- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon (AMZN) Valuation in Focus After Strong Quarterly Results and Launch of New AI Business Tools

Reviewed by Simply Wall St

Amazon.com has been in the spotlight after releasing strong quarterly results and unveiling several new AI-powered business tools. The latest update in Amazon’s cloud performance is shaking up investor sentiment in a significant way.

See our latest analysis for Amazon.com.

Amazon’s stock has seen an uptick in momentum since its strong earnings report and new AI solution launches, with a recent 11% one-month share price return reflecting optimistic outlooks for its innovation pipeline. Over the past year, investors enjoyed a 14% total shareholder return, and longer-term holders have been well rewarded with a 151% total shareholder return over three years. This signals enduring confidence in Amazon’s growth and scale.

If you’re looking to uncover the next big stories in tech and AI innovation, it’s the perfect time to check out See the full list for free.

With shares approaching analysts’ targets after a recent rally and continued buzz around Amazon’s AI initiatives, investors must now weigh whether current levels represent an attractive entry point or if the market is already pricing in years of future growth.

Most Popular Narrative: 4% Overvalued

Amazon.com’s current price of $244.20 is above the most popular narrative fair value of $234.75 according to investor Zwfis. While the gap isn’t dramatic, it suggests the market could be a touch too optimistic about future upside, especially as Zwfis sharply details both the strengths and vulnerable points in Amazon’s story.

“Their E-commerce platform is the undisputed leader, especially with its robust options for customers and the scale of its logistics network. AWS is one of the best cloud services available to companies, especially with a growing need for this industry, and it continues to validate this segment of the business. Ads are not often talked about, but being able to take data and create more efficient and targeted ads creates a great opportunity for outside businesses to purchase into, since they have such a large online retail space and Prime Video network.”

Curious which future profit margin, growth rates, and market assumptions led to Zwfis’s bold calculation? Find out what’s behind this valuation and see the growth levers that just might surprise you.

Result: Fair Value of $234.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing AWS growth and lingering uncertainty around AI strategy could quickly challenge the optimistic outlook that investors currently hold for Amazon.

Find out about the key risks to this Amazon.com narrative.

Another View: Is the Market Discounting Amazon?

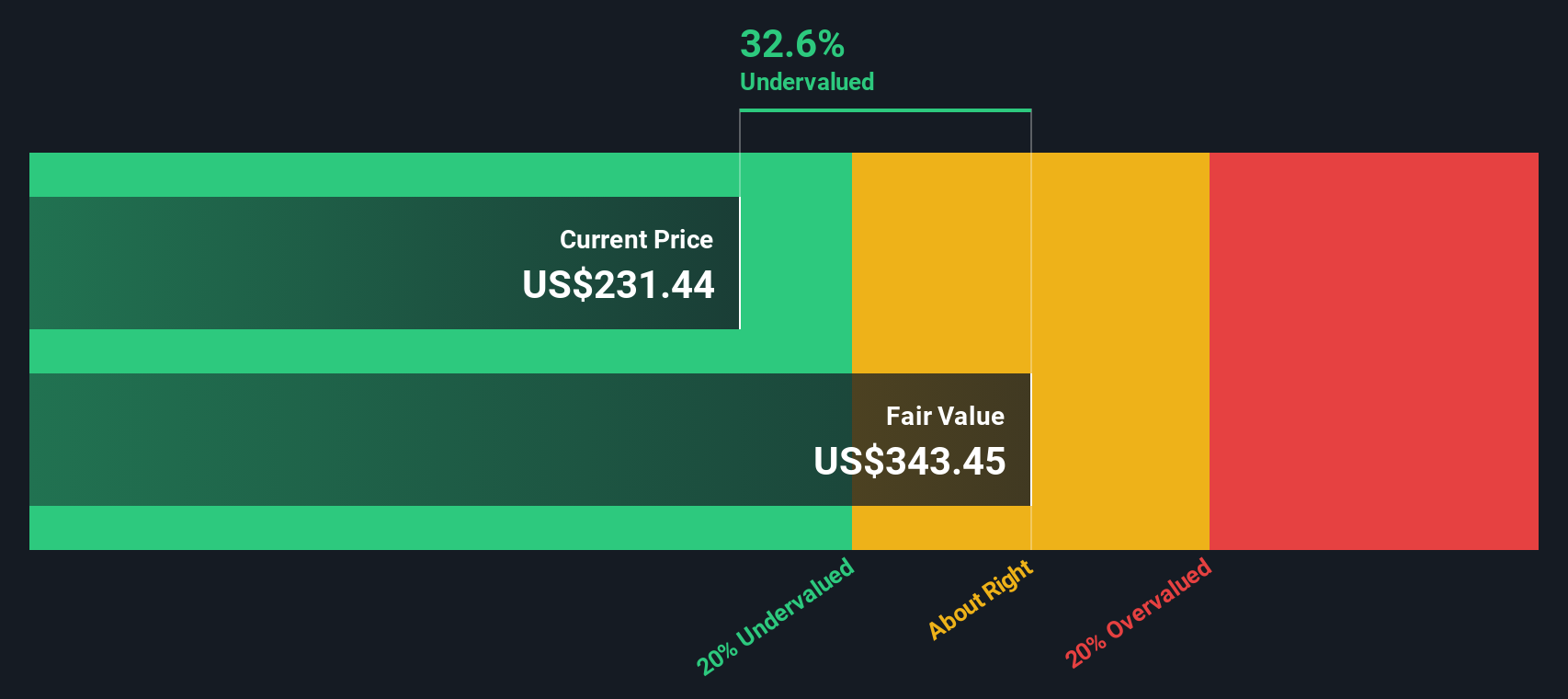

While the most popular narrative argues Amazon is overvalued, our SWS DCF model presents a different perspective. It estimates Amazon's fair value at $301.61, about 19% higher than today’s price. This suggests the stock could be trading at a discount. Which story will the market listen to?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amazon.com for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amazon.com Narrative

If you think the numbers or outlook could tell a different story, feel free to dive in and build your own Amazon.com narrative in just a few minutes. Do it your way

A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities move fast in today’s market, so don’t limit yourself to just one winner. Smart investors seize their advantage by tapping into fresh stock ideas in seconds.

- Uncover growth opportunities with these 25 AI penny stocks, which are driving some of the most exciting advancements in artificial intelligence and automation.

- Boost your portfolio's potential income by targeting these 14 dividend stocks with yields > 3%, which offer yields above 3% and strong fundamentals.

- Gain first-mover advantage in new technologies with these 27 quantum computing stocks, which are at the forefront of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives