- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Expands With New 65,000-Sq-Ft Facility In Missouri

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) plans to enhance its delivery network with a new last-mile facility in Missouri, indicating expansion efforts that align with broader market trends. However, despite a generally positive market environment with the S&P 500 and Nasdaq showing gains driven by strong tech earnings from peers like Microsoft and Meta, Amazon's share price edged down slightly by 1.14% over the past week. This movement might reflect investor caution or anticipation ahead of earnings releases, amid additional investor scrutiny on executive pay. Overall, Amazon's recent expansion and collaborations may have partially countered market gains.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The recent development of Amazon.com's last-mile facility highlights its commitment to streamlining delivery networks and could bolster the company's fulfillment capabilities. This initiative aligns with efforts in automation and AI, expected to play a critical role in enhancing retail and cloud service profitability. Although Amazon's share price experienced a 1.14% decline last week, the potential long-term benefits of this expansion may reinforce positive sentiment around future earnings. Over the past three years, Amazon's total shareholder returns, including share price and dividends, have grown significantly, rising 58.43%, showcasing strong longer-term gains for investors.

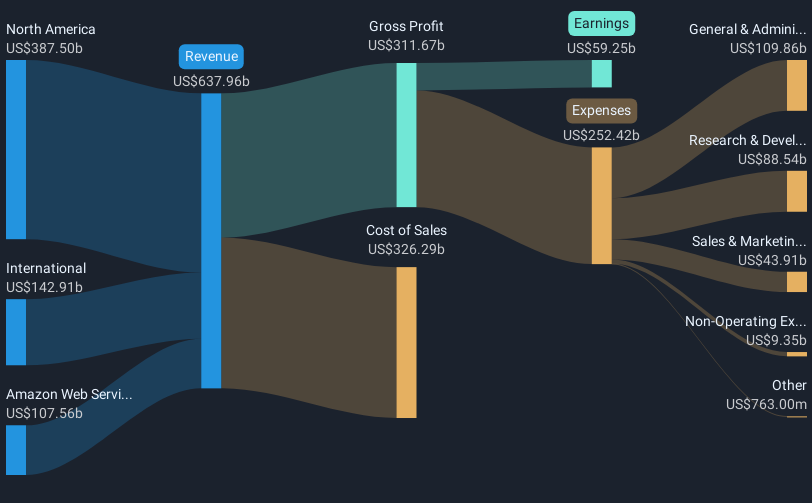

Compared to the US Multiline Retail industry, Amazon underperformed over the past year, with the industry returning 4.8% while Amazon lagged behind. In the context of revenue and earnings forecasts, the newly announced facility could contribute to anticipated revenue growth and improvement in profit margins, as Amazon leverages AI-driven efficiencies. The expectations that the company's earnings could rise to US$103.4 billion by 2028 remain, with a bullish view requiring acceptance of a higher PE ratio compared to today's valuation. The current share price of US$173.18, when viewed against a consensus price target of approximately US$248.71, suggests a potential appreciation of 30.4% but requires validation through future performance.

Examine Amazon.com's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives