- United States

- /

- Office REITs

- /

- NYSE:SLG

What Does SL Green’s Recent 13.6% Drop Mean for Its 2025 Value?

Reviewed by Bailey Pemberton

Thinking of what to do with your SL Green Realty shares? You are not alone. This stock is famous for defying expectations, which means there is always lively debate over whether it is a smart buy, a risky hold, or now just a watch-and-wait situation. If you have been tracking the price lately, you will have noticed some pretty surprising ups and downs. After rallying through the past three years and returning a remarkable 93.9% over that stretch, as well as a strong 74.1% in five years, SL Green has recently hit turbulence. Year-to-date, the stock is down 13.6%, with a 4.7% drop in the last month alone, and most recently, a 1.2% dip just this past week. These numbers hint at new concerns among investors about risk and the future of the commercial real estate market, especially as market developments add a new layer of uncertainty.

So, how does valuation fit into this story? SL Green’s value score sits at a flat 0 out of 6, meaning it is not ticking the boxes for undervaluation on any of the industry’s key measures right now. That kind of score is important context for decision making, but it is only the start of the conversation. Let us walk through the main valuation angles and keep an eye out for a more insightful way to think about what this stock is really worth, still to come.

SL Green Realty scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SL Green Realty Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows, in this case, adjusted funds from operations, and discounting them back to today's dollars. For SL Green Realty, analysts estimate that the company generated $459.4 million in free cash flow over the last twelve months. Looking forward, forecasts suggest that free cash flow will fluctuate and ultimately rise to a projected $359.7 million in 2035. Only the next five years are based directly on analyst inputs, with Simply Wall St extrapolating beyond that point.

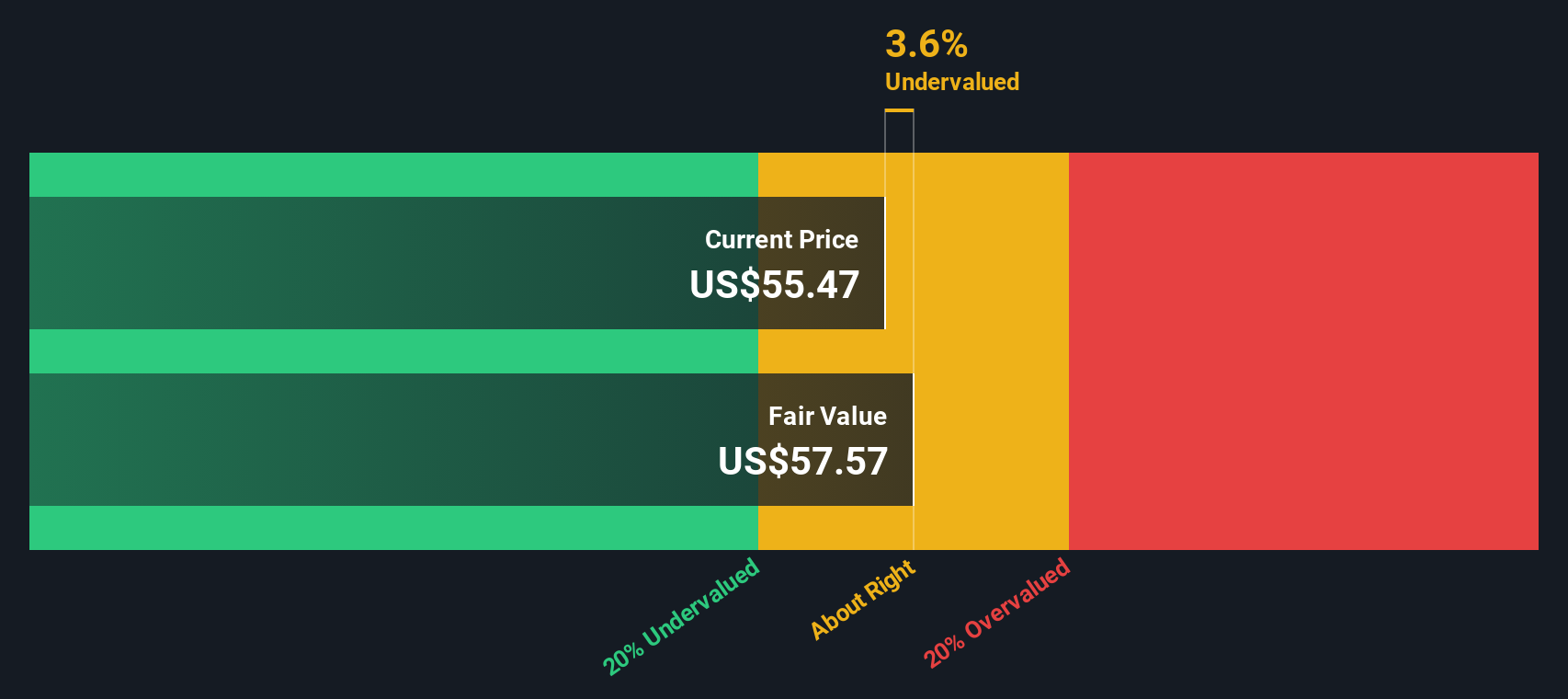

Current projections indicate SL Green's free cash flow will be $269.5 million in 2029, with the yearly growth rate moderating over time. Using these projections, the DCF model calculates an intrinsic value of $56.90 per share. At present prices, this implies the stock is trading about 3.8% above its intrinsic value, suggesting only a slight overvaluation relative to its long-term expected cash generation.

So, while the numbers do not flag a dramatic mispricing, they suggest SL Green's shares are about where they should be considering expected performance and risks built into the DCF assumptions.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out SL Green Realty's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: SL Green Realty Price vs Sales

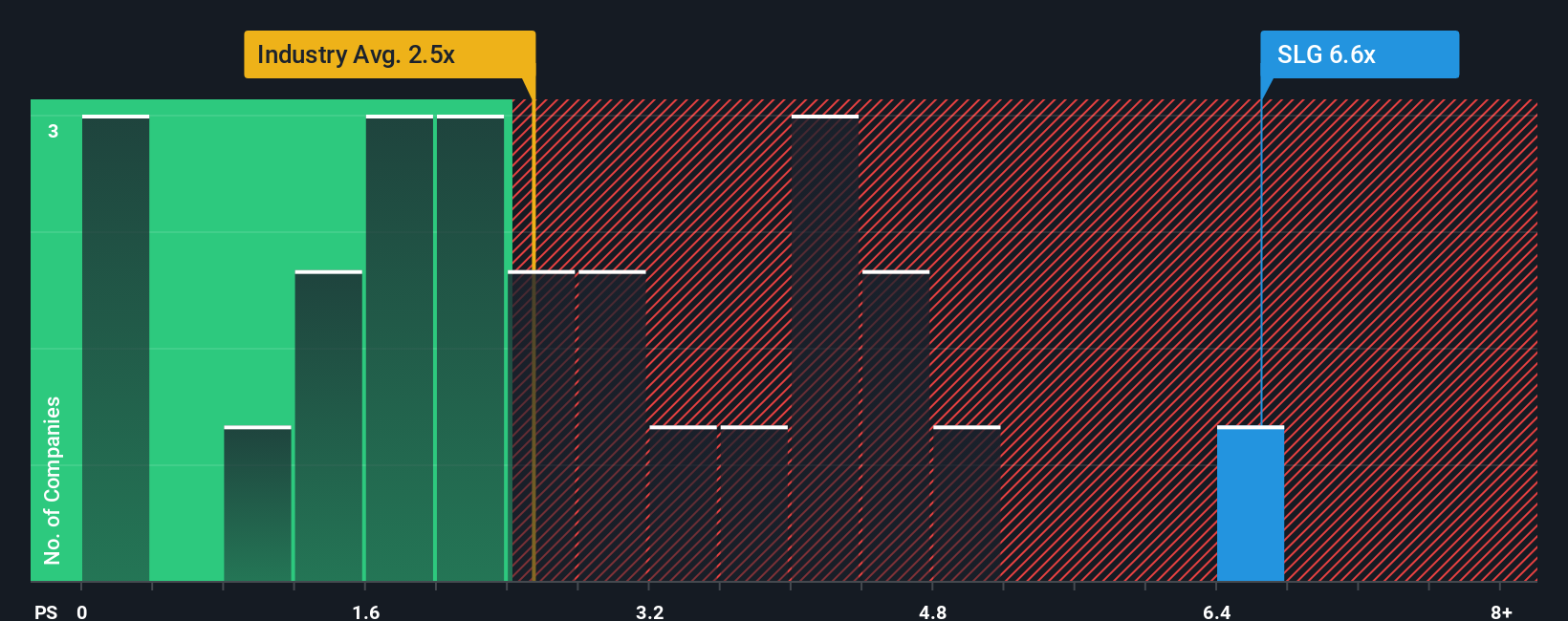

Price-to-Sales (P/S) is a particularly useful multiple for valuing companies like SL Green Realty, especially when profitability is impacted by non-cash items or industry-specific factors. Unlike earnings-based metrics, P/S focuses on the actual revenue a company brings in, which can provide a clearer picture for firms in sectors such as real estate investment trusts where bottom-line results may fluctuate due to accounting choices rather than operational performance.

In general, growth expectations and risk levels play a key part in determining what level of P/S multiple is reasonable for a given stock. Faster growing, lower risk businesses typically command higher multiples, while companies with slower growth or elevated uncertainty tend to trade at lower ratios. Comparing SL Green’s current P/S multiple of 6.55x to the Office REITs industry average of 2.40x and a peer group average of 4.49x, it is apparent that investors are paying a significant premium for each dollar of sales.

To dig deeper, Simply Wall St uses a proprietary “Fair Ratio” (in this case, 2.15x for SL Green Realty), which blends in factors such as company-specific growth rates, profit margins, market cap, and its unique risk profile. This approach goes beyond the basic peer and industry comparisons by reflecting what investors should ideally pay for this particular business given its characteristics, rather than relying solely on group averages.

Comparing the Fair Ratio of 2.15x to SL Green’s actual P/S multiple of 6.55x reveals a substantial premium. Since this gap is well above the threshold for a fair value call, it suggests that the stock is currently priced above what its fundamentals would justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SL Green Realty Narrative

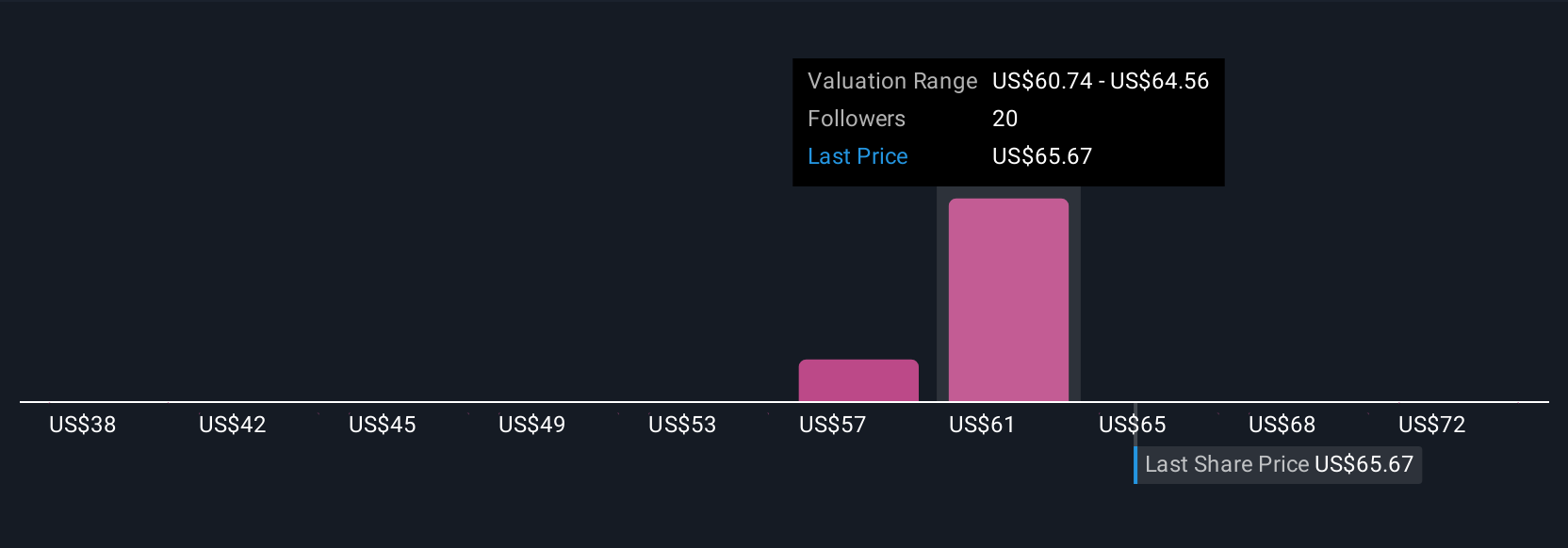

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is your personal “story” behind the numbers: it connects your perspective on a company’s prospects with your forecasts for revenue, earnings, and profit margins, and arrives at a fair value based on those assumptions. Narratives help you tie the unique details you believe about a business directly to its financial future, so you can see how your view stacks up against market prices.

On Simply Wall St’s platform, Narratives are accessed and shared on the Community page, making it easy to explore diverse viewpoints from millions of investors. Narratives translate your ideas about a stock into concrete forecasts and compare your calculated Fair Value to the current market price. This provides a powerful way to decide whether to buy, hold, or sell. In addition, Narratives are kept up to date as new information (such as earnings, news, or market events) emerges, so your analysis stays fresh and relevant.

- For example, some SL Green Realty Narratives expect premium office demand and new developments to lift fair value as high as $76.00 per share.

- Other Narratives, focused on persistent risks and industry headwinds, estimate fair value at just $50.00.

This range shows how Narratives empower you to invest according to your convictions and adapt as the story unfolds.

Do you think there's more to the story for SL Green Realty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLG

SL Green Realty

SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial properties.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives