As an investor, I look for investments which does not compromise one fundamental factor for another. By this I mean, I look at stocks holistically, from their financial health to their future outlook. In the case of STORE Capital Corporation (NYSE:STOR), it is a dependable dividend-paying company with a an impressive track record of delivering benchmark-beating performance. Below is a brief commentary on these key aspects. For those interested in understanding where the figures come from and want to see the analysis, read the full report on STORE Capital here.

Proven track record average dividend payer

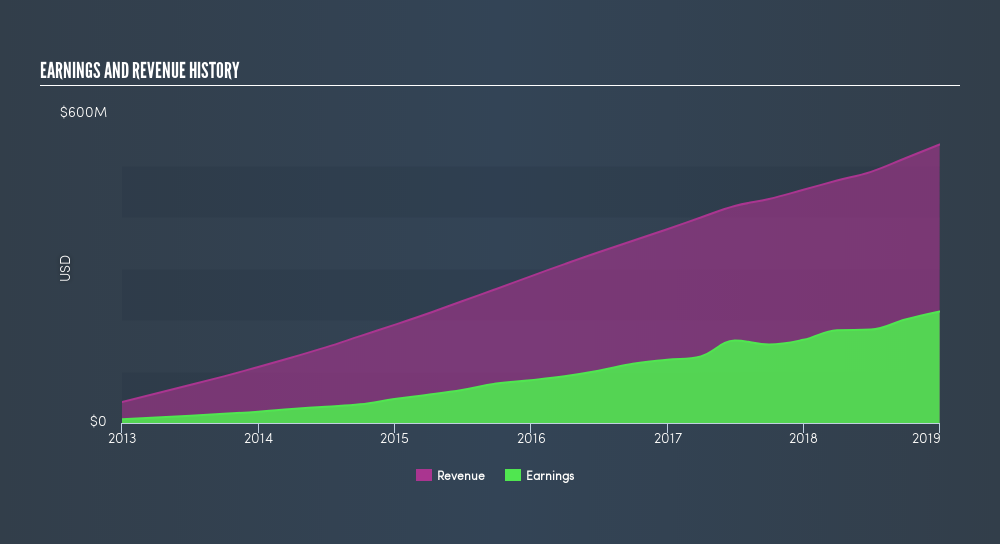

STOR delivered a satisfying double-digit returns of 4.9% in the most recent year Not surprisingly, STOR outperformed its industry which returned 4.8%, giving us more conviction of the company's capacity to drive bottom-line growth going forward.

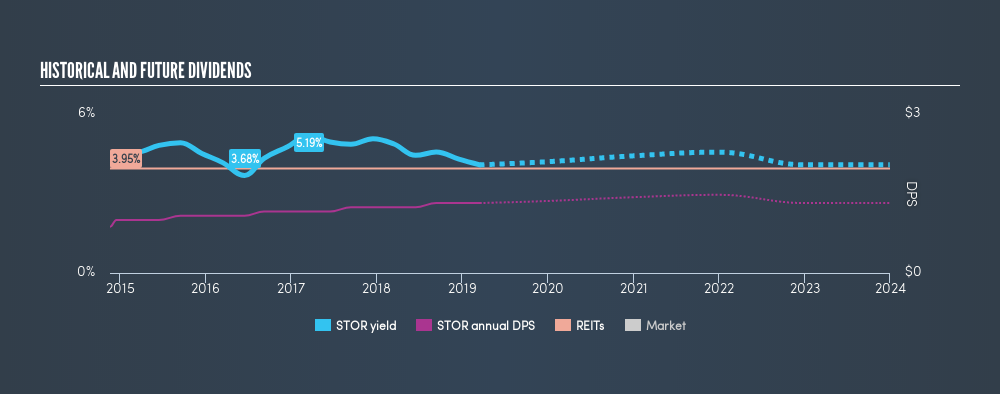

STOR is considered one of the top dividend payers in the market, and it has also been able to maintain it at a level in which net income is able to cover dividend payments.

Next Steps:

For STORE Capital, I've put together three pertinent factors you should look at:

- Future Outlook: What are well-informed industry analysts predicting for STOR’s future growth? Take a look at our free research report of analyst consensus for STOR’s outlook.

- Financial Health: Are STOR’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of STOR? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:STOR

STORE Capital

STORE Capital Corporation is an internally managed net-lease real estate investment trust, or REIT, that is the leader in the acquisition, investment and management of Single Tenant Operational Real Estate, which is its target market and the inspiration for its name.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives