- United States

- /

- Hotel and Resort REITs

- /

- NYSE:RLJ

Will Bhalla’s CFO Appointment Shape RLJ Lodging Trust’s (RLJ) Long-Term Financial Strategy?

Reviewed by Simply Wall St

- RLJ Lodging Trust announced the appointment of Nikhil Bhalla as Senior Vice President, Chief Financial Officer, and Treasurer, effective September 15, 2025, following his longstanding tenure with the company and a new employment agreement.

- The transition marks a shift from interim financial leadership under Leslie D. Hale to an executive who brings a mix of operational company experience and background in capital markets.

- We'll look at how Nikhil Bhalla's internal appointment as CFO might influence RLJ Lodging Trust's investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is RLJ Lodging Trust's Investment Narrative?

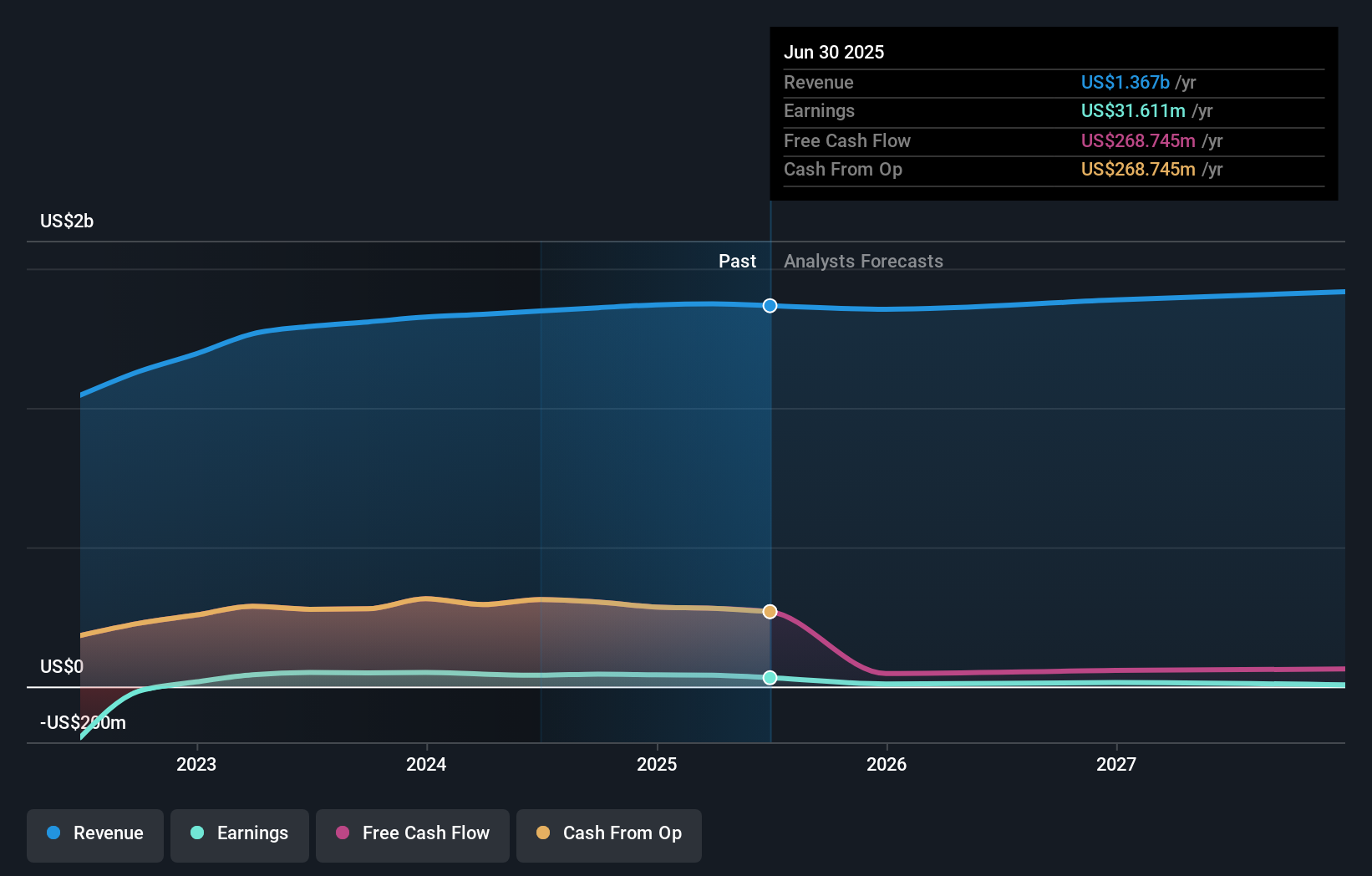

For anyone considering RLJ Lodging Trust, the core investment case rests on belief in the long-term resilience of hotel and resort REITs, the company's established management tenure, and ongoing efforts to return value through dividends and buybacks. While recent results have shown declining revenue and earnings with cautious forward guidance, ongoing dividends and the share buyback program remain important catalysts. The appointment of Nikhil Bhalla as CFO, an insider with deep capital markets experience, offers stability after a period of interim leadership. However, this move is unlikely to materially reshape the near-term risks or catalysts unless his strategic direction leads to a shift in capital allocation or cost management. The overriding risks for shareholders remain slow profit growth and below-peer returns; these have not suddenly changed with the executive appointment and will likely continue to weigh on sentiment until there is a clear trend reversal in results.

However, slower profit growth and steep earnings declines are risks shareholders need to have on their radar.

RLJ Lodging Trust's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on RLJ Lodging Trust - why the stock might be worth just $8.97!

Build Your Own RLJ Lodging Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RLJ Lodging Trust research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free RLJ Lodging Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RLJ Lodging Trust's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RLJ

RLJ Lodging Trust

RLJ Lodging Trust ("RLJ") is a self-advised, publicly traded real estate investment trust that owns 94 premium-branded, rooms-oriented, high-margin, urban-centric hotels located within the heart of demand locations.

Average dividend payer with low risk.

Market Insights

Community Narratives