- United States

- /

- REITS

- /

- NYSE:WPC

W. P. Carey (WPC): Is the Net Lease Giant Fairly Priced or Still Undervalued?

Reviewed by Simply Wall St

W. P. Carey (WPC) continues to attract attention from yield-seeking investors, as the company demonstrates steady performance and maintains a focus on diversified net lease real estate across the U.S. and Europe. Shares have drifted slightly higher over the past month, adding just over 0.8%, while the broader real estate sector adjusts to current market conditions.

See our latest analysis for W. P. Carey.

W. P. Carey’s share price momentum has cooled after a strong first half of the year, but the stock still stands out with a 24.1% year-to-date share price return and an impressive 24.2% total shareholder return over the past year. Momentum may be gentler lately; however, long-term holders have seen steady gains, suggesting ongoing appeal for investors seeking a mix of yield and stability.

If you’re thinking about what other opportunities might align with this kind of steady growth, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading just below analyst targets and after such solid gains, the question for investors is clear: Is W. P. Carey undervalued at these levels, or has the market already priced in its future growth?

Most Popular Narrative: 3% Undervalued

According to the most followed narrative, W. P. Carey’s fair value estimate sits just above the last close price. This puts the current level in the undervalued camp by a slim but notable margin. It presents a close debate on whether the company’s earnings power and portfolio resilience can drive further upside from here.

Significant lease structures feature inflation-linked escalators (CPI-based) and higher fixed annual bumps (around 2.8% on recent deals). This enables robust same-store rent growth even in a stable inflation environment, directly enhancing rental revenues and overall earnings.

Wondering what bold growth bets underpin this near-fair valuation? The key lies in forecasts around future rent growth and margin expansion. Analysts are placing significant expectations on a new phase of portfolio performance. Dive deeper to see the aggressive projections driving this estimate.

Result: Fair Value of $69.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tenant credit risks and the possibility of slowing non-core asset sales could quickly undermine W. P. Carey's projected growth and stability.

Find out about the key risks to this W. P. Carey narrative.

Another View: What Do Earnings Multiples Say?

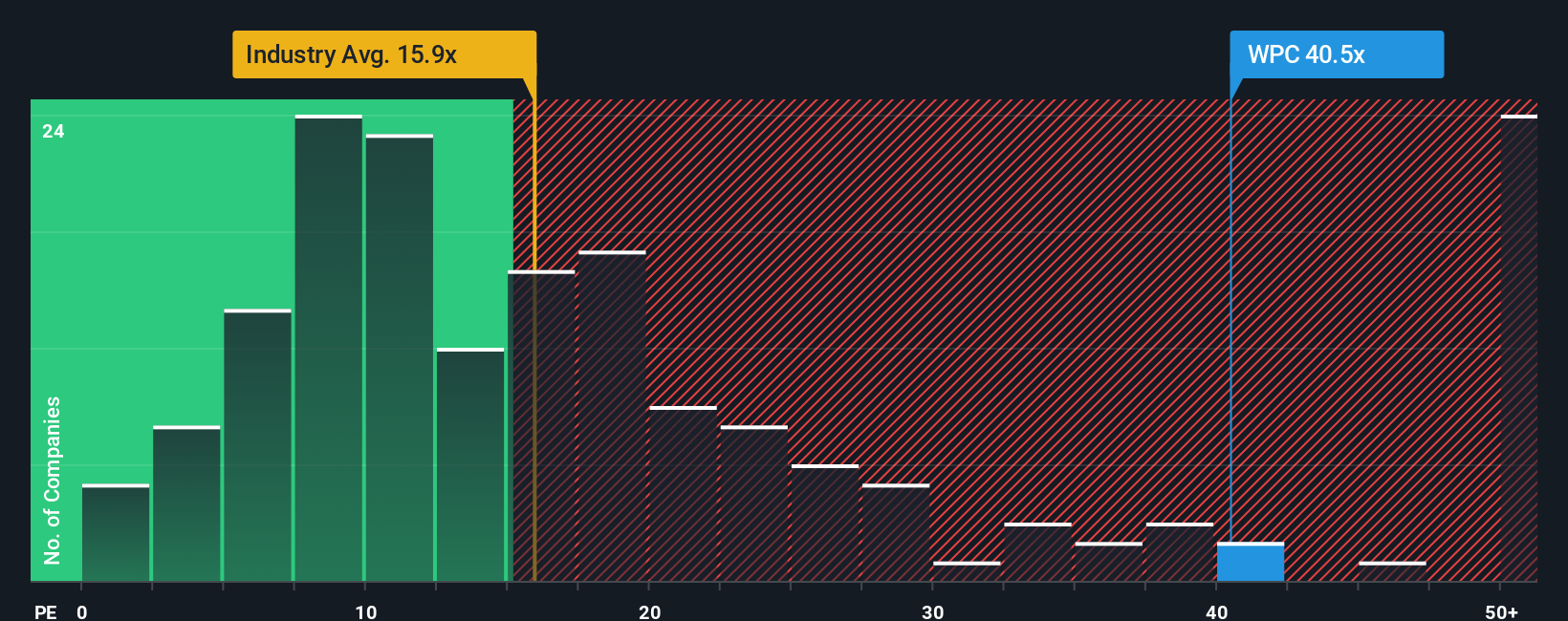

Looking at valuation from another angle, W. P. Carey trades at a price-to-earnings ratio of 40.5 times, which is much higher than both the global REITs industry at 15.8x and its selected peers at 27.9x. Even when compared to the fair ratio of 39.3x, the stock still appears a little pricey. This suggests there may be more valuation risk than first meets the eye. Could the market be overly optimistic, or are investors betting on a rebound in earnings?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W. P. Carey Narrative

If you see the story differently, or want to interpret the data in your own way, you can create a personalized narrative in just a few minutes. Do it your way

A great starting point for your W. P. Carey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities pass you by. The Simply Wall Street Screener lets you uncover incredible stocks with standout traits that could supercharge your portfolio.

- Tap into aggressive growth potential by scouting these 25 AI penny stocks that are propelling the artificial intelligence revolution forward and transforming entire industries.

- Secure your future income by targeting these 15 dividend stocks with yields > 3% with higher yields and consistent performance, ideal for building steady returns.

- Take advantage of Wall Street’s best-kept secrets with these 927 undervalued stocks based on cash flows that may be flying under the radar now but offer potential for strong upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,600 net lease properties covering approximately 178 million square feet and a portfolio of 66 self-storage operating properties as of June 30, 2025.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success