- United States

- /

- Residential REITs

- /

- NYSE:SUI

Is Now The Time To Put Sun Communities (NYSE:SUI) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Sun Communities (NYSE:SUI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Sun Communities

Sun Communities' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Impressively, Sun Communities has grown EPS by 30% per year, compound, in the last three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

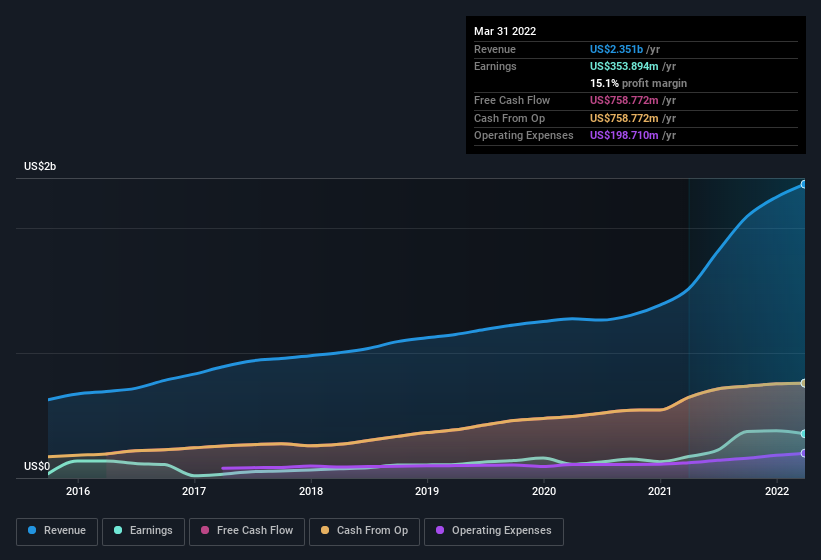

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Sun Communities' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Sun Communities remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 55% to US$2.4b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Sun Communities' forecast profits?

Are Sun Communities Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The US$51m worth of shares that insiders sold during the last 12 months pales in comparison to the US$71m they spent on acquiring shares in the company. This bodes well for Sun Communities as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was Chairman & CEO Gary Shiffman who made the biggest single purchase, worth US$46m, paying US$194 per share.

Along with the insider buying, another encouraging sign for Sun Communities is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$347m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does Sun Communities Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Sun Communities' strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. You still need to take note of risks, for example - Sun Communities has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sun Communities, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Sun Communities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SUI

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives