- United States

- /

- REITS

- /

- ARCA:ESBA

Assessing Empire State Realty OP (ESBA) Valuation as Shares Trade Near Multi-Year Lows

Reviewed by Kshitija Bhandaru

Empire State Realty OP (ESBA) has recently caught the attention of investors after its stock recorded a modest movement over the past week. With shares now trading at $7.04, some investors are looking at the longer-term performance trends.

See our latest analysis for Empire State Realty OP.

Empire State Realty OP’s share price has lost momentum this year, with a year-to-date decline of 28.82%. While recent weeks have seen only mild fluctuations, the bigger story is the 34.95% drop in total shareholder return over the last twelve months. However, the longer-term picture remains stronger with positive multi-year returns. Shifts in risk perception and overall sentiment appear to be weighing on the stock right now more than any single headline.

If you want to see what else is out there, now could be the perfect opportunity to discover fast growing stocks with high insider ownership.

With shares near multi-year lows, is Empire State Realty OP being overlooked by the market? Or is today’s price simply reflecting lower growth prospects that investors should be wary of?

Price-to-Earnings of 30.4x: Is it justified?

The market currently values Empire State Realty OP at a price-to-earnings (P/E) ratio of 30.4x, with the last close price at $7.04. This is significantly higher than both the global REITs industry average (15.5x) and the company's peer group average (30.1x).

The price-to-earnings ratio shows how much investors are willing to pay for each dollar of a company's earnings. For a real estate investment trust like ESBA, this multiple typically reflects the outlook for future profit growth, property values, and resilience of rental income streams.

At 30.4x, ESBA's share price looks expensive relative to industry benchmarks. This suggests the market is pricing in stronger earnings growth or quality that is not reflected in the most recent year. However, the company’s reported earnings are affected by large, one-off gains rather than recurring growth. Investors may be paying a premium that is difficult to justify based on fundamentals.

Compared to the global REITs industry average of 15.5x and its peer average of 30.1x, ESBA’s high P/E multiple stands out. Without support from sustainable profit growth, this valuation could be tough to defend if current trends continue.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.4x (OVERVALUED)

However, unforeseen changes in property values or a slowdown in rental demand could quickly undermine the current valuation and alter market sentiment.

Find out about the key risks to this Empire State Realty OP narrative.

Another View: Discounted Cash Flow Shows Deep Value

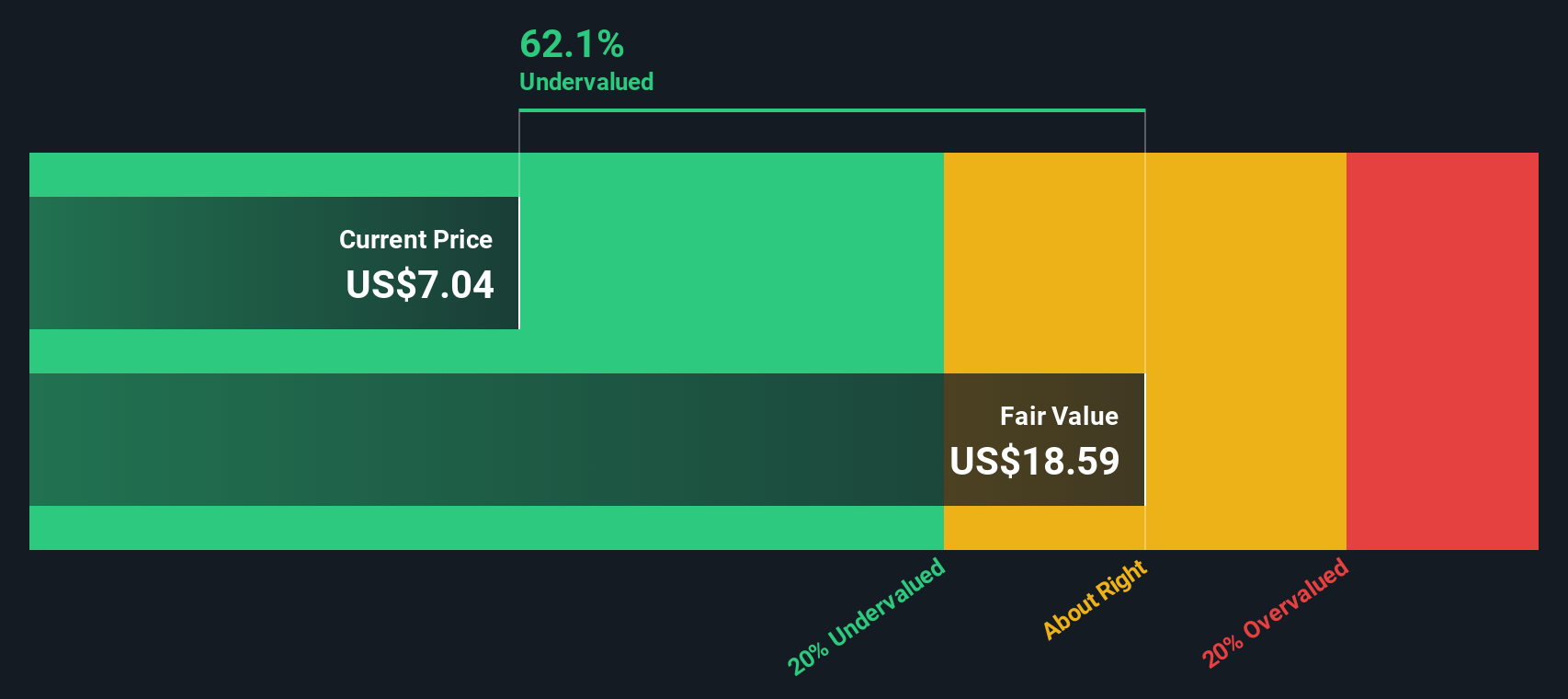

Take a look at the SWS DCF model, which estimates Empire State Realty OP’s fair value at $18.63 per share. With the current share price at just $7.04, this approach suggests the stock trades at a steep discount of over 62%. Could the market be missing hidden value, or are there risks beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Empire State Realty OP for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Empire State Realty OP Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own investment story in just a few minutes with Do it your way.

A great starting point for your Empire State Realty OP research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great returns are often found by looking beyond the obvious. Strengthen your portfolio by tapping into powerful trends and sectors. Make sure you do not miss these standout opportunities.

- Tap into the future as AI transforms industries by learning more about these 24 AI penny stocks pushing boundaries with innovative applications and intelligent automation.

- Capture long-term value and potential bargains through these 878 undervalued stocks based on cash flows that our analysts have flagged for strong cash flow and resilient fundamentals.

- Boost your portfolio’s income with stability by targeting these 18 dividend stocks with yields > 3% offering yields above 3 percent and a record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty OP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ARCA:ESBA

Empire State Realty OP

Operates as a subsidiary of Empire State Realty Trust, Inc.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives