- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NASDAQ:AMZN) is Slowly Converting to a Mature Company with an Emphasis on Cash-Flows and Value Maximization

Amazon.com, Inc. ( NASDAQ:AMZN ) has always been a force that vigorously re-invests into the business at high expense to profit margins. This policy had the effect of rendering the company more risky, as it engaged in fast-paced expansion, both by capital investments in their own business and acquisitions. At the same time, this policy is responsible for Amazon's US and International growth in online retail and the Cloud Segment (AWS).

In this article, we will examine Amazon's latest investment and expansion projects, as well as look at their transition to a business model in line with more mature companies.

Check out our latest analysis for Amazon.com

It is always a pleasure looking at Amazon's investments in their distribution centers, cloud capacity and the rest. Their strategy can be reasoned to be beneficial from a business, investor, and contrary to popular belief - an employment point of view. In short, the arguments for every perspective can be summarized as:

- The business interest is benefiting because capital is flowing into their operating capacities instead of being paid to the government, and thus the company manages to expand and innovate, providing even more services that give clients choice for a lower price.

- Shareholders are also benefiting because the company has managed to invest efficiently into the top line (revenue growth), and maxed out in their high growth phase. This growth delivers stock price appreciation and lowers the cost of equity for the business, creating a benevolent feedback loop where growth allows for even more re-investing, resulting in stock price appreciation.

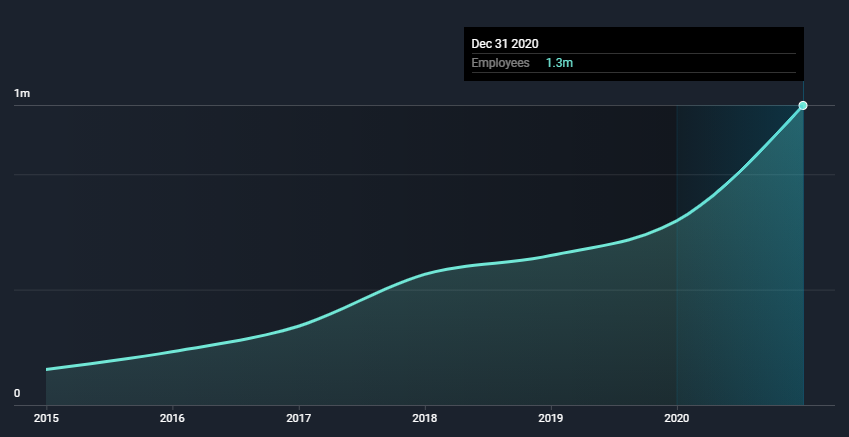

- Stakeholders are central beneficiaries. Both employees and clients benefit from Amazon's operations. It is fairly simple to recognize that consumers are being exposed to a high variety of products with low margins, review based quality control, and very efficient shipping. Amazon is also a large scale employer, which has been in the attention of the media for quite a while recently. In fact, Amazon has more than 1.3 million full time employees. The interesting part, is that this number was about 150 thousand in 2015, that is an 8.6-fold increase in the span of 5 years . You can view the details HERE .

We can see that the company has even larger plans for the futures, and just as Non-Farm Payrolls are used as a proxy for the market's performance, so too does the ever-increasing number of employees show us the direction where the business is headed.

In the last three months, Amazon has announced multiple expansion projects:

- Second Robotics Fulfillment Center in Louisiana. A 820,000 square-foot center, employing more than 1000 people.

- 375-Mw Solar Deal in Canada.

- First Robotics Fulfillment Center in Alberta. 1000 employees in a 600,000 square-foot center, set to launch in 2022.

- A pledge to hire 100,000 U.S. Veterans and Military Spouses by 2024.

- A Fulfillment Center in St. Lucie County , FL. The center is anticipated to launch in 2022 and create more than 500 jobs.

- Another Robotics Fulfillment Center Plus Five New Delivery Stations in Florida. This larger scale investment is set to create 2000 jobs and six new sites to open by 2022.

- Amazon also launches an Air Cargo Hub in Northern Kentucky, creating 2000 jobs.

The list does not include some of the more prominent acquisition procedures and product updates. With this, we can feel the pulse of Amazon's expansion strategy in action. It is this type of activities that have generated the massive growth for investors and development of the primarily US economy.

One can argue that with a wide, efficient and flexible distribution center, Amazon can help the US lower the reliance of manufactured goods from China, by allowing small businesses to participate in their distribution and source products locally.

In their last (Q2) earnings presentation , Amazon highlighted that the long term focus of the company is to optimize free cash flows.

This is a central point, and it delineates a possible shift in the way Amazon operates. When companies seek to optimize, or increase cash flows, they are focusing on maximizing value. This means that the company will look more inwards and focus on the efficacy and quality of operations and products.

This is a sign that Amazon is entering a mature phase, and there are a few things investors might want to be aware of.

Amazon will increase expenses for general administrative purposes of the business and seek to implement optimization of processes. This can already be seen in their expense structure, as the company went from small administrative expenses, US$6.6b in 2020, to US$34.1b in the trailing 12 months ending in Q2 2021.

Another sign of maturity is an increase in debt levels, which is precisely what we can see for Amazon.

As you can see from the chart above, at the end of June 2021, Amazon had US$52.3b of debt, up from US$35b a year ago. This is a substantial jump, though the debt to equity ratio has actually reduced from 47.5% to 45.6%. But on the other hand, it also has US$89.9b in cash, leading to a US$37.6b net cash position. So, it is safe to say that Amazon is taking on more debt, but has quite enough capacity to manage it. Additionally, the interest expense from debt payments is booked as an expense item and helps lower a corporation's effective tax rate. This gives the double benefit of fresh capital for expansion or margin optimization, and a lowered tax rate for the company.

Lastly, we will see a tendency for the growth rate to go down, but Amazon will keep investing in driving up margins. This is hard to estimate, but it is a key driver in the intrinsic value of the business, and the future margins can be the difference between investors buying into a US$1t, US$1.5t or US$2.47t stock, currently Amazon has US1.66t Market Cap.

Summing Up

Amazon is still massively reinvesting into their business, and is setting the foundation for a sustainable growth rate above 10%

The business is showing signs of maturity, which means that they will start focusing on maximizing value via operation optimizations. They will also make larger provisions for debt and administrative expenses, because these factors help improve the efficacy of the business.

Margins and free cash flows will be a large factor going forward, and investors should be aware that small fluctuations will lead to large changes in the Market Capitalization of the company.

Amazon has increased their workforce 8.6-fold since 2015 and is employing more than 1.3 million workers. Their dedication to consumers help multiple stakeholders and keep the company attractive for investors.

But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with Amazon.com (including 1 which shouldn't be ignored) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion