- United States

- /

- Industrial REITs

- /

- NYSE:TRNO

Terreno Realty (TRNO): Evaluating Valuation After Full Leasing of Countyline Corporate Park Phase IV Building 34

Reviewed by Kshitija Bhandaru

If you are watching Terreno Realty (TRNO), the announcement that it has leased 100% of Countyline Corporate Park Phase IV Building 34 in Hialeah is hard to ignore. Inking deals with tenants across cruise ship food supply, delivery logistics, and manufacturing, Terreno has effectively filled one of its major developments even before full build-out is finished. This marks a tangible step forward for the company’s ambitions in Miami’s industrial market and answers questions about tenant demand as the project heads toward its expected stabilization next year.

Zooming out, this latest flurry of leasing comes during a period where Terreno Realty’s share price has seen mixed signals. After a fairly quiet three months, the stock has eked out a small gain for the year, but it is still down about 12% compared to twelve months ago. Longer-term gains over the past three and five years hint that momentum has faded recently despite solid revenue growth, and this leasing milestone follows other recent moves, such as a long-term renewal at a key California facility, that signal ongoing activity even as market sentiment wavers.

After a year of underperformance and with new leasing successes in the mix, the question is whether Terreno Realty is trading at a discount or if the market is already anticipating future growth from these projects.

Price-to-Earnings of 24x: Is it justified?

Terreno Realty currently trades at a price-to-earnings (P/E) ratio of 24x, which is notably higher than the industry average of 16.5x for global industrial REITs. This suggests the stock might be trading at a premium compared to its peers on this metric.

The P/E ratio is a widely followed valuation measure that compares a company's current share price to its per-share earnings. For real estate investment trusts like Terreno, it is used by investors to gauge future earnings expectations and to assess whether the share price reflects the company’s underlying profitability.

This elevated multiple implies that investors are either expecting above-average growth or the market may be overpricing current and future earnings by placing Terreno in a premium bracket. However, given that Terreno's earnings are forecast to decline over the next three years, this valuation could be difficult to justify based on growth expectations alone.

Result: Fair Value of $58.82 (OVERVALUED)

See our latest analysis for Terreno Realty.However, slowing net income growth and continued underperformance over the past year could weigh on sentiment if fundamentals do not improve in the coming quarters.

Find out about the key risks to this Terreno Realty narrative.Another View: What Does the SWS DCF Model Say?

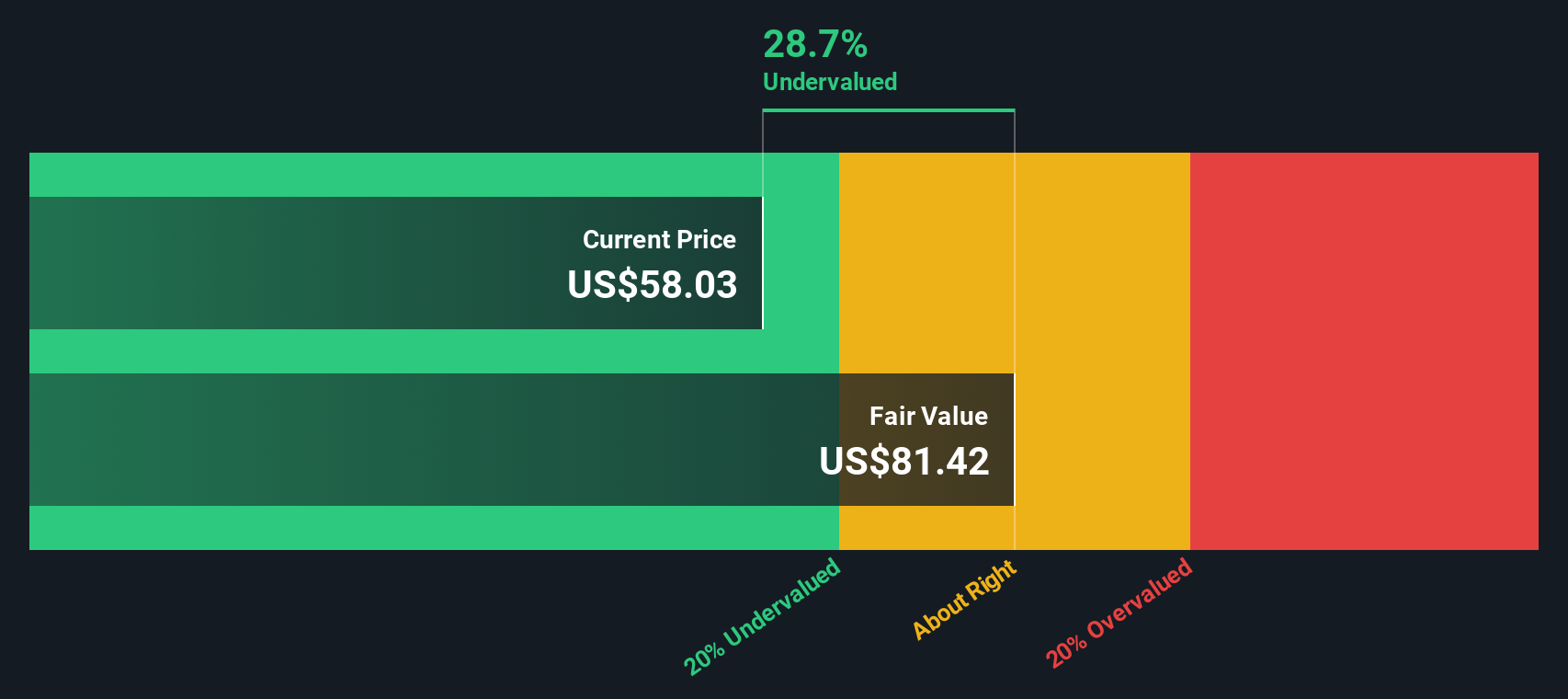

Our SWS DCF model takes a different approach by examining Terreno Realty's future cash flows instead of its earnings ratio. Interestingly, this method suggests the stock could be undervalued by the market right now. Which method tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Terreno Realty Narrative

Your own perspective may differ or you might want to dig deeper into the numbers. Crafting your own view only takes a few minutes. Do it your way

A great starting point for your Terreno Realty research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their eye on every opportunity. Don't let market trends or hidden winners pass you by. Set yourself up for success by browsing the best stocks Simply Wall Street can surface for you.

- Supercharge your portfolio with companies leading the digital money revolution by following the latest cryptocurrency and blockchain stocks.

- Take advantage of stable payouts from companies offering above-average yields by checking out dividend stocks with yields > 3%.

- Seize bargains before others by seeking out hidden gems among undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terreno Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRNO

Terreno Realty

Terreno Realty Corporation (“Terreno”, and together with its subsidiaries, the “Company”) acquires, owns and operates industrial real estate in six major coastal U.S.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives