- United States

- /

- Retail REITs

- /

- NYSE:SPG

How Investors May Respond To Simon Property Group (SPG) Credit Rating Upgrade and Experiential Retail Initiative

Reviewed by Sasha Jovanovic

- In September 2025, IEM and Simon Property Group announced the launch of new 10x15-foot experiential micro retail spaces to provide emerging brands with turnkey access to prime mall locations, complemented by flexible service packages and short-term leases.

- This initiative, alongside an S&P Global Ratings upgrade to an 'A' rating and ongoing insider buying by company directors, signals growing internal and external confidence in Simon Property Group’s operational strength and leadership.

- We’ll explore how the credit rating upgrade and record of director share purchases may strengthen Simon Property Group’s investment thesis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Simon Property Group Investment Narrative Recap

To consider investing in Simon Property Group, you need to believe in the sustained value of high-traffic, experience-driven retail space and management's ability to adapt its portfolio to evolving consumer habits. The newly launched micro-retail initiative may support near-term leasing demand and tenant diversity, but does not materially change the immediate catalyst of further occupancy gains or the key risk from potential retail bankruptcies and ongoing tenant turnover.

Among Simon’s recent announcements, the upgrade to an ‘A’ rating from S&P Global Ratings stands out. While it underscores external confidence following improved occupancy and stable property income, the primary challenge remains exposure to structural risks in retail, including tenant stability and shifting demand patterns.

In contrast, investors should be aware that persistent retailer bankruptcies have continued to result in millions of square feet of vacant space not easily backfilled…

Read the full narrative on Simon Property Group (it's free!)

Simon Property Group's narrative projects $6.2 billion revenue and $2.4 billion earnings by 2028. This requires a 0.7% annual revenue decline and a $0.3 billion earnings increase from $2.1 billion currently.

Uncover how Simon Property Group's forecasts yield a $186.45 fair value, in line with its current price.

Exploring Other Perspectives

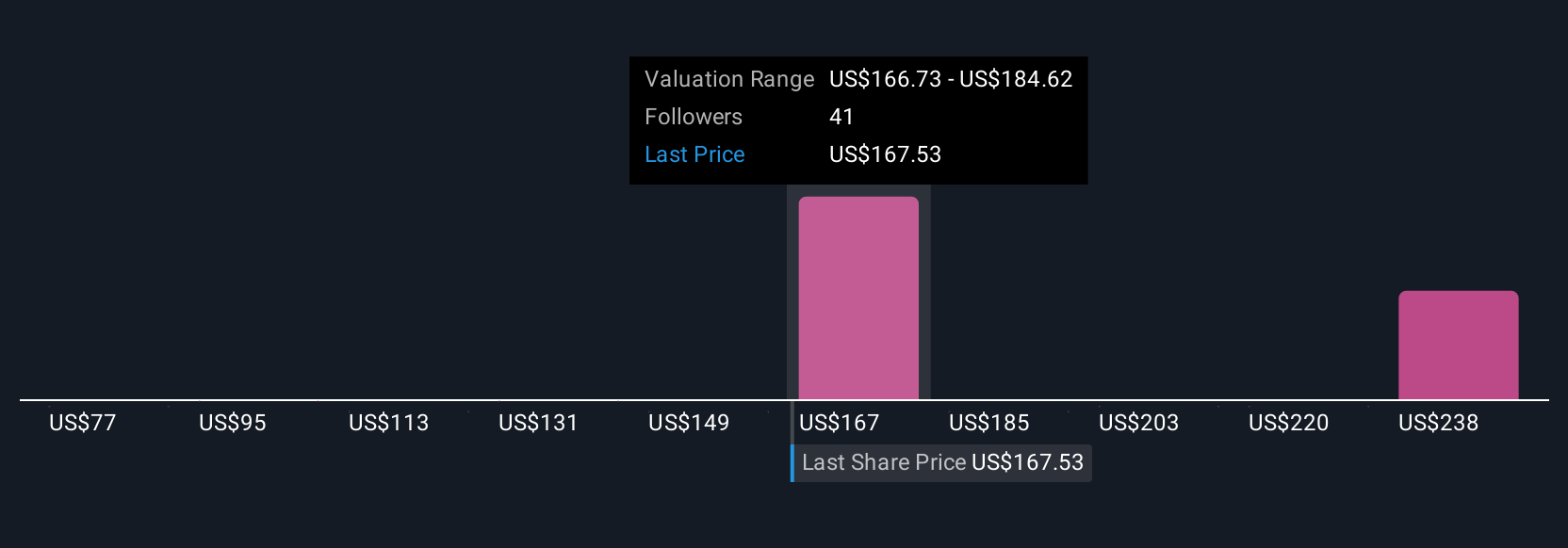

Nine Simply Wall St Community estimates put Simon Property Group’s fair value between US$77 and US$246 per share. While many see value, retailer instability remains a concern for future returns and income; explore the full range of viewpoints.

Explore 9 other fair value estimates on Simon Property Group - why the stock might be worth less than half the current price!

Build Your Own Simon Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simon Property Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simon Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simon Property Group's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives