- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (AMZN) Faces Legal Action While Expanding AI Offerings

Reviewed by Simply Wall St

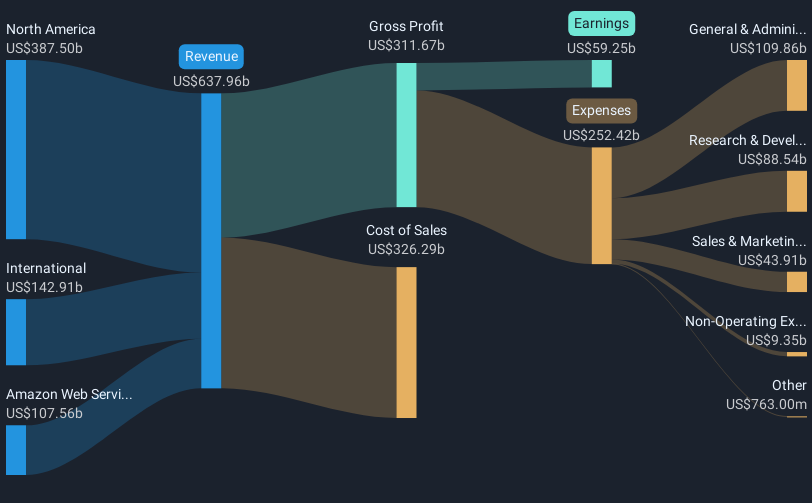

Amazon.com (AMZN) has recently witnessed a 23% price increase over the past quarter, a period marked by significant events. Apex Systems's introduction of Peak CX-AI within AWS Marketplace facilitates seamless AI tool integration, reinforcing competitive positioning. However, Amazon faces legal challenges with significant lawsuits concerning alleged market dominance abuse, which could weigh on investor sentiment. Despite these challenges, the broader market trend—with major indexes like the S&P 500 and Nasdaq reaching new highs due to strong corporate earnings—supports Amazon's rise. These aspects collectively illustrate a scenario where Amazon's initiatives align with positive market trends.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

Amazon's recent developments, including the introduction of Peak CX-AI within AWS Marketplace, directly contribute to its efforts to streamline operations and enhance AI services, aligning with its ongoing narrative of optimizing fulfillment and expanding advertising and AWS segments. However, legal challenges regarding market dominance could introduce uncertainties impacting investor outlook and operational forecasts. These factors are pivotal as Amazon aims to achieve an annual revenue growth of 9% and a profit margin improvement from 10.1% to 12.1% over the next three years.

Over a three-year span, Amazon's total shareholder return was 89.92%, demonstrating strong performance. This robust growth exceeds the Multiline Retail industry's 29.3% return over the past year, positioning Amazon favorably against industry benchmarks. The substantial price rise coupled with the analyst consensus price target of US$250.77 indicates market confidence yet shows only a modest share price discount to this target. This suggests a relatively balanced current valuation.

In terms of revenue and earnings forecasts, the technological strides in fulfillment efficiency and AI services materially boost Amazon's potential to achieve its projected 15.52% annual earnings growth. The current share price of US$232.23, closely approaching the analysts' consensus price target, reflects market enthusiasm yet highlights the importance of continued operational success and legal navigation in maintaining growth momentum.

Upon reviewing our latest valuation report, Amazon.com's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives