- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Expands AWS Presence With US$5 Billion Data Center Investment In Taiwan

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) recently announced the launch of its AWS Asia Pacific (Taipei) Region, highlighting a $5 billion investment in data center infrastructure. This expansion, coupled with a $10 billion investment in North Carolina to bolster AI and cloud computing capabilities, underscores Amazon's commitment to innovation and business growth. These significant developments align with Amazon's overall strategic objectives and may enhance its market position. The company's share price rose 13% over the past month, coinciding with the market's general upward trend, which experienced a 13% rise over the past year across the broader market.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The recent developments regarding Amazon's investments in the AWS Asia Pacific (Taipei) Region and North Carolina can significantly influence the company's operational strategy, furthering its drive towards AI and cloud computing capabilities. These initiatives are expected to enhance revenue streams, aligning with the company's narrative of optimizing efficiency through advanced technologies. Over the three-year timeframe, Amazon's total shareholder return, inclusive of share price and dividends, achieved a 94.77% increase. Within the past year, Amazon's share price rise of 13% outpaced the broader market's 12.6% gain, reflecting robust performance despite prevailing industry challenges.

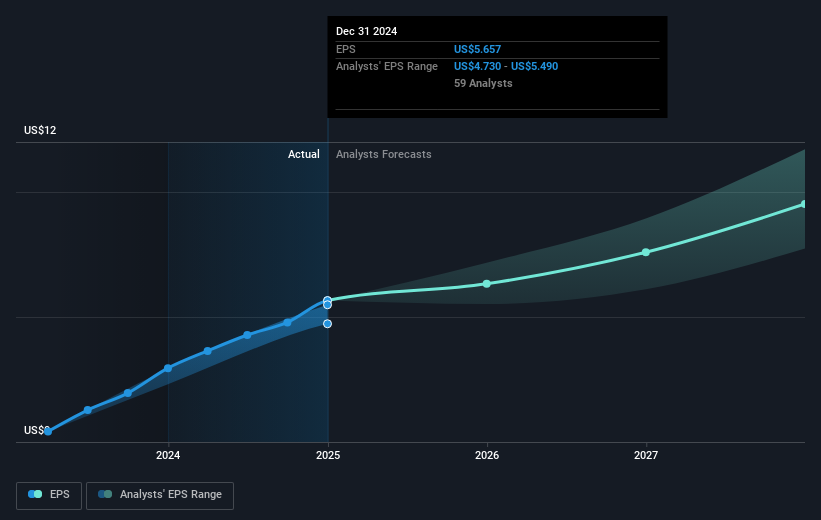

In light of Amazon's stated commitments, analysts have projected revenue growth of 8.9% per annum, bolstered by both traditional and AI-driven cloud services. Earnings prospects are anticipated to rise to US$103.6 billion by 2028, up from US$65.94 billion today. While these expansions present opportunities for substantial revenue increases, the pressure from infrastructure investments must be carefully managed to sustain growth expectations. With a current share price of US$185.01, the 22.7% higher analyst price target of US$239.33 illustrates an optimistic market consensus. However, investors are advised to consider both market risks and the variations in analyst predictions when evaluating Amazon's future prospects.

Unlock comprehensive insights into our analysis of Amazon.com stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion