- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Expands Collaboration With FICO On AI Solutions Through AWS Marketplace

Reviewed by Simply Wall St

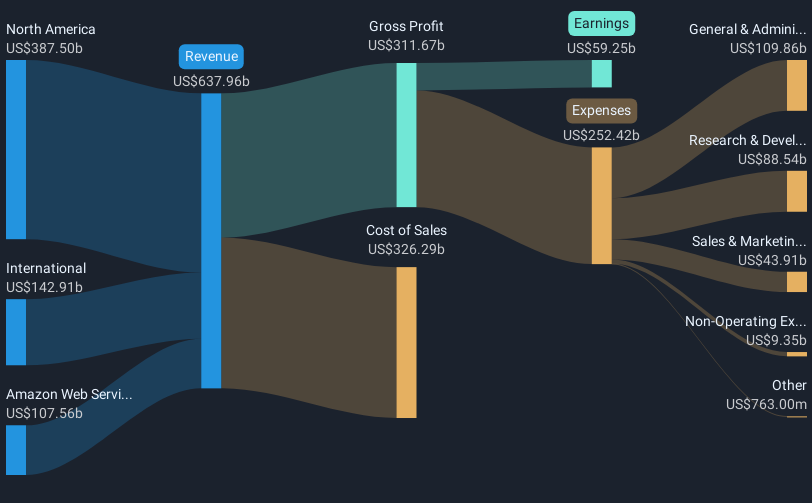

Amazon.com (NasdaqGS:AMZN) experienced a strategic collaboration with FICO through its subsidiary, Amazon Web Services (AWS), enhancing AI-driven automated workflows. This event, along with Amazon's significant earnings report for Q1 2025, reflecting substantial revenue and net income growth, likely added weight to the company's overall price movement of 9% last month. The prevailing market context showed flat returns with anticipation around Nvidia's imminent earnings report, which steadied investor sentiment. While the collaboration with AWS highlights Amazon's innovative endeavors, the earnings report reinforced its robust financial performance, aligning with broader market stability.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The collaboration between Amazon Web Services (AWS) and FICO to enhance AI-driven automated workflows aligns with Amazon's narrative of focusing on AI and operational efficiency. This initiative is expected to contribute positively to revenue growth, particularly in AWS and advertising services, by expanding the company's technological capabilities and broadening its service offerings. Furthermore, this increased emphasis on AI is anticipated to support Amazon's long-term revenue and earnings projections, which foresee revenue growing to US$856.2 billion and earnings reaching US$103.6 billion by 2028.

Over the past three years, Amazon's total return, including share price and dividends, was 71.38%. This reflects investors' positive reception of Amazon's strategic investments and consistent growth in earnings. In comparison, over the past year, Amazon's earnings growth of 75% considerably outpaced the US Multiline Retail industry’s 6.9% growth. The company's shares have shown resilience, with a current price trading close to the consensus analyst price target of US$239.33, suggesting investor confidence in its growth trajectory.

This growth is indicative of the market's faith in Amazon's capacity to navigate challenges such as infrastructure costs and competitive pressures. Despite the potential risks associated with high investment expenditures and uncertainties in global trade policies, the company’s investment in AI and infrastructure is aimed at sustaining earnings momentum. The current share price at a discount to the consensus target signals potential market optimism for continued growth, assuming forecasted revenue and earnings materialize as expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion