- United States

- /

- Residential REITs

- /

- NYSE:UMH

Should Analyst’s Bullish View on Filling Vacant Sites and JV Expansion Require Action From UMH (UMH) Investors?

Reviewed by Sasha Jovanovic

- In recent days, an analyst issued a strong buy opinion on UMH Properties, emphasizing the REIT’s manufactured housing portfolio, land bank, and Southeast expansion as key advantages amid the U.S. affordable housing shortage.

- The commentary highlights how filling roughly 3,500 vacant sites and using joint ventures to grow without heavy new land costs could materially enhance UMH’s cash flow profile while still leaving interest rate and regulatory risks in focus.

- Next, we’ll examine how this bullish view on UMH’s growth runway from filling vacant sites interacts with the company’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

UMH Properties Investment Narrative Recap

To own UMH Properties, you need to believe that manufactured housing remains a core solution to the U.S. affordable housing shortage and that UMH can steadily convert its vacant sites into income-producing lots. The recent bullish analyst view reinforces that near term catalyst but does not materially change the biggest current risk, which is UMH’s reliance on sizeable external capital needs in a still uncertain interest rate backdrop.

The most relevant recent development is UMH’s November 2025 move to add seven communities with 1,765 sites to its Fannie Mae credit facility for about US$91.8 million at a fixed 5.46 percent rate. This type of long term, interest only financing directly affects how efficiently UMH can fund expansions, fill its roughly 3,500 vacant sites, and still manage balance sheet pressure from higher borrowing costs.

However, investors should also be aware that rising debt costs could interact with those capital needs in ways that ...

Read the full narrative on UMH Properties (it's free!)

UMH Properties' narrative projects $327.1 million revenue and $32.3 million earnings by 2028.

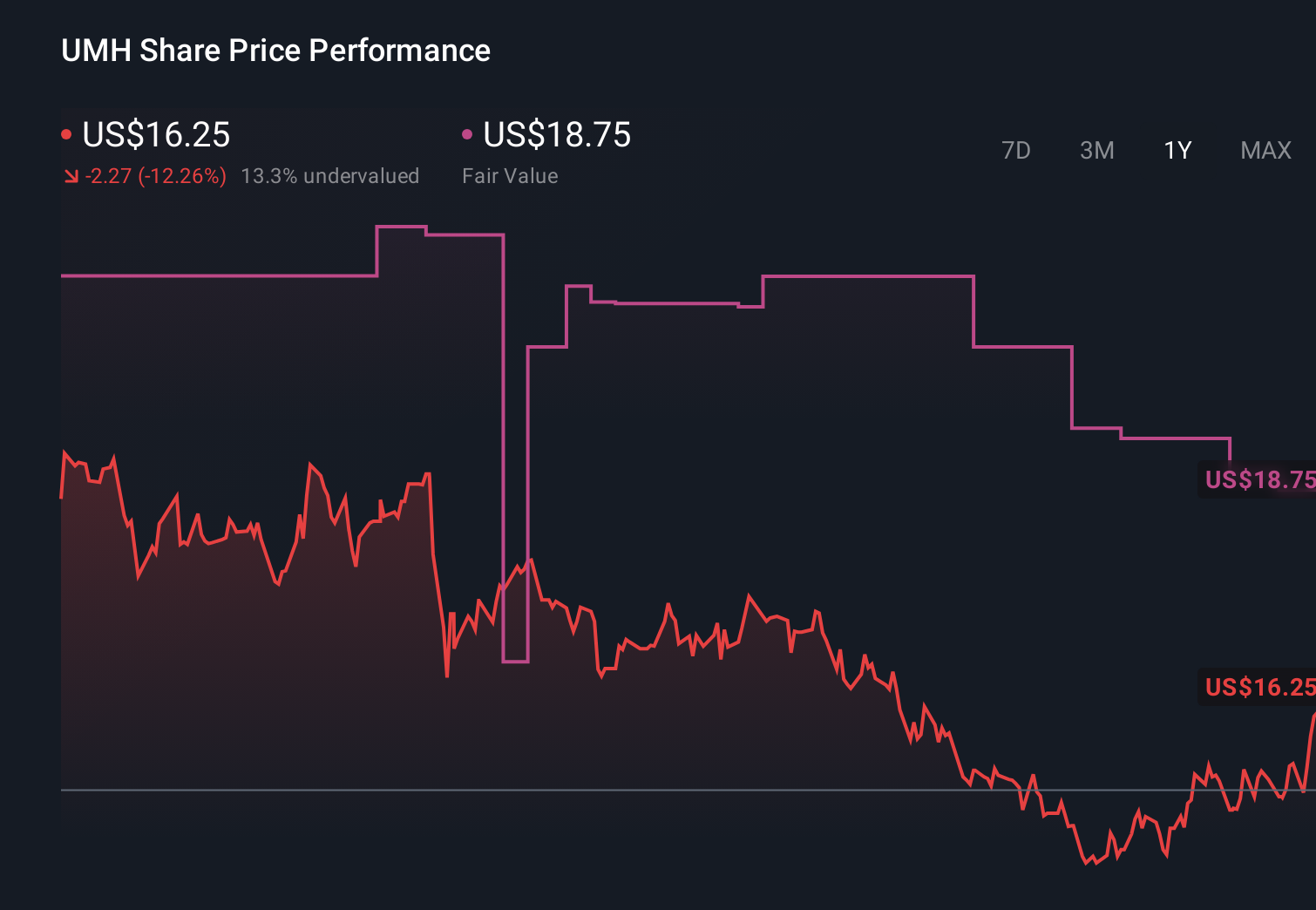

Uncover how UMH Properties' forecasts yield a $18.75 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$9 to over US$4,900 per share, showing just how far apart retail views can be. Against that backdrop, UMH’s heavy dependence on fresh capital in a higher rate setting gives you a concrete issue to weigh as you compare these different perspectives.

Explore 6 other fair value estimates on UMH Properties - why the stock might be worth 44% less than the current price!

Build Your Own UMH Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UMH Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free UMH Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UMH Properties' overall financial health at a glance.

No Opportunity In UMH Properties?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UMH

UMH Properties

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that currently owns and operates 145 manufactured home communities, containing approximately 27,000 developed homesites, of which 10,800 contain rental homes, and over 1,000 self-storage units.

Established dividend payer with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)