- United States

- /

- REITS

- /

- NYSEAM:BRG

Shareholders Of Bluerock Residential Growth REIT (NYSEMKT:BRG) Must Be Happy With Their 90% Return

Thanks in no small measure to Vanguard founder Jack Bogle, it's easy buy a low cost index fund, which should provide the average market return. But you can make superior returns by picking better-than average stocks. To wit, Bluerock Residential Growth REIT, Inc. (NYSEMKT:BRG) shares are up 54% in three years, besting the market return. In contrast, the stock is actually down 4.5% in the last year, suggesting a lack of positive momentum.

View our latest analysis for Bluerock Residential Growth REIT

Given that Bluerock Residential Growth REIT didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Bluerock Residential Growth REIT saw its revenue grow at 19% per year. That's pretty nice growth. While the share price has done well, compounding at 15% yearly, over three years, that move doesn't seem over the top. If that's the case, then it could be well worth while to research the growth trajectory. Keep in mind that the strength of the balance sheet impacts the options open to the company.

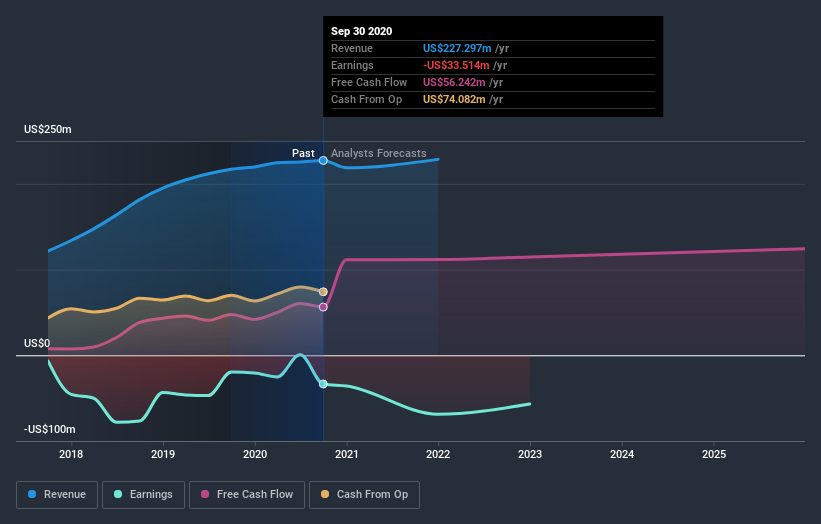

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Bluerock Residential Growth REIT stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Bluerock Residential Growth REIT's TSR for the last 3 years was 90%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Bluerock Residential Growth REIT shareholders gained a total return of 4.2% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 12% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 5 warning signs for Bluerock Residential Growth REIT (1 is potentially serious!) that you should be aware of before investing here.

Of course Bluerock Residential Growth REIT may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Bluerock Residential Growth REIT, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bluerock Residential Growth REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:BRG

Bluerock Residential Growth REIT

Bluerock Residential Growth REIT, Inc. (NYSE American: BRG) is a real estate investment trust that focuses on developing and acquiring a diversified portfolio of institutional-quality highly amenitized live/work/play apartment communities in demographically attractive knowledge economy growth markets to appeal to the renter by choice.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives