- United States

- /

- Hotel and Resort REITs

- /

- NYSE:XHR

Xenia Hotels & Resorts (XHR): What Recent Earnings Reveal About Valuation and Growth Prospects

Reviewed by Simply Wall St

Xenia Hotels & Resorts (XHR) just released its third quarter results. The company reported funds from operations that met expectations, while revenue fell a bit short of forecasts. Management struck a careful tone for the months ahead and lowered expectations for Q4 performance.

See our latest analysis for Xenia Hotels & Resorts.

Xenia Hotels & Resorts’ share price has staged a solid recovery over the past month, climbing nearly 10%. However, it is still trailing for the year with a -5% total shareholder return. This recent bounce reflects growing optimism about next year’s growth drivers, even as some near-term caution lingers from management’s latest update.

If you’re interested in spotting more momentum or potential turnarounds, now’s the perfect time to discover fast growing stocks with high insider ownership

With shares still down year-to-date but optimism building for 2026, the key question is whether Xenia Hotels & Resorts is undervalued at current levels or if the market has already accounted for its next phase of growth.

Most Popular Narrative: 6.8% Undervalued

At a current price of $13.98, Xenia Hotels & Resorts is trading notably under the most widely followed narrative’s fair value estimate of $15. This positions the stock for modest upside if the narrative’s assumptions play out.

The company's exposure to high-growth urban and tech-centric markets such as Northern California is starting to pay off, with strong weekday corporate demand linked to the AI and tech sectors boosting occupancy and rates. As business travel continues its gradual rebound, this should drive sustained improvements in RevPAR and EBITDA in these strategically positioned assets.

Why are analysts expecting such a premium? The answer lies in some bold forecasts about how competitive positioning in tech hubs might shift future earnings, revenue trends, and profit margins. Craving the breakdown behind this valuation leap? Discover which core business levers make this view more optimistic than the market’s and which pivotal figures analysts are betting on.

Result: Fair Value of $15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer leisure demand and rising labor costs, especially in core markets, could challenge revenue growth and put pressure on Xenia’s operating margins going forward.

Find out about the key risks to this Xenia Hotels & Resorts narrative.

Another View: What Do Market Ratios Say?

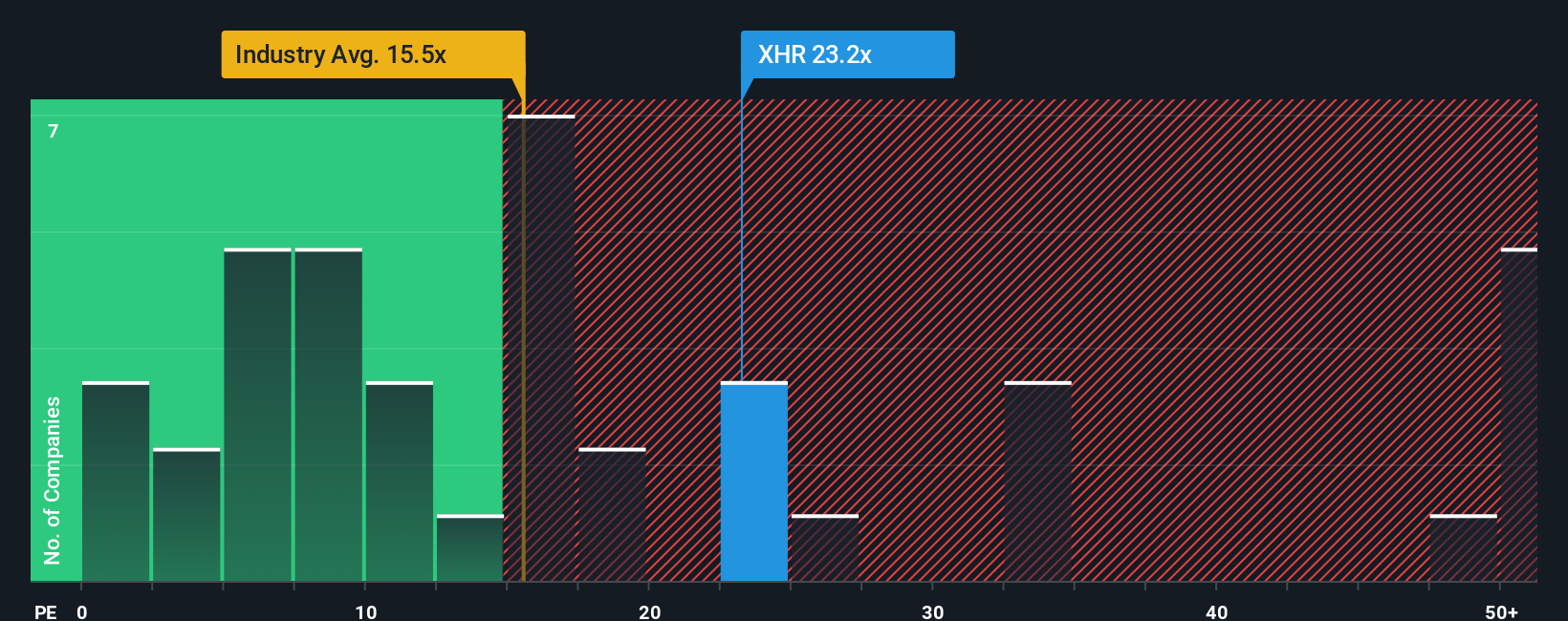

Looking from a different angle, Xenia Hotels & Resorts is trading at a price-to-earnings ratio of 23.7x. This is higher than the global industry average of 15.6x and well above its fair ratio of 13.5x. Compared to similar peers, it still looks relatively cheaper. Does the market see growth that the usual metrics are missing, or is there valuation risk building under the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xenia Hotels & Resorts Narrative

Prefer a hands-on approach? You can review the data and shape your own perspective in just a few minutes. Why not Do it your way

A great starting point for your Xenia Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Level up your portfolio by targeting fresh themes and industries favored by savvy investors. Uncover unique momentum and diversify your strategy before others catch on.

- Boost your passive income with reliable companies, starting with these 15 dividend stocks with yields > 3% that offer yields above 3% and maintain a solid dividend track record.

- Capitalize on the next wave of healthcare innovation by scanning these 30 healthcare AI stocks for companies combining AI with medical breakthroughs to drive growth.

- Tap into overlooked, potentially undervalued gems by evaluating these 920 undervalued stocks based on cash flows so you’re ahead when the market reassesses these cash flow winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XHR

Xenia Hotels & Resorts

A self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts with a focus on the top 25 lodging markets as well as key leisure destinations in the United States.

Proven track record with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.