- United States

- /

- REITS

- /

- NYSE:WPC

It Looks Like Shareholders Would Probably Approve W. P. Carey Inc.'s (NYSE:WPC) CEO Compensation Package

The performance at W. P. Carey Inc. (NYSE:WPC) has been quite strong recently and CEO Jason Fox has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 17 June 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for W. P. Carey

How Does Total Compensation For Jason Fox Compare With Other Companies In The Industry?

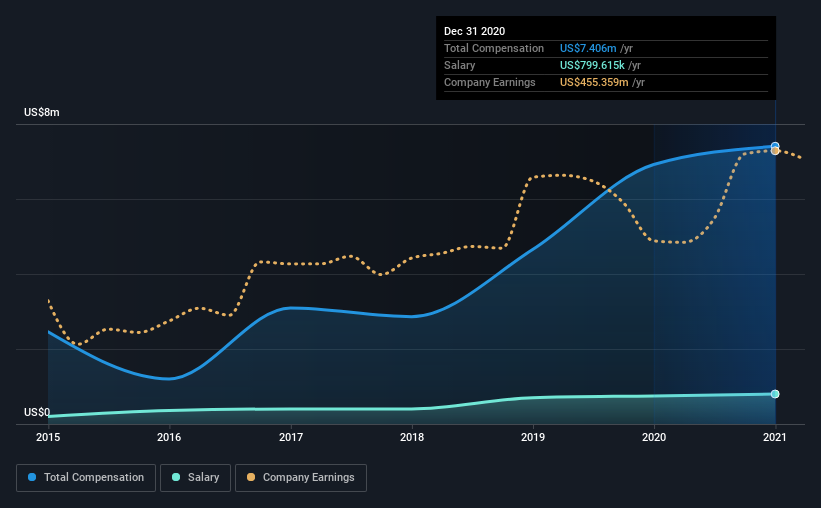

At the time of writing, our data shows that W. P. Carey Inc. has a market capitalization of US$14b, and reported total annual CEO compensation of US$7.4m for the year to December 2020. That's a fairly small increase of 7.0% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$800k.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$7.8m. From this we gather that Jason Fox is paid around the median for CEOs in the industry. Moreover, Jason Fox also holds US$37m worth of W. P. Carey stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$800k | US$750k | 11% |

| Other | US$6.6m | US$6.2m | 89% |

| Total Compensation | US$7.4m | US$6.9m | 100% |

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. It's interesting to note that W. P. Carey allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at W. P. Carey Inc.'s Growth Numbers

Over the past three years, W. P. Carey Inc. has seen its funds from operations (FFO) grow by 17% per year. In the last year, its revenue is up 1.8%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has W. P. Carey Inc. Been A Good Investment?

We think that the total shareholder return of 38%, over three years, would leave most W. P. Carey Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for W. P. Carey (1 shouldn't be ignored!) that you should be aware of before investing here.

Switching gears from W. P. Carey, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade W. P. Carey, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,600 net lease properties covering approximately 178 million square feet and a portfolio of 66 self-storage operating properties as of June 30, 2025.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion