- United States

- /

- Residential REITs

- /

- NYSE:UDR

UDR (UDR) Margin Decline Reinforces Bearish Case on High Valuation

Reviewed by Simply Wall St

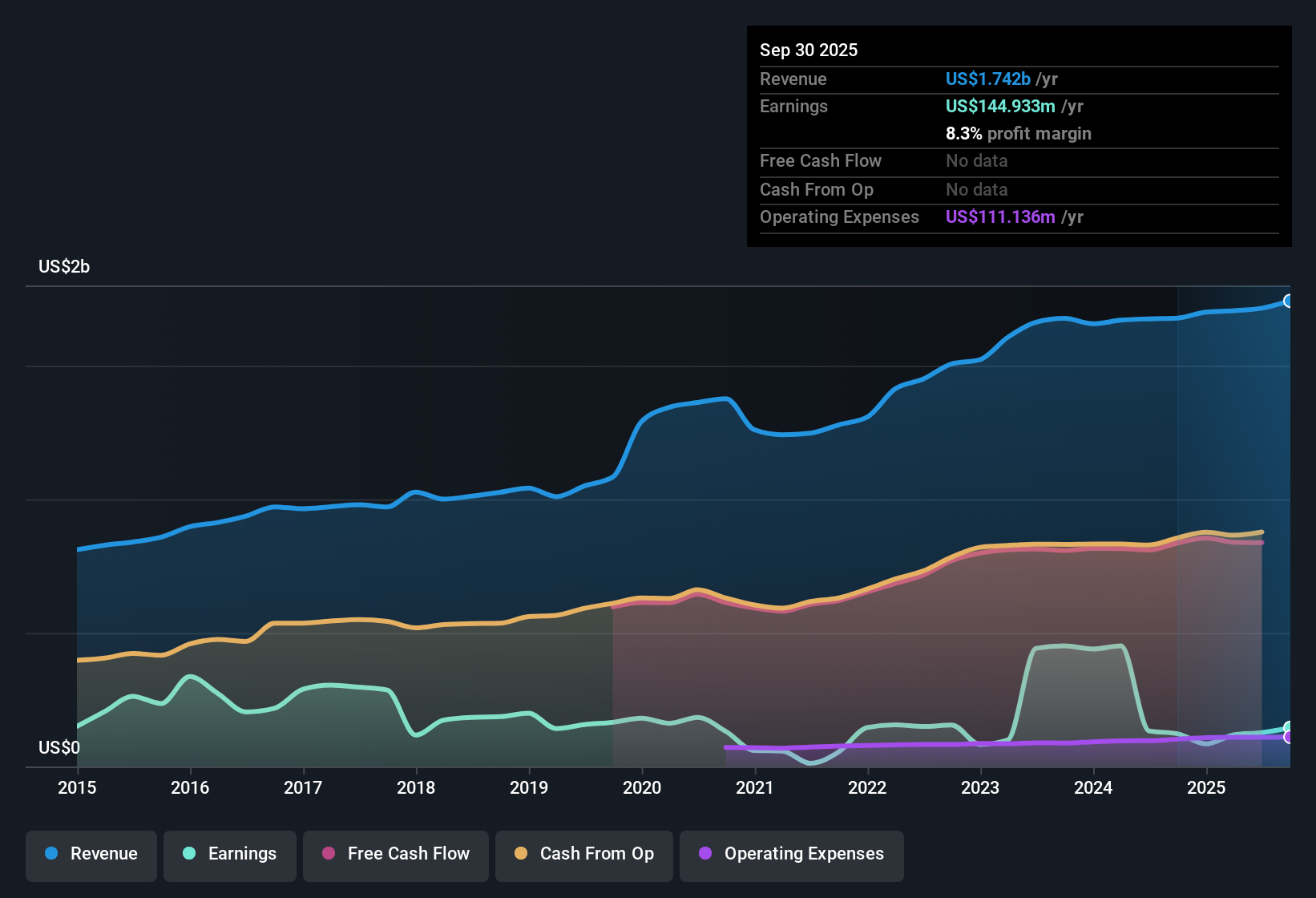

UDR (UDR) has posted average annual earnings growth of 18.6% over the past five years. However, its latest results show a decline in earnings growth over the past year. Net profit margins now stand at 7.4%, lower than last year’s 7.9%. A non-recurring $25.3 million gain has impacted the trailing twelve months. Looking ahead, analysts expect UDR’s earnings to grow 8.3% annually, while revenue is forecast to rise 3.5% per year. Both figures are below the broader US market, leaving investors to weigh its lower growth outlook, higher price-to-earnings ratio compared to peers, and recent earnings volatility.

See our full analysis for UDR.Now, let’s see how these headline numbers compare to the major narratives circulating on Simply Wall St. In some areas the results may reinforce the story; in others, the outlook could be challenged.

See what the community is saying about UDR

Analyst Price Target Sits Well Above Current Share Price

- UDR’s current share price stands at $33.63, which is 21.5% below the analyst consensus price target of $42.84. It also trades at a discount to its DCF fair value of $57.78.

- According to analysts' consensus view, this gap reflects expectations that UDR’s profit margins could improve from 7.4% today to 11.9% within three years.

- Revenue is forecast to grow at 3.7% annually for the next three years, with earnings potentially rising from $127.1 million now to $227.8 million by 2028.

- Despite current headwinds, consensus narrative sees strong rental demand and margin expansion as providing upside for the stock. However, there is a wide range of analyst forecasts, indicating uncertainty in earnings durability.

What if the market is closer to the consensus view than the skeptics? Dive into why analyst forecasts could matter with this full narrative: 📊 Read the full UDR Consensus Narrative.

High Price-to-Earnings Ratio Signals Premium Valuation

- UDR is trading at a price-to-earnings ratio of 87.6x, which far exceeds the peer average of 33.6x and the North American residential REIT industry average of 24.4x.

- Consensus narrative suggests this premium is driven by investors betting on UDR’s ability to grow earnings through innovations like smart home upgrades and a focus on high-growth markets.

- The narrative emphasizes that capital allocation and operational efficiency are enhancing long-term earnings potential, so the premium multiple could be warranted if recent investments pay off.

- Still, any shortfall in achieving projected margin increases or rent growth could expose the downside of this high valuation, especially if broader industry multiples remain much lower.

Concentration Risks and External Threats Remain High

- UDR’s strong focus on major coastal and urban markets, while supporting high occupancy rates around 97%, leaves it exposed to regional market shifts and regulatory risks such as potential rent controls in key areas.

- Consensus narrative points out that persistent elevated supply, higher operating costs, and exposure to demographic fluctuations could limit rental and NOI growth.

- Ongoing supply pressures in markets like the Sunbelt and select urban regions are leading to slightly negative same-store revenues year-to-date, which could drag down overall performance if absorption lags.

- Rising construction costs and regulatory actions like rent control could limit upside even if rental demand stays strong, highlighting the importance of closely tracking these risks when evaluating UDR’s outlook.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UDR on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the numbers tell a different story to you? In just a few minutes, you can build your own narrative and share your perspective. Do it your way

A great starting point for your UDR research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

UDR’s premium valuation and uneven earnings growth make its future performance uncertain. Profitability and margin expansion remain unproven compared to industry peers.

If you want more consistent performance, focus your search on stable growth stocks screener (2112 results) to discover companies delivering steady revenue and earnings growth regardless of market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate properties in targeted U.S.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives