- United States

- /

- Retail REITs

- /

- NYSE:SPG

Should Simon Property Group, Inc. (NYSE:SPG) Be Part Of Your Dividend Portfolio?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at Simon Property Group, Inc. (NYSE:SPG) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

In this case, Simon Property Group likely looks attractive to investors, given its 5.0% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. There are a few simple ways to reduce the risks of buying Simon Property Group for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 57% of Simon Property Group's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Simon Property Group paid out 85% of its cash flow last year. This may be sustainable but it does not leave much of a buffer for unexpected circumstances. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

It is worth considering that Simon Property Group is a Real Estate Investment Trust (REIT). REITs have different rules governing their payments, and are often required to pay out a high portion of their earnings to investors.

Is Simon Property Group's Balance Sheet Risky?

As Simon Property Group has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). Simon Property Group has net debt of 5.45 times its EBITDA, which implies meaningful risk if interest rates rise of earnings decline.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Interest cover of 3.55 times its interest expense is starting to become a concern for Simon Property Group, and be aware that lenders may place additional restrictions on the company as well. High debt and weak interest cover are not a great combo, and we would be cautious of relying on this company's dividend while these metrics persist.

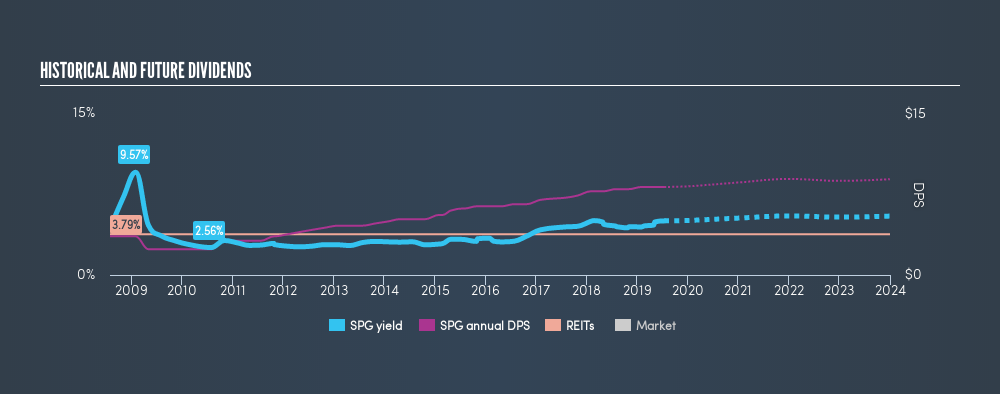

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Simon Property Group has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having fallen by at least 20% one or more times over this time. During the past ten-year period, the first annual payment was US$3.60 in 2009, compared to US$8.20 last year. Dividends per share have grown at approximately 8.6% per year over this time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Simon Property Group has grown its earnings per share at 16% per annum over the past five years. Simon Property Group's earnings per share have grown rapidly in recent years, although more than half of its profits are being paid out as dividends, which makes us wonder if the company has a limited number of reinvestment opportunities in its business.

Conclusion

To summarise, shareholders should always check that Simon Property Group's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think Simon Property Group is paying out an acceptable percentage of its cashflow and profit. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Simon Property Group out there.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 8 Simon Property Group analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives