- United States

- /

- Health Care REITs

- /

- NYSE:WELL

Welltower (NYSE:WELL) Launches US$7.5B Offering, Withdraws US$5B Proposal Amid 5% Rise

Reviewed by Simply Wall St

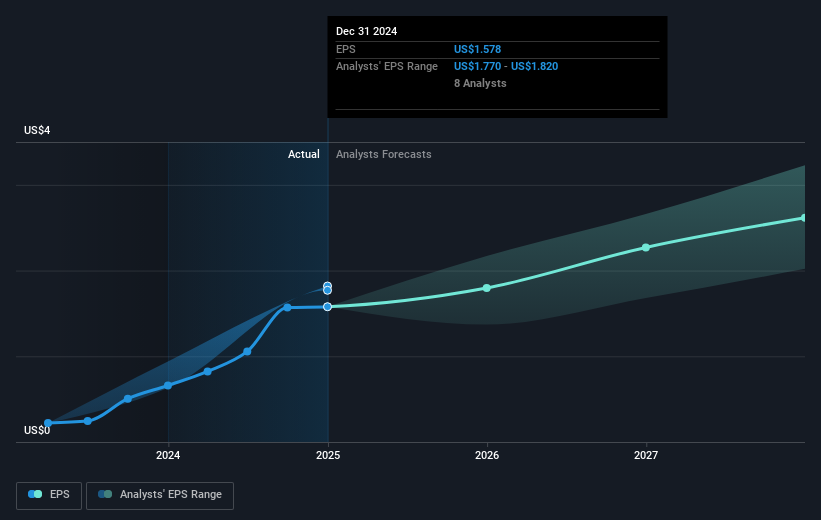

Welltower (NYSE:WELL) recently saw a 23% price increase over the last quarter, a move possibly influenced by significant corporate actions and broader market trends. The company announced major equity offering plans, filing for a $7.5 billion offering and withdrawing a $5 billion one, which might have affected investor sentiment. Additionally, stellar earnings results, with net income and revenue up substantially from the previous year, likely bolstered the share price. Amid this, Welltower's affirmation of a $0.67 cash dividend demonstrates confidence in its financial outlook. These company-specific events occurred against a backdrop of fluctuating markets impacted by new tariffs and economic uncertainties.

Be aware that Welltower is showing 2 risks in our investment analysis.

Over the last five years, Welltower (NYSE: WELL) has experienced a significant total shareholder return of 381.98%. This return reflects the company's strong growth trajectory, buoyed by various strategic initiatives and market trends. A notable factor contributing to this impressive return includes Welltower's successful senior housing operations, which saw consecutive quarters of strong same-store NOI growth, indicating robust future revenue potential. The shift towards capital-light transactions, particularly transitioning assets to stronger operating partners, has also played a crucial role in enhancing cash flow and occupancy rates.

In addition, demographic shifts favoring the senior living business and Welltower's strategic capital allocation, evidenced by US$2 billion of investments under contract focusing on regional densification, further underline its success. Continued efforts in digital transformation to improve operational efficiency also stand out. The company's five-year performance seriously outperformed the US Health Care REITs industry, which returned 33.3% over the past year, showcasing Welltower's robust positioning in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Welltower, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Welltower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WELL

Welltower

Welltower Inc. (NYSE: WELL) an S&P 500 company, is the world's preeminent residential wellness and healthcare infrastructure company.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives