- United States

- /

- Office REITs

- /

- NYSEAM:FSP

What Did Franklin Street Properties Corp.'s (NYSEMKT:FSP) CEO Take Home Last Year?

George Carter has been the CEO of Franklin Street Properties Corp. (NYSEMKT:FSP) since 2002. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Franklin Street Properties

How Does George Carter's Compensation Compare With Similar Sized Companies?

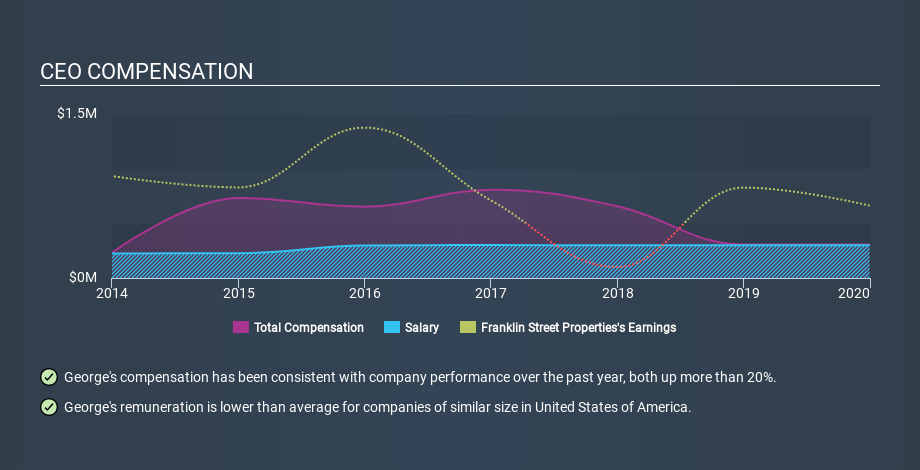

According to our data, Franklin Street Properties Corp. has a market capitalization of US$619m, and paid its CEO total annual compensation worth US$306k over the year to December 2019. It is worth noting that the CEO compensation consists almost entirely of the salary, worth US$300k. We looked at a group of companies with market capitalizations from US$400m to US$1.6b, and the median CEO total compensation was US$3.2m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Franklin Street Properties stands. On an industry level, roughly 15% of total compensation represents salary and 85% is other remuneration. Investors will find it interesting that Franklin Street Properties pays the bulk of its rewards through a traditional salary, instead of non-salary benefits.

At first glance this seems like a real positive for shareholders, since George Carter is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance. You can see, below, how CEO compensation at Franklin Street Properties has changed over time.

Is Franklin Street Properties Corp. Growing?

Franklin Street Properties Corp. has seen earnings per share (EPS) move positively by an average of 41% a year, over the last three years (using a line of best fit). The trailing twelve months of revenue was pretty much the same as the prior period.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. You might want to check this free visual report on analyst forecasts for future earnings.

Has Franklin Street Properties Corp. Been A Good Investment?

Since shareholders would have lost about 45% over three years, some Franklin Street Properties Corp. shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

It looks like Franklin Street Properties Corp. pays its CEO less than similar sized companies.

Many would consider this to indicate that the pay is modest since the business is growing. Few would deny that the total shareholder return over the last three years could have been a lot better. So while we would not say that George Carter is generously paid, it would be good to see an improvement in business performance before too an increase in pay. When I see fairly low remuneration, combined with earnings per share growth, but without big share price gains, it makes me want to research the potential for future gains. Taking a breather from CEO compensation, we've spotted 5 warning signs for Franklin Street Properties (of which 2 are a bit unpleasant!) you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSEAM:FSP

Franklin Street Properties

Franklin Street Properties Corp., based in Wakefield, Massachusetts, is focused on infill and central business district (CBD) office properties in the U.S.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026