- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

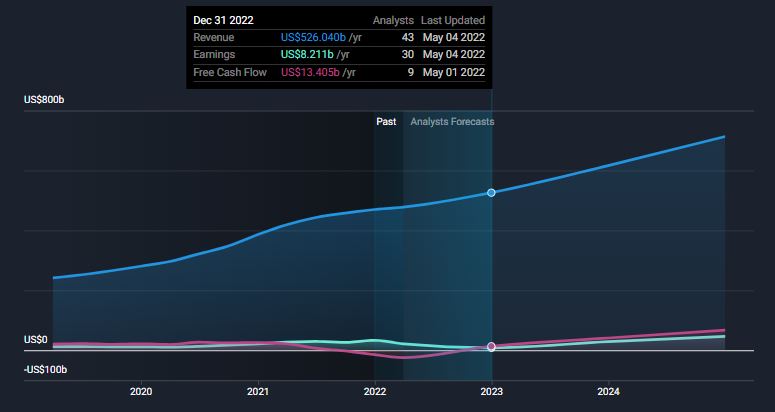

Amazon’s (NASDAQ:AMZN) Cash Flows are set to Improve which may lead to Improved Sentiment

Amazon’s ( NASDAQ: AMZN ) share price has remained under pressure since the company reported first-quarter results. It appears that these results have resulted in capitulation by investors who have been frustrated by Amazon’s low margins over the last few years. However, there are a few reasons for optimism regarding the longer-term outlook.

Key takeaways from this analysis:

- Investors have become frustrated by Amazon's low margins.

- Cash flows are set to improve as Capex investment slows.

- Higher margin businesses are contributing an increasing percentage of revenue.

First-quarter earnings - disappointing growth and profitability

Amazon’s recent results contained plenty of bad news, including a $3.8 billion net loss, a $7.6 bln charge on its Rivian investment, and a year-on-year decrease in online sales.

The individual business segments performed as follows:

- Online sales: 51.13 bln, down 3% year-on-year

- Third-party seller services: $25.3 bln, up 7% year-on-year.

- Subscription services: $8.4 bln, up 11% year-on-year.

- Advertising services $7.9 bln, up 23% year-on-year

- AWS: $18.44 bln, up 37% year-on-year.

Guidance for the current quarter was also weak with operating income expected to be between -$1 bln and $3 bln.

There was a lot to unpack in these results, but the concerns really come down to profitability and e-commerce growth. The Rivian loss was a one-off event, which reversed previous gains. AWS continues to grow and accounts for an increasing share of total revenue. Furthermore, the advertising and services businesses are now contributing meaningfully to overall revenue.

The stock price is now down 41% from its November high and 23% since the results were released. With all this bad news in the share price, it's worth considering factors that may lead to improved sentiment going forward.

View our latest analysis for Amazon.com

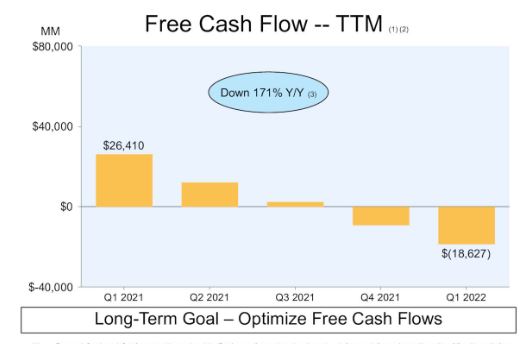

Amazon’s Free Cash Flow

One of the bright spots from these results was the suggestion that the cash flow margin may improve going forward. Amazon has always prioritized long-term growth potential over short-term profitability. This has often frustrated investors as the company’s margins have remained low.

The free cash flow margin has oscillated around 5% since 2004, briefly falling to 1% in 2012. It briefly topped 10% in 2009, 2018, and 2020. However, by June last year, it had fallen to a five-year low, and in the recent quarter, it fell into negative territory. One of the reasons it has fallen over the last two years is that the company increased its investment in fulfillment capacity when e-commerce sales accelerated in 2020.

The company has now reached a point where the fulfillment capabilities are at overcapacity, and investment can be reduced. During the earnings call, Amazon CFO Brian Olsavsky said: “ During the pandemic, we were facing not only unprecedented demand but also extended lead times on new capacity. And we built towards the high end of a very volatile demand outlook. Now that demand patterns have stabilized, we see an opportunity to better match our capacity to demand.”

The lower Capex requirements should lead to better margins in the future, even if e-commerce revenue remains flat. In addition, AWS and the subscription segments now account for 29% of total net sales. These segments are growing faster and have wider margins than the e-commerce segments, meaning they contribute a larger percentage to net income each quarter.

Conclusion

Amazon’s share price remains under pressure along with the rest of the market. However, there are several reasons to believe margins will improve at some point in the next few quarters, and this could lead to improved sentiment.

You can keep track of Amazon's margins and other key metrics by referring to the Simply Wall St Amazon Analysis

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives