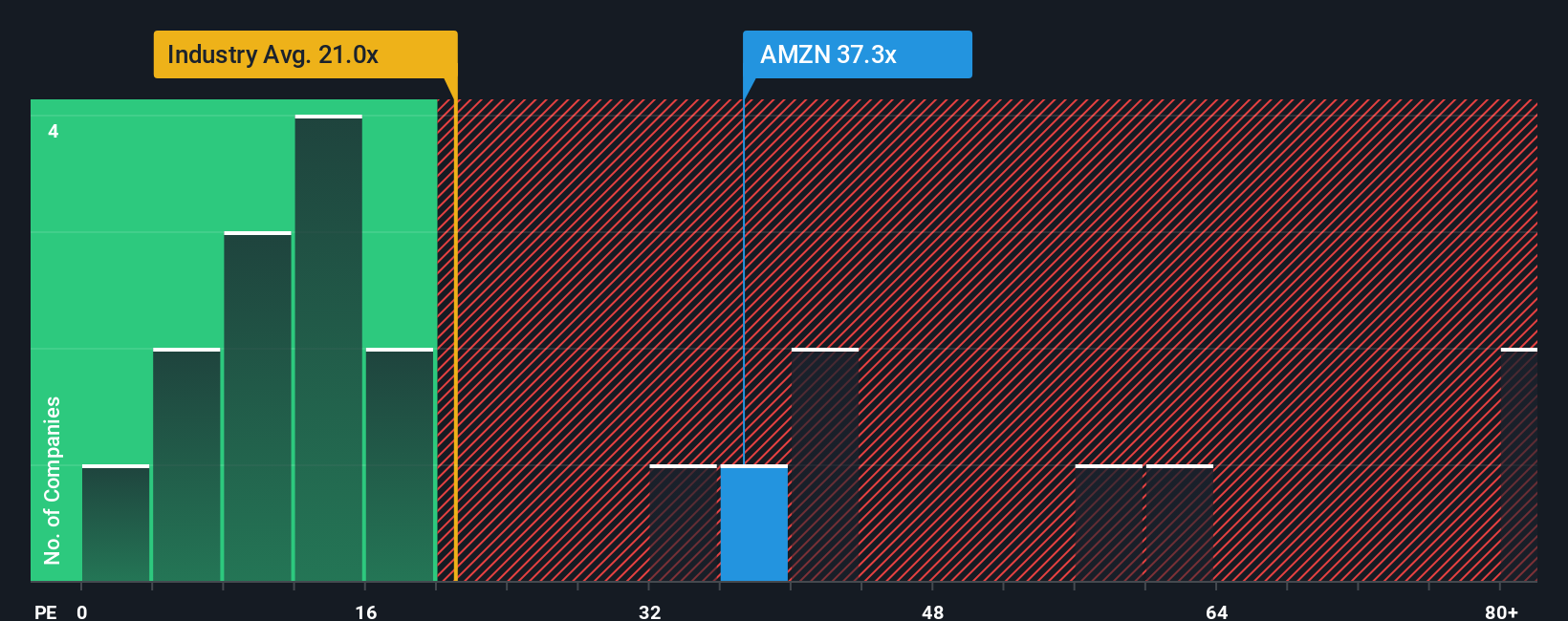

Zwfis’ narrative points to Amazon.com as roughly 3.3% overvalued around US$242.60, but our multiples view is more forgiving. The current P/E is 33.9x, slightly below the peer average of 34.1x and below a fair ratio estimate of 41.3x, which signals some valuation cushion rather than stretch.

Compared with the broader Global Multiline Retail industry P/E of 20.1x, Amazon.com does carry a clear premium, which reflects its scale and earnings profile but also adds valuation risk if sentiment turns. The question for you is whether that premium feels like justified quality or just extra price you are paying.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amazon.com Narrative

If you see the numbers differently or simply prefer reaching your own conclusions, you can test your assumptions and build a full thesis in minutes: Do it your way.

A great starting point for your Amazon.com research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Amazon.com already sits on your radar, do not stop there. Widen your watchlist using focused stock ideas that match the kind of opportunities you care about most.

- Spot potential mispricings by scanning these 884 undervalued stocks based on cash flows that may offer more attractive entry points than the names everyone already talks about.

- Zero in on future tech themes with these 29 quantum computing stocks that connect real businesses to breakthroughs beyond today’s headlines.

- Strengthen your income focus by reviewing these 13 dividend stocks with yields > 3% that might complement growth holdings with steadier payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Nike (NKE): When Brand Power Meets a Faster Fashion Cycle

Microsoft Stock: AI Momentum Is Strong — But Rising Capex Tests Investor Patience

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Early mover in a fast growing industry. Likely to experience share price volatility as they scale