- United States

- /

- Office REITs

- /

- NYSEAM:FSP

Franklin Street Properties (FSP): Five-Year Losses Worsen, Dividend Concerns Challenge Bullish Narratives

Reviewed by Simply Wall St

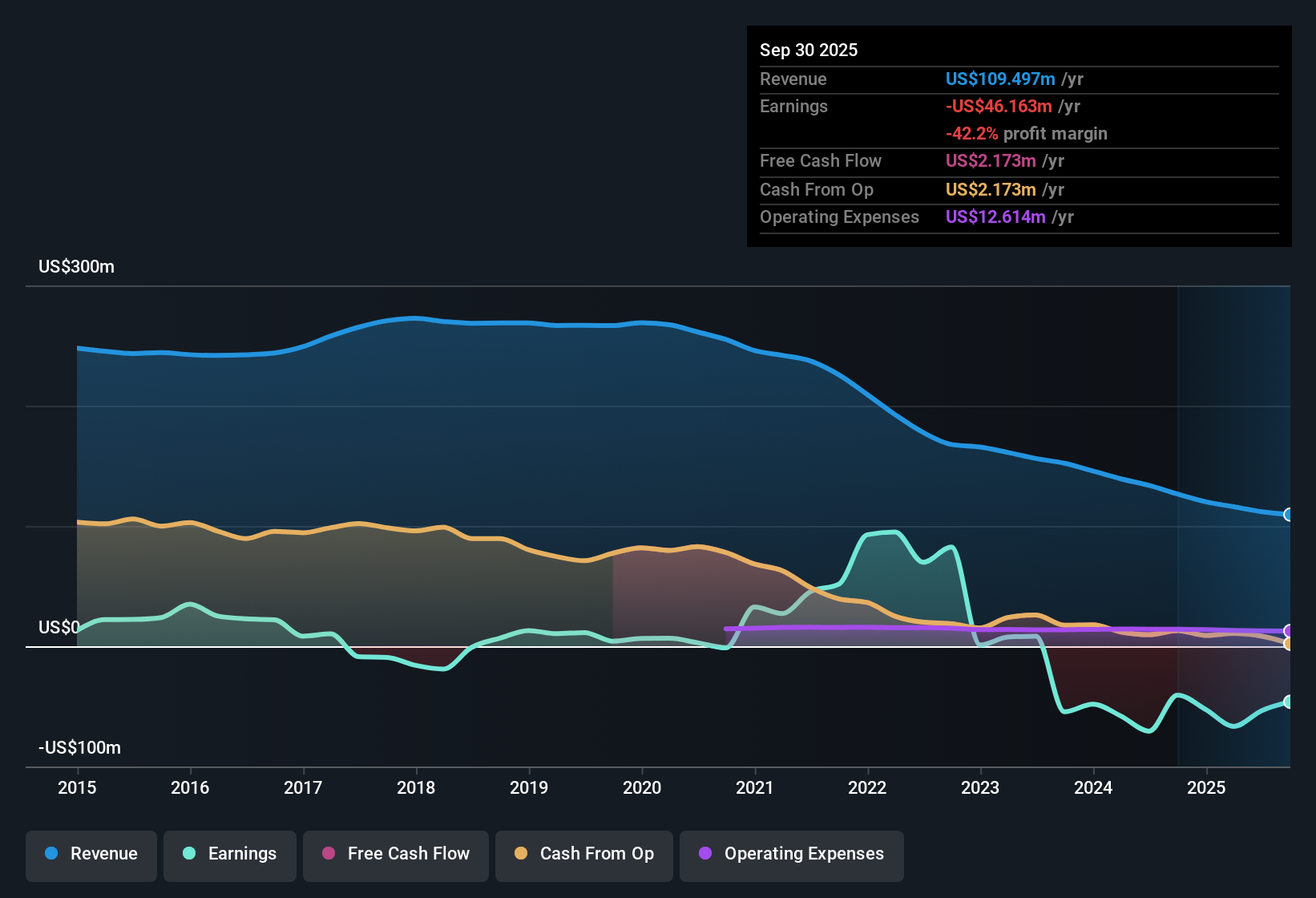

Franklin Street Properties (FSP) continues its unprofitable streak, with losses worsening at an annual rate of 57.1% over the past five years. Forecasts indicate further unprofitability ahead. The company’s net profit margin shows no sign of improvement, and with no positive earnings catalysts, recent results offer little near-term relief for investors. This backdrop of growing losses is fueling a cautious market stance as concerns about dividend sustainability and overvaluation remain front of mind.

See our full analysis for Franklin Street Properties.Next, we will see how the latest numbers hold up against the widely tracked narratives shaping market sentiment and whether the prevailing story stands up to scrutiny.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Discount vs Peers

- Franklin Street Properties trades at a price-to-sales ratio of 1.2x, meaning investors currently pay $1.20 for every $1 of revenue. This is lower than both the US Office REITs industry average of 2.3x and its closest peer group at 1.6x.

- While some investors may note that a below-average price-to-sales ratio can suggest undervaluation, the prevailing analysis questions whether this metric alone offers enough reassurance.

- Critics highlight that the relative discount on price-to-sales contrasts sharply with the continued deep operating losses, which signals the market's skepticism about future value creation.

- There is a tension here, as value-focused investors could see this as a bargain, but ongoing sector challenges and lack of profit improvements may explain why the market is wary.

DCF Fair Value Gap Widens

- The company’s share price of $1.27 is significantly higher than its DCF fair value of $0.06, revealing a steep premium of over twenty times what cash flow projections suggest it is worth.

- Scenario analysis suggests that this large gap leaves little margin for error. Rather than pricing in a turnaround, the market is tolerating a sizable risk, especially as ongoing losses deepen.

- DCF-based critics argue that, even after adjusting for real estate sector pressures, the present valuation exposes investors to considerable downside if fundamentals do not improve.

- The scale of the dislocation between share price and conservative cash flow value sets FSP apart from typical REIT peers, where price typically sits much closer to modeled intrinsic value.

Dividend Sustainability in Question

- Concerns about dividend sustainability dominate risk discussions, with the company’s history of steady losses and no sign of net profit margin improvement undermining confidence in future payouts.

- What is most pressing is that the prevailing analysis directly links these ongoing losses and stretched payout risks to a cautious stance among both management and investors.

- Without positive catalysts or earnings traction, the dividend may represent more risk than reward for income-seeking shareholders.

- This risk-first perspective is further fueled by the absence of any reported rewards or turnaround milestones in recent disclosures.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Franklin Street Properties's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Franklin Street Properties faces mounting operating losses, a risky dividend, and trades at a significant premium to its fair value. This leaves investors exposed to potential downside.

If you want value for your money and greater safety, check out these 854 undervalued stocks based on cash flows to discover companies priced well below their intrinsic worth and offering better fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:FSP

Franklin Street Properties

Franklin Street Properties Corp., based in Wakefield, Massachusetts, is focused on infill and central business district (CBD) office properties in the U.S.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives