- United States

- /

- Specialized REITs

- /

- NYSE:VICI

VICI Properties (NYSE:VICI) Announces US$0 Dividend Per Share for Q1 2025

Reviewed by Simply Wall St

VICI Properties (NYSE:VICI) recently declared a regular quarterly cash dividend of $0.43 per share, likely influencing its share price movement, which rose 7% in the past month. The dividend announcement, alongside the company's strategic partnership with Cain International and Eldridge Industries LLC for the One Beverly Hills development, reflects VICI's commitment to shareholder value and growth in the real estate sector. Despite a dip in their fourth-quarter net income, the annual performance saw increased revenue and net income for 2024, suggesting resilience in challenging economic conditions. Meanwhile, broader market indices faced declines amidst economic concerns and tariff-related uncertainties, which underscores VICI's solid performance against a volatile market backdrop. While the Dow Jones Industrial Average and S&P 500 logged significant weekly losses, VICI's strategic initiatives and continued dividend commitment might have provided investors with confidence, contributing to its positive price movement during a period when the overall market showed signs of instability.

Unlock comprehensive insights into our analysis of VICI Properties stock here.

Over the past five years, VICI Properties' total shareholder returns amounted to 156.49%, showing significant growth when compared to broader market trends. Several key factors contributed to this performance. A consistent dividend policy, including a recent affirmation with payouts such as US$0.4325 per share, underscores its commitment to shareholder value. Major strategic partnerships, like the one with Cain International and Eldridge Industries for the One Beverly Hills development, reflect VICI's strategic focus on growth in the experiential real estate sector.

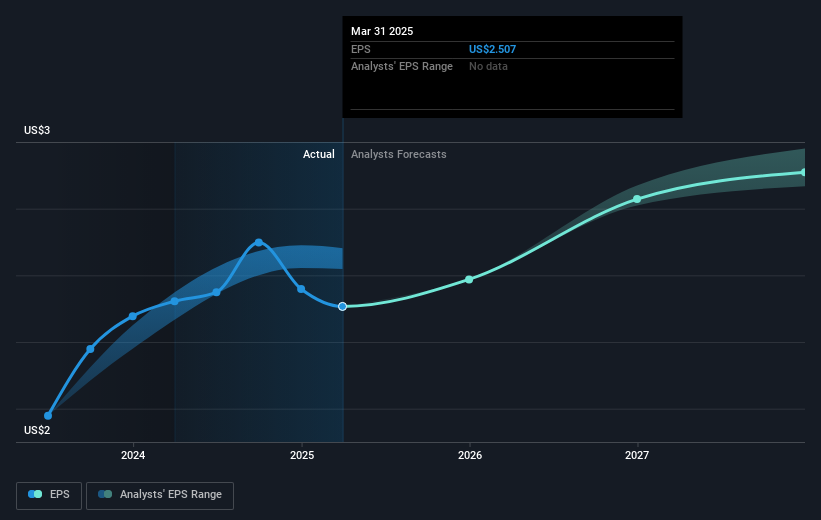

Further, robust earnings growth has been a major driver, with profits increasing significantly by 34.2% per year over this period. Despite recent deceleration in profit growth, VICI still outperformed the US Specialized REITs industry. It also demonstrated financial acumen through successful follow-on equity offerings raising substantial capital, such as the US$948.5 million in May 2024, helping bolster its investment capacity.

- See whether VICI Properties' current market price aligns with its intrinsic value in our detailed report

- Analyze the downside risks for VICI Properties and understand their potential impact—click to learn more.

- Invested in VICI Properties? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives